| Juggernaut...

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | .png) | | Juggernaut

| | | Gold is looking like an irresistible force, and now silver is joining the party.

| |

April 3, 2024

Dear Fellow Investor, | | For today’s headline, I tried to come up with one word to describe gold’s incredible run, and you can see what I came up with above.

| | I decided to look up the definition of “juggernaut” on Dictionary.com, and this is the first of two listed:

| | 1. any large, overpowering force or object, such as war, a giant battleship, or a powerful football team.

| | Yep, that applies!

I couldn’t help but laugh to myself, however, when I saw a second definition that I wasn’t aware of:

| | 2. anything requiring blind devotion or cruel sacrifice.

| | Hah...that would certainly apply to gold as well!

In all seriousness, the gold juggernaut has continued its stampede since our last issue on Monday. Yesterday the price was up “only” about $6.00 before CNBC finally began to cover the metal’s run with some positive commentary (only a month late, but better late than never).

Whether coincidence or not, gold quickly added about $15 after a number of talking heads had spouted bullish forecasts.

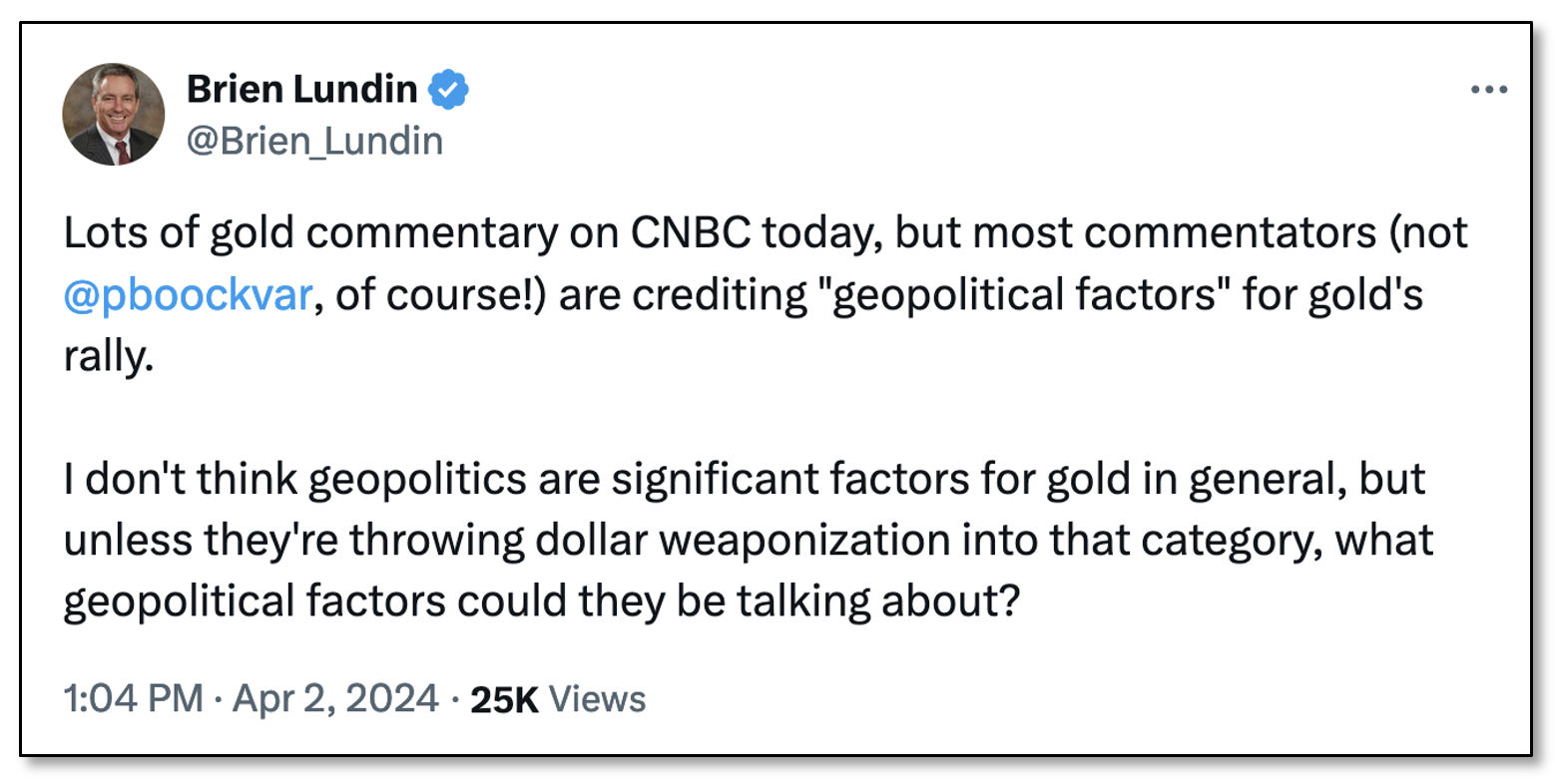

Those analysts, with one exception, were way off the mark, however in trying to explain why gold was soaring. As I noted on X:

|  | | That kind of commentary is continuing today, and from some sources that should know better. To reiterate, the demand for gold has been coming from central banks in general, and particularly from the People’s Bank of China, along with remarkable buying from Chinese citizens.

If you want to put a shift away from dollar hegemony under the “geopolitical” heading, I guess that’s fine. But what the pundits have been referring to are Gaza and Ukraine, and these are having zero effect on gold.

Importantly, we’re now seeing Western investors jumping on the trend, as evidenced by the amazing move in silver over the last few days.

|  | | As you can see, after resistance at $25 was taken out, silver quickly broke through resistance at $26...and is already challenging $27.

Looking at silver’s performance relative to gold, you can see that the gold/silver ratio is plummeting — reflecting how silver is now providing tremendous leverage to the yellow metal.

|  | | This is precisely what we want to see, not only for the effect it has on our portfolios of junior silver miners, but also because it’s an important confirmation of a secular bull market in gold.

As I write, gold is up another $12, while silver is continuing to rocket higher.

| | Again, this is the bull market we’ve been waiting for...and it’s begun before the major catalyst of a Fed pivot.

| | There’s much more to come, so make sure you’re positioned.

| | All the best,

|  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

| | CLICK HERE

To Subscribe To

Gold Newsletter

| | | CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the

Gold Newsletter Youtube channel.

| | | | | © Golden Opportunities, 2009 - 2024

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |