November 6, 2024

Dear Fellow Investor, |

| Over the past six months, in interviews and conversations with friends and media in Canada and elsewhere in the world, I was consistently asked how the U.S. presidential election would affect gold.

|

| My answer was always the same: Not a whit.

I would explain that, because the debt situation in the U.S. had gotten so completely out of hand...and because neither party was inclined or even able to solve it at this point...far higher gold prices would result no matter who was elected.

|

| Obviously, I should have cautioned that a clear-cut win by Trump would evaporate any perceived geopolitical risk being factored into the gold price by some speculators, and therefore result in a short-term sell-off.

|

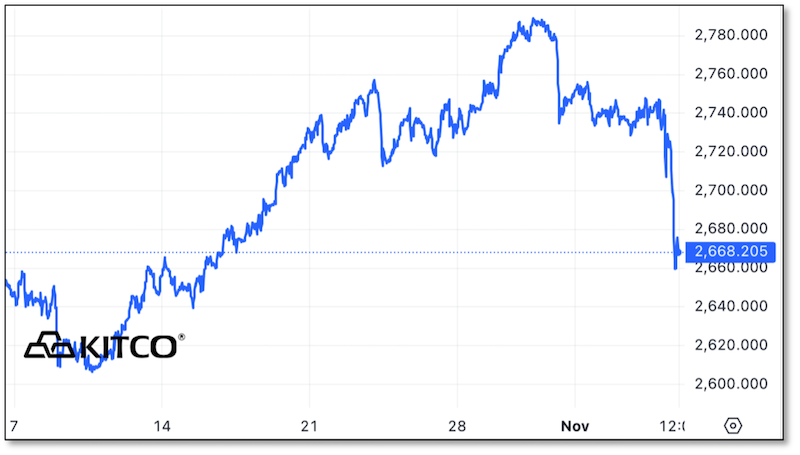

| That’s exactly what’s happened. As I write, gold is off $77 (2.8%), and silver is leveraging the move to the downside with a drop of $1.48 (4.5%).

|

|

| A move of this magnitude is obviously being driven by traders shorting the metals with wild abandon. I sincerely doubt that much of the big money that’s moved into gold over the past year was motivated by concerns over this election.

Thus, this short-term trade seems destined to reverse soon.

And, if you’ve read anything I’ve been writing for the last few years, you will not be surprised to learn that I view this as a long-term opportunity.

|

| Golden Opportunities continues below...

|

|

| SPONSOR:

Panex, LLC

|

|

| You Are In The Oil Business,

Whether You Want To Be Or Not

|

| The soaring cost of energy is affecting everyone’s pocketbooks. It might be time for you to get in the game.

|

| GREAT NEWS: If you are an accredited investor, you have a chance to realize tremendous tax benefits and revenue by investing with a proven oil producer and developer — Panex, LLC.

Panex develops and produces “American Oil.” Demand for oil continues to rise, while the supply has been greatly diminished, leaving a window of opportunity for those willing to take advantage of this powerful situation.

At Panex, we own our own fields, which have produced millions of barrels of oil over the years. We are not wildcatters. We are drilling direct offsets to producing wells, which mitigates the risks associated with drilling.

Being third generation producers of American oil, the people at Panex offer a unique perspective on the oil and natural gas industry. To learn more about the opportunities that Panex has to offer accredited investors, click to learn more about Panex and gain a valuable introduction to the oil business: Introduction to Panex.

|

| CLICK HERE

To Learn More about Panex

|

|

| The Window Temporarily Reopens

|

| It’s a mixed bag in the post-election markets today. With the Dow jumping over 3% and the Dollar Index soaring, investors are obviously considering that lower taxes and looser regulation will unleash the U.S. economy.

But with Treasury yields also rising strongly, they also seem to recognize that higher tariffs will be inflationary.

And finally, the big sell-off in gold and silver is just crazy — rooted in the belief that the rise in the metals over the past year was due to worries over political mayhem following the election, and not the intractable debt trap that would have embroiled any presidential administration.

As a reminder, consider again this chart:

|

| |

| The red line above shows the federal debt, which began to accelerate higher with the post-2008 Great Financial Crisis rescue efforts and truly exploded higher with the fiscal and monetary response to Covid...and then the desperate federal spending as the Biden administration attempted to ensure their re-election.

