| Big value gold at a bargain price

| | Please find below a special message from our advertising sponsor, Delta Resources. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| |  | | Big Value

At A Bargain Price

| | | While the bombed-out gold-stock market created a host of bargains, the new gold bull run has begun to change things.

But one big value play still remains: Delta Resources (DLTA.V; DTARF.OTC) — a tiny, cash-rich company that’s looking at a possible million-ounce-plus, open-pittable deposit.

| | | | Right now, the gold market is offering investors a chance to take advantage of a rare imbalance.

| | You see, while gold has been reaching record highs on a regular basis, gold equities have yet to come along for the ride.

The resulting bargains, particularly in the junior end of the sector, are now ripe for the picking, before generalist investors start to play the gold trend in earnest.

| | One stock that represents an especially good bargain in today’s gold market is Delta Resources (DLTA.V; DTARF.OTC).

| | This is a company looking squarely at a potential million-ounce-plus, open-pittable gold deposit on its Delta-1 project in western Ontario.

And that’s only the start: The company is currently trading at a mere C$15 million market value...boasts over C$5 million in cash...and drills are turning now to grow the gold target even larger.

As gold continues to run higher, investors aren’t likely to overlook this bargain much longer.

Let’s take a closer look while we still can....

| | A Large And Growing Gold Zone

| | Delta Resources’ flagship — the eponymously named Delta-1 project — is remarkable for a number of reasons.

|  | | Click image to enlarge

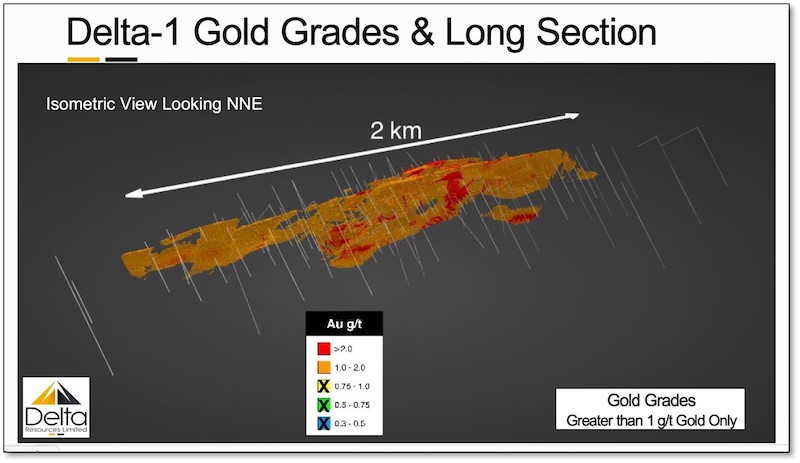

| | Located 50 kilometers west of the city of Thunder Bay, Ontario, Delta-1 lies on a crustal-scale structure with pervasive alteration and high gold background. Since 2019, Delta has drilled 26,288 meters in 86 holes at Delta-1, including 19,629 meters in 60 holes last year alone.

| | That drilling has, to date, defined a near-surface gold zone spanning 2 kilometers in strike, between 10 and 100 meters in width and from surface to 250 meters vertical depth. It remains open in all directions.

| | There’s no resource estimate for Delta-1 yet. But, as you can see from the graphic above, grades from all that drilling have yielded long intersections above 1 g/t gold...many above 2 g/t...strongly suggesting that the target hosts an open-pittable resource with a potential size well over the key million-ounce threshold.

| | Why So Rich?

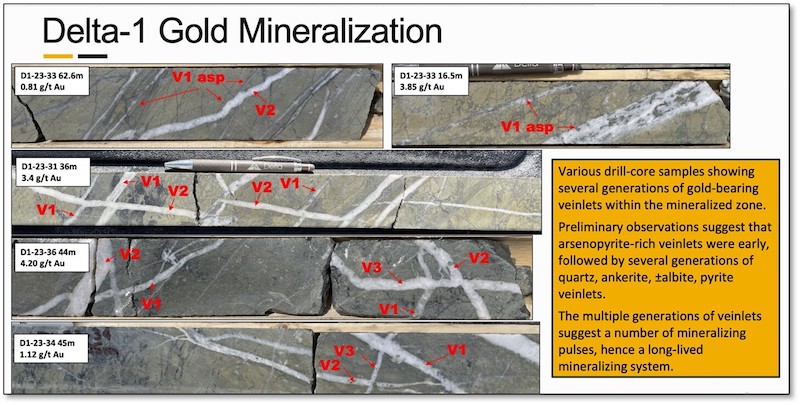

| | Open-pit gold deposits often average less than 1 g/t gold. But the Delta-1 resource, when it’s eventually calculated, should stand out for its much richer grades.

It’s a special gold target, and the reason is the multiple pulses of mineralizing events that kept adding to the gold in the system.

|  | | Click image to enlarge

| | The drill core pictured above, with its multiple, crossing veinlets, clearly shows these multiple events that repeatedly deposited gold into the host rock.

With this kind of mineralization and these gold grades, it doesn’t take as much ore to generate a sizeable resource. Yet Delta-1 boasts a lot of this rich rock, and there’s more to come.

| | Just The Start...

| | The conceptual resource at Delta-1 is already quite large. The even better news is that it still has plenty of room to grow, especially to the east, where prior drilling has encountered significant intersections of gold.

| | A 5,000-10,000-meter drill program began in January and is working to expand the 2-kilometer trend to the east, west and at depth at this very moment.

| | In addition, Delta Resources finished an induced polarization survey in December 2023 covering 4.5 kilometers of strike along the structural zone.

Normally, geophysical surveys like this are ignored by the market. But in this case, a survey including the known mineralization could clearly reveal far greater potential for kilometers along strike.

The market will be hard pressed to ignore that.

| | A Wealth Of Available Infrastructure

| | Many near-surface zones of mineralization with 1 g/t material are in remote locations, far from capital-reducing infrastructure.

That’s decidedly not the case with Delta-1.

Consider that the Trans-Canada highway runs directly through the property, as do two power lines. A high-voltage transmission line is planned for nearby.

The project also has rail access and, with Thunder Bay nearby, ready access to a city of 120,000 and its skilled labor force.

| | Simply put, Delta-1 could hardly be in a better position in terms of available infrastructure.

| | | That matters because when it comes time to put pencil to paper on building a mine at Delta-1, this abundance of infrastructure will lower the project cost and the barriers to financing an operation there.

| | Undervalued…For Now

| | With gold surging to and past record highs, investor attention will soon turn to the best junior mining bargains. And it’s hard to imagine a better one than Delta Resources right now.

As mentioned, the company’s current market cap is just C$15 million.

For that bargain valuation, investors get a company with C$5 million in cash and a project with a large and growing zone of near-surface gold.

| | How big is the resource? There’s nothing calculated yet, but at 2 kilometers long by 250 meters deep...and with these grades...it’s clear that this is a gold endowment that will make the market stand up and take notice once an official resource estimate is reported.

| | That said, the market is just beginning to catch wind of how remarkably undervalued this company is at this moment.

The window is closing, and the time to take a hard look at Delta Resources is now.

| | CLICK HERE

To Learn More about Delta Resources Ltd.

| | | | © Golden Opportunities, 2009 - 2024

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |