March 11, 2024

Dear Fellow Investor, |

| This new gold bull run has been absolutely shocking in its intensity.

|

| Since it started just 10 days ago, gold has added $150 in price. It’s up another $30 in the three trading sessions since I last wrote you.

|

|

| Looking at that chart, it seems apparent that the rally is cooling off a bit, and indeed, gold is trading flat today as I write.

Frankly, I welcome this. Gold has gotten extremely oversold, and it can solve this condition by either correcting lower or simply biding time for a while. I prefer the latter, but either will do to help form a firm foundation for the next leg upward.

|

| Look Who’s Joining The Party

|

| If the intensity of this price move has been the most shocking aspect of the rally, the second-most part has been who’s been involved...and who hasn’t.

Specifically, central bank and Chinese buyers have driven gold’s big move, while Western/U.S. investors have been noticeably absent.

This is starting to change, but in a still-inconsistent manner.

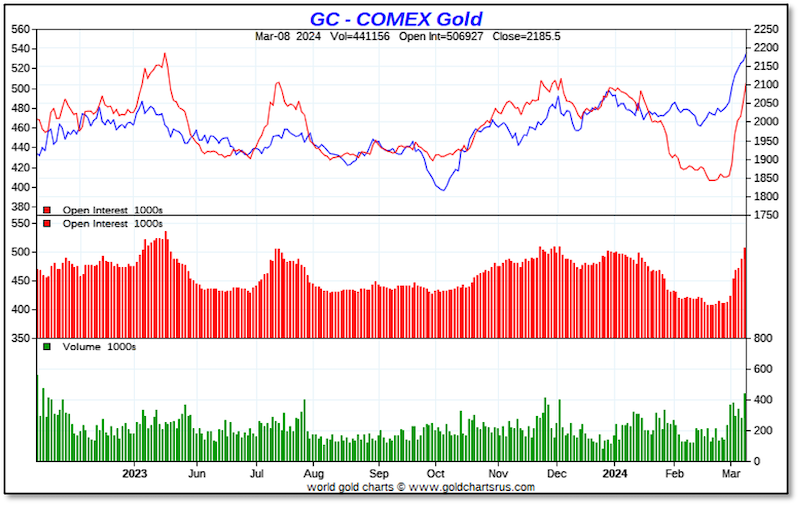

For example, consider this chart of open interest and trading volume for gold on the Comex futures exchange:

|

|

| As you can see, open interest (red line in the top panel) has begun to chase the gold price (blue line) higher. In the bottom panels you can see that we’re rising strongly off the lows in open interest and volume.

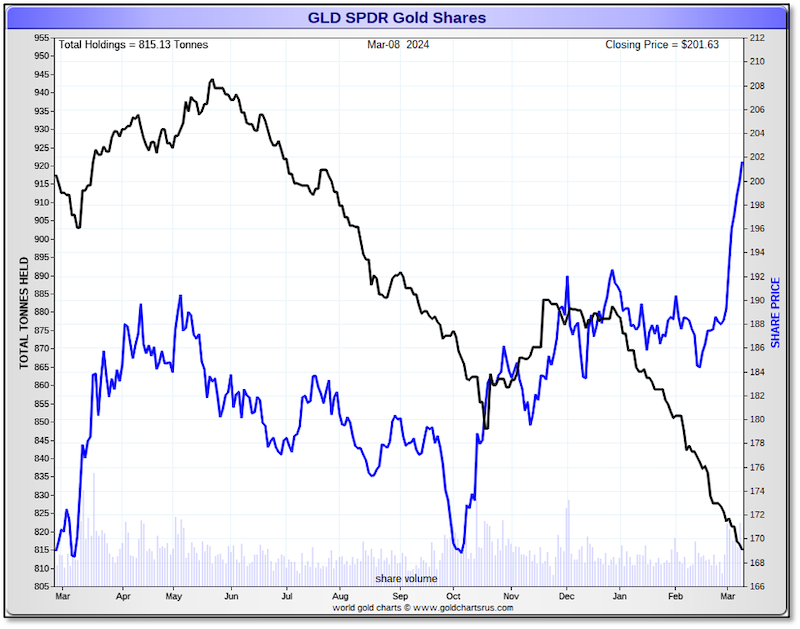

But the evidence of Western participation is still spotty. Most notable is the continued selling in the GLD gold ETF:

|

|

| This is a truly amazing chart. It shows that, as of last Friday, selling in GLD has accelerated to the downside even as the gold price has accelerated to the upside.