This fiscal stimulus ran in direct opposition to monetary policy, as the Fed attempted to kill off inflation with severe rate hikes. You can see the effect of rising rates meeting head-on with soaring debt loads in the blue line above showing federal interest expense.

|

| This is a classic debt trap...a “doom loop” as many have called it...in which the Fed must lower rates to keep the house of cards erect, while the markets force rates and gold higher in recognition of the inflationary consequences.

|

| Neither party addressed this situation at all during the campaign, and neither is motivated in the least to do anything about it. Far to the contrary, in fact, as control of the White House and both houses of Congress have never promoted spending restraint.

This is a truth that the markets will realize shortly, I believe, which makes this an extraordinary investment opportunity.

The key to profiting from a secular bull market like this one in the metals is to buy the dips. And this is one heck of a dip.

|

| Two Ways To Take Advantage Of This Opening

|

| Conveniently, there are two events in the near future that can help us understand the repercussions of these election results...guide us to the best strategies for profits and protection...and reveal specific investments poised to generate significant gains in the days ahead:

|

| 1) The Election Townhall Livestream

By the Collective Inner Circle

|

| Tomorrow, at 8:00 p.m. EST/7:00 p.m. CST/5:00 p.m. PST, five great friends of mine — George Gammon, Russell Gray, Jason Hartman, Robert Helms and Ken McElroy — will host an amazing townhall with a litany of other top experts as guests.

They’re going to do a deep dive into the election results and the implications for the economy, geopolitics and every investment sector. I can guarantee you that this is going to be an absolute blast...and will deliver tremendously valuable insights.

Remarkably, this event is absolutely free of charge. All you have to do is CLICK HERE to register, and I strongly recommend that you do so now.

You’re going to truly enjoy this townhall event, especially because it’s a bit of a preview for the other big opportunity coming up...

|

| 2) The Investment Event Of The Half Century

|

| In just a couple of weeks, we’ll convene for the 50th anniversary of the New Orleans Investment Conference, renowned as the “world’s greatest investment event.”

And this year’s gathering will be historic for other reasons, coming as it is during a time of great uncertainty, with exceptional risks accompanied by equally exceptional opportunities.

This event is also historic for the amazing roster of experts who will deliver their best ideas to attendees, including...

|

| James Grant...George Gammon...Rick Rule...Danielle DiMartino Booth...Brent Johnson...Jim Iuorio...Peter Boockvar...Jim Bianco...James Lavish...Adrian Day...Dave Collum...Alex Green...Bob Prechter...Tracy Shuchart...Avi Gilburt...Adam Taggart...Lawrence Lepard...Mark Skousen...Doug Casey...Tavi Costa...Peter Schiff…Lyn Alden…

...Chris Powell...Russ Gray...Robert Helms...Nick Hodge...Sean Brodrick...Lobo Tiggre...Jennifer Shaigec...Mary Anne & Pam Aden...Dana Samuelson...Bill Murphy...David Morgan...Gary Alexander...Jeff Deist...Byron King…Albert Lu...Omar Ayales...Gerardo Del Real...Rich Checkan...Thom Calandra...and more, including yours truly.

Plus, we’ll have a scintillating geopolitical panel — featuring popular political pundits Mary Katharine Ham, Charles C.W. Cooke and Scott McKay — to give us up-to-the-minute post-election analyses.

|

| Historic Risks And Historic Opportunities

|

| There is great uncertainty ahead in the economy and the investment markets, there are some things that we can rely on.

|

| One is that current levels of debt cannot be managed without significant depreciation of the dollar and other fiat currencies...a fact that will send some investments to the trash bin and others skyward.

The other is that the experts listed above can help guide us to safety and profits through these tumultuous markets.

|

| I urge you to sign up for the Collective Inner Circle Election Townhall, and to click on the link below to learn more about this year’s New Orleans Conference and guarantee your place.

|

| All the best,

|

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

|

| CLICK HERE

To Learn More

And Claim Your Place At

The 50th Anniversary

New Orleans Investment Conference

|

|

| CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the

Gold Newsletter Youtube channel.

|