| What the postponed pivot means for gold…

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | .png) | | Pivot Postponed

| | | As we predicted, Jerome Powell threw a bucket of cold water on gold and the rest of the markets, and we’re now experiencing sell-offs as expectations reset.

| |

February 5, 2023

Dear Fellow Investor, | | Gold — along with just about every other investment sector — continues to sell off in the wake of last week’s Fed meeting.

| | It wasn’t so bad after the Fed’s policy statement was released, nor during much of the Chairman Powell’s subsequent press conference. But then came a question as to the timing of the first rate cut, to which Powell replied:

| | “Based on the meeting today, I would tell you that I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that (a rate cut).”

| | And so the sell-off began.

Then, in an interview on “60 Minutes” Sunday evening, he repeated that statement even more forcefully:

| | “We've said that we want to be more confident that inflation is moving down to (the Fed's target rate of) 2%. I think it's not likely that this committee will reach that level of confidence in time for the March meeting....”

| | And so the sell-off continued today.

If you’ve been reading these newsletters, this isn’t coming as a surprise to you. In last week’s Golden Opportunities, published the day before the Fed meeting concluded, I noted that...

| | “...Jerome Powell is probably going to push back on the idea that the first rate cut will come as soon as March, and this will be bearish for gold in the near term.”

| | Bearish it has been, but perhaps not as bad as one might have expected, given the forcefulness of Powell’s statements. Gold’s lost about $30 since the Fed meeting, and even posted a nice gain last Thursday. It could’ve been worse, considering how obsessed investors have been over the March meeting.

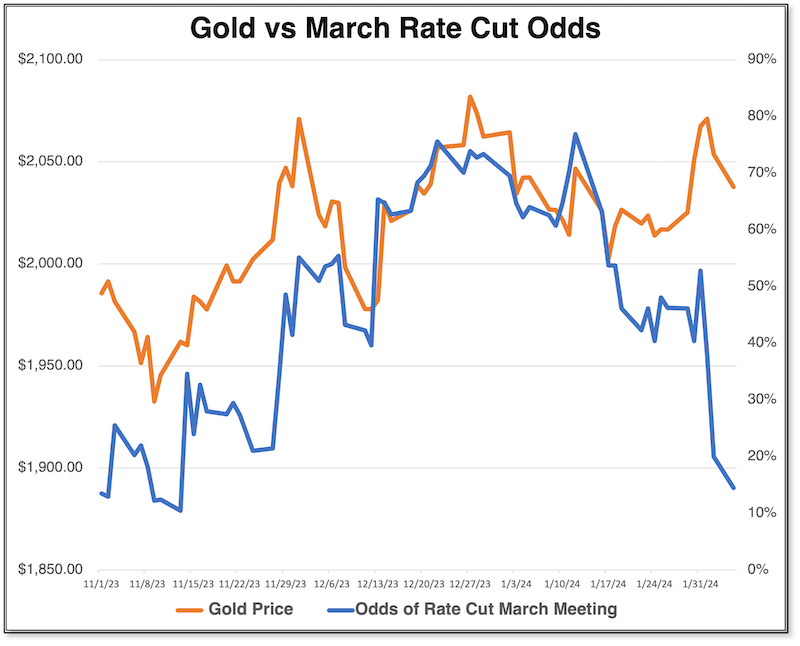

I featured the following chart in our February issue of Gold Newsletter, which was published last Thursday. I’ve updated it for you today:

|  | | As you can see, over the last few months gold has risen and fallen along with investor expectations that the Fed pivot would begin in March. The correlation weakened a little last week as U.S. retaliatory strikes on Iranian-sponsored militia groups sparked some gold-buying, but the connection remains the same.

And again, the reaction in gold could have been much worse, as fed funds futures odds for a March cut have plummeted from 53% just before the Fed policy statement last week to only 14.5% as I write.

| | A Meaningless Exercise

| | All of this short-term hand wringing and insane focus on every word uttered by any Fed official is ridiculous, to be sure.

I only report on it because gold is, unfortunately, caught up in all of it.

And not in a good way: The obsession with Fed policy has resulted in the weird calculation of current markets that high inflation is actually bearish for gold. It is so, the logic goes, because hotter inflation numbers will lead the Fed toward more-hawkish stances.

Never mind the relationship that has held throughout thousands of years of human history, that gold protects against the ravages of monetary inflation. Asset values today aren’t established by thoughtful, longer-term investment decisions, but rather by bets on what’s going to move the next day, hour or even minute.

| | In this bizarro world where every market is dependent upon the flow of liquidity from the Fed like suckling piglets at their mother’s teats, a tilt in the direction of tighter monetary policy means everything gets sold, and vice versa.

| | No matter whether the policy tilt, tighter or looser, will actually accomplish anything.

Because a shift in FOMC mindset will move all markets, the greatest gains go to the quickest actors.

It’s the greatest fool phenomenon in action, of course, but we don’t have to acquiesce and join the parade of fools. The record shows that things even out over the longer term.

Gold, for example, was derided for its lackluster performance during the inflationary spike of last year. What critics failed to understand, however, was that gold soared during the tsunami of monetary and fiscal accommodation that followed the emergence of the Covid pandemic. Being perhaps the most sensitive of predictive markets, gold anticipated the inflationary wave that was to come.

As I’ve noted, the fact that gold managed to gain over $300 an ounce during what was arguably the harshest rate hiking cycle in the Fed’s history argues for an exceptional performance once the cycle turns toward rate cutting.

| | Whether that cycle begins in March or May will matter little in the long run. We know it’s coming...and we know we’ll want to be in gold, silver and mining stocks once it begins.

| | I cover all of this and more — including an exciting new pick in the red-hot uranium sector — in this month’s issue of Gold Newsletter.

If you’re not already a subscriber, I urge you to get onboard now by clicking on the link below.

| | All the best,

|  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

| | CLICK HERE

To Subscribe To Gold Newsletter

And Receive Our February Issue

| | | CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the

Gold Newsletter Youtube channel.

| | | | | | © Golden Opportunities, 2009 - 2024

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |