September 16, 2024

Dear Fellow Investor, |

| The turn has come.

|

| For the last six months, I’ve explained why this was an historic new gold bull market, but also why it was different from any other before it.

|

| That’s because it was being driven by central bank and Chinese buying, which had never happened before in combination, much less as the price was rising.

Another key difference: Western investors were absent. That’s because they couldn’t project how long central banks and investors in China would continue buying.

|

| I’ve also explained in recent months why this was going to change as the Fed’s long-awaited pivot approached. A shift from monetary tightening to easing was something Western investors could understand and project ahead for years.

This would be the catalyst for the next big leg in the metals.

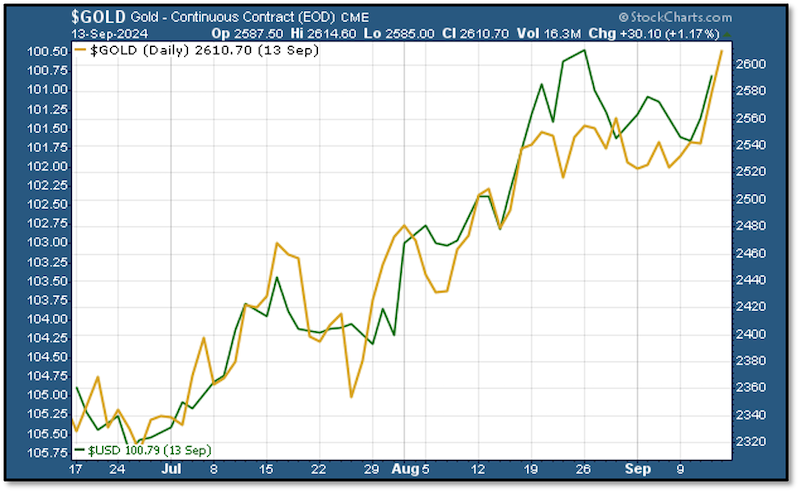

And so it happened. As predicted, gold started taking off in early July as big money in hedge funds, family offices and institutions began adding gold:

|

|

| As you can see in the above chart, the U.S. Dollar Index (shown in the green line with an inverted scale) was also being priced lower in anticipation of the shift to easier money.

Note two key, “big number” levels: $2,600 for gold and 100 for the Dollar Index.

Gold has just barreled through $2,600, while the Dollar Index has bounced off of support at 100. If — and when — the DXY falls through 100, I think both trends will accelerate.

|

| This Changes Everything...Even More

|

| When gold broke through $2,500, I told you that “this changes everything.” I noted how even the wildest gold bug plays, the companies with huge projects that were uneconomic at then current gold prices, had suddenly become exceptionally profitable.

These companies were still selling for pennies on the dollar compared with what they’d sell for in a normal gold market, much less one that was breaking records day after day.

But still, the broader market was failing to notice.

Now, however, with gold miners reporting blow-out cash flows and gold breaking through $2,600 with ease...it’s all starting to change.

Let’s take a look at two dramatic changes over just the last week or so.

|

| The First Big Change:

Silver

|

| Yes, silver has outperformed gold here and there during this bull run, but now it’s really taken off:

|

|

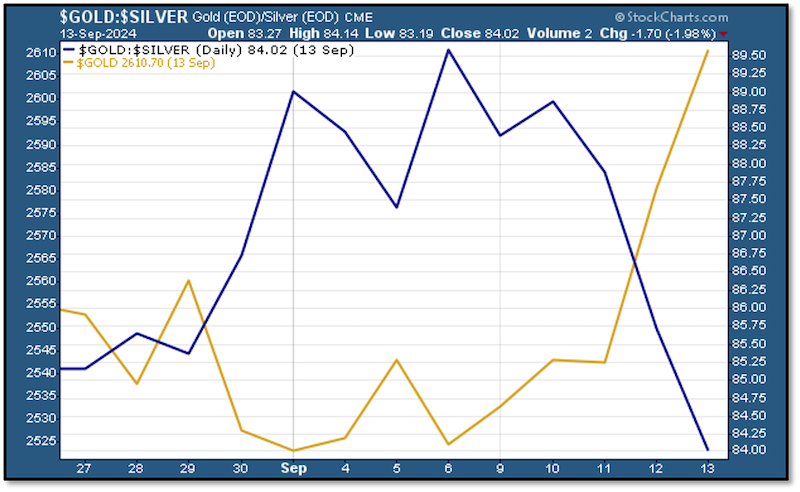

| As you can see, about a week ago the futures price for silver started catapulting higher. It didn’t even pause at $30, and went right through $31.

It’s early, of course, but I’m very encouraged by how silver has been outperforming gold during this move. Consider this extraordinary move in the Gold/Silver ratio:

|

|

| You couldn’t ask for a more compelling chart. Look at how, as gold soared to and through $2,600...the Gold/Silver ratio plummeted.

Silver is dramatically outperforming gold now, which is not only a great sign for our junior silver stocks, but also a classic and important confirmation of the move in gold.

And speaking of stocks....

|

| The Second Big Change:

Mining Stocks

|

| We’ve been patiently waiting for the investing world to rediscover gold mining stocks. Now, after these companies have reported massive free cash flows thanks to the rise in gold, neither Wall Street nor Main Street investors can ignore them any longer.

And that’s started an amazing new run in gold equities:

|

|

| This chart of the ratio of the GDX gold stock index to gold itself shows a dramatic breakout beginning last week.

Again, it’s early...but with gold continuing to break records every day and seemingly headed much higher as the Fed continues to lower interest rates, we could soon see the kind of mining stock bull market that made fortunes for us in the 2000s.

|

| A Generational Opportunity...

|

| That’s why I’ve been calling this a “generational opportunity.” The last time we saw this kind of gold bull market was the early 2000s. But back then, gold had yet to post anything like the kind of performance it’s doing now.

And the gold producers weren’t throwing off cash flows anywhere near what we’re seeing today.

Importantly, we’re also starting to see our high-powered junior mining stocks starting to move. This is where the truly massive returns will come from.

So what should you do now? Two things:

|

| 1) Make sure you own physical gold and silver to safeguard your wealth against the inevitable depreciation of fiat currencies ahead. As I’ve shown, the huge debt loads that have been accumulated over decades of ever-easier money makes significant erosion of purchasing power inevitable.

2) Invest in junior mining stocks to leverage this historic move.

This means subscribing to the best junior resource newsletters (you can subscribe to Gold Newsletter here)...

...And attending the best investment conferences (you can register for this year’s 50th Anniversary New Orleans Investment Conference here).

|

| Whatever you do, don’t let this opportunity escape. The big turn seems to be happening at this very moment.

Get ready and hang on. This is going to be fun.

|

| All the best,

|

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

|

| CLICK HERE

Or Call Toll-Free 800-648-8411

To Register For This Year’s

Blockbuster 50th Anniversary

New Orleans Conference

|

|

| CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the

Gold Newsletter Youtube channel.

|