Something truly strange is going on here. It’s impossible to tell what at this point, but it’s apparent that those Western investors who are buying gold right now are seeking greater leverage via futures.

So you might think that this mixed picture is still negative for gold stocks.

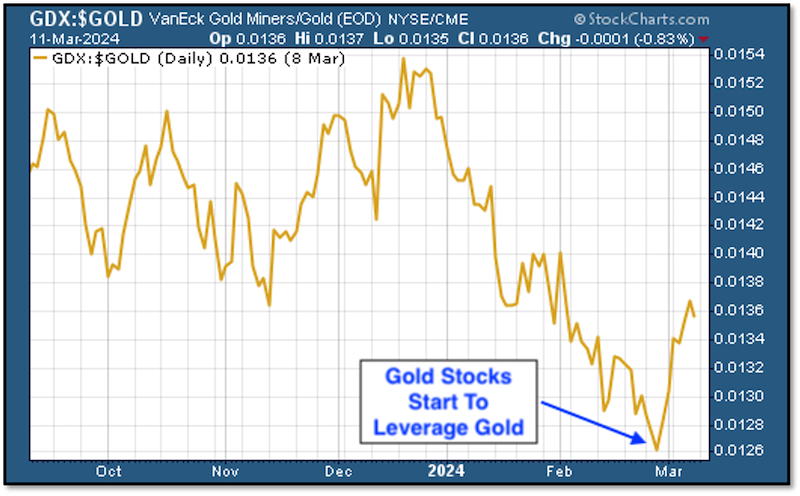

On the contrary, it’s in this sector that we see the next phase of the gold bull market taking shape. Consider this chart of the GDX gold stock index divided by the gold price:

|

|

| While many have been bemoaning the performance of gold stocks during this rally, the record shows that the equities have in fact been outperforming gold. So has silver.

This is precisely what we want to see, as it’s a prime characteristic of a secular, monetarily-based gold bull market.

You’ll also notice that the relative valuations for gold stocks have a long way to go just to get back to where they were at the beginning of this year. And a longer-term chart would show that huge gains — over and on top of those for gold — are long overdue.

The lesson: You haven’t missed the biggest gains in gold, because gold stocks are just beginning what could be far greater moves.

|

| How To Play Gold And Silver Stocks In This Bull Run

|

| I constantly tell new gold investors that the mining share market is remarkably inefficient. Dig a little, and you can find great companies that have been temporarily overlooked or are on the verge of big developments.

Get into these plays at the right time and you can dramatically outperform not only gold and silver, but the vast majority of mining equities. The result can be multi-bagger returns.

The key to finding tomorrow’s big winners is to educate yourself, and one way to do that is by investing in the best newsletters and conferences.

We work hard to make Gold Newsletter and the New Orleans Investment Conference the best values in the market, and I think we’re successful.

|

| I’ve just unveiled some truly explosive new junior mining picks in Gold Newsletter, and you can discover them by subscribing here.

We’re celebrating the 50th Anniversary of the New Orleans Conference this year — it’s going to be a true blockbuster, with dozens of today’s top experts. You can register now (and save hundreds of dollars in admission) by clicking here.

We also offer a great way to learn about top junior mining companies at no charge, without leaving the comfort of your home or office: The Gold Newsletter YouTube Channel.

|

| My friend Kai Hoffman and I use this channel to feature concise, hard-hitting interviews with executives of many of today’s leading junior mining companies. While there are no specific stock recommendations, this is a super way of learning about new stories and opportunities.

Here are some of our recent interviews:

|

| Austin Gold Corp.

Prosper Gold Corp.

Bunker Hill Mining Corp.

Scottie Resources Corp.

Dryden Gold Corp.

|

| The Markets Are Moving —

Don’t Let This Opportunity Get Away

|

| I can’t advise you any more strongly: Whichever route you take...get moving now.

|

| We’ve waited years for this bull market in gold, silver and mining stocks. The macro story has never been better and, indeed, it argues for much, much higher valuations across the board.

|

| Enormous profits are about to be realized for those who can get into the right stocks now; you don’t want to waste this opportunity.

|

| All the best,

|

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

|