|

| Often called the poor man’s gold, silver has a history of providing significant leverage over gold in a metals bull market.

|

| And because most silver is produced mainly as a by-product of base metals production, the universe of primary silver equities is quite small.

Thus, in a gold and silver bull market, as generalist investors rotate into the sector, that small number of silver equities offers more leverage on top of leverage.

|

| In this tiny, high-powered sector, Blackrock Silver (BRC.V; BKRRF.OTC) stands out as 100%-owner of the high-grade Tonopah West silver-gold project in Nevada.

|

| Tonopah West is both high-grade and located in a very mining-friendly jurisdiction. It sits on private land and is transected by a major highway.

As you’re about to see, those advantages have translated into compelling economics for the project — and at conservative metals prices.

Those economics hit the market in early September, and Blackrock’s shares have started to take off since then.

Yet far greater gains seem ahead as this gold and silver bull market continues, because the company still trades at just a fraction of its flagship project’s conservative net present value.

|

| Tonopah West PEA Sends Blackrock’s

Share Price Soaring...

|

| Again, the preliminary economic assessment (PEA) on Tonopah West sent Blackrock’s share price higher, and with good reason:

|

| Using base-case numbers of just $23/oz. for silver and $1,900/oz. for gold, the project has an after-tax NPV, discounted at 5%, of $323 million. It boasts a robust after-tax internal rate of return (IRR) of 39.2%.

|

| The studies show that the 100-million-ounce silver-equivalent deposit at Tonopah West will have a head grade of 570 g/t silver-equivalent — making it the highest-grade development-stage silver project by a good margin.

|

|

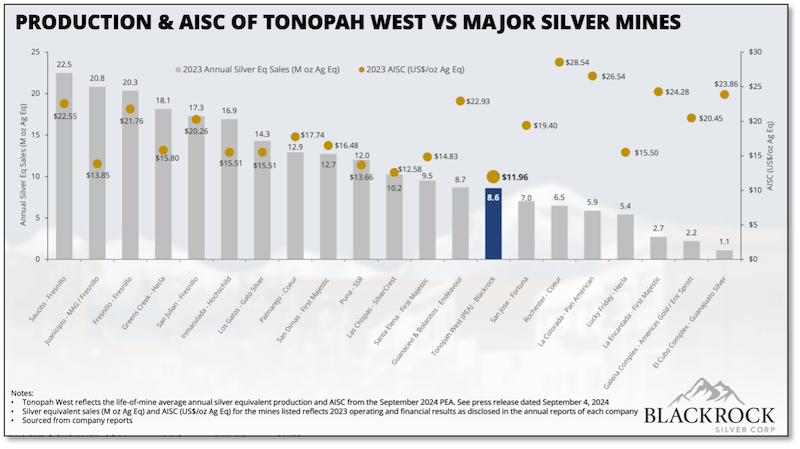

| Click image to enlarge

Blackrock Silver’s recent PEA showed Tonopah West would boast one of the largest silver production rates and lowest production costs of major silver mines.

|

| The projected mine there would generate 8.6 million ounces silver equivalent annually at all-in sustaining costs of just $11.96/oz over a 7.8-year mine life. Initial capex would be $178 million, roughly half of the conservative, base-case NPV.

The upside at base case +20% ($27.60/oz. silver and $2,280/oz. gold) delivers an after-tax NPV, discounted at 5%, of $495 million and an after-tax IRR of 54.0%.

With gold and silver trading well above those base-case assumptions, those economic numbers surely explode to far higher levels.

|

| …And Attracts Another Big Investment

From Eric Sprott

|

| Industry leader Eric Sprott is renowned as one of the savviest investors in the sector.

|

| So it raised eyebrows when, in June, before the PEA release, Sprott invested C$4 million in a C$10.35 million financing for Blackrock Silver.

And then, after the PEA came out in September, Sprott stepped up with yet another C$5 million in private placement money.

|

| The remarkable PEA numbers combined with silver’s strong run during that period to send Blackrock’s share price higher.

Clearly, Sprott thinks Blackrock Silver has the potential to deliver even bigger returns as the precious metals bull market marches on. And some of the sharpest gains could come at any time, because...

|

| ...The Drills Are Turning

|

| Thanks to the investments from Eric Sprott and other smart investors, Blackrock Silver has ample funds to continue delineating and expanding the resource at Tonopah West.

|

| The company’s property area consolidated fractured ownership in the region and, for the first time, brought the western side of the historic silver resource at Tonopah under one umbrella.

|

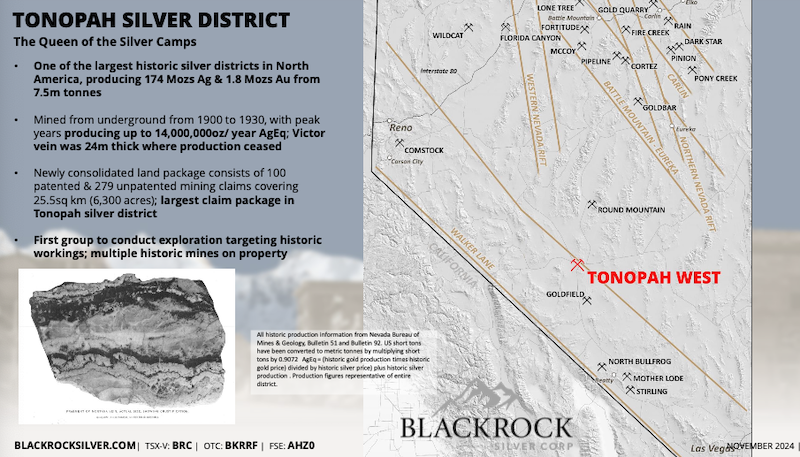

| Consider how important this achievement was: After the Comstock Lode, Tonopah was considered the Queen of the Silver Camps in Nevada, producing 174 million ounces of silver and 1.8 million ounces of gold between 1900 and 1930.

|

|

| Click image to enlarge

Blackrock Silver has consolidated the entire west side of the fabled Tonopah Silver District and has an ongoing drill program to delineate and grow its silver resources.

|

| Low silver prices during the Great Depression caused the mine to close, and it then went on an extended hiatus, with the property ownership split up among many different holders.

Now that Blackrock has consolidated the district and proven up a 100-million-ounce silver equivalent resource, the drills are turning to not only upgrade that resource but also expand it along the proven veins and structures to the northwest.

Drills are turning on a major 22,000-meter, 56-hole program that will drill 46 holes on the shallow portions of the Bermuda and Merten vein systems to upgrade the resource from inferred to indicated.

They could also potentially shorten the payback period for the mine by delineating more resources closer to surface.

|

| And consider this: The drills will also use 10 holes to test the one-kilometer gap between the DPB deposit and NW Step-Out resource area. Given the continuity of mineralization to date, there’s a good chance those two areas connect.

|

| In short, we could soon see a big addition to the Tonopah West resource in the days just ahead.

|

| Not Much Time Left

To Get On Board

|

| High-grade assays are already starting to come back from the infill drill program at Tonapah West.

|

| Highlights include Hole 87 (2.59 meters of 3,744 g/t silver equivalent, including 1.07 meters of 8,515 g/t silver equivalent) and Hole 92 (3.35 meters of 953 g/t silver equivalent and 1.13. meters of 1,156 g/t silver equivalent).

|

| Not only were these hits richer than the average grade for the project, but they also came from areas shallower than the average depth of the resource.

Both those factors give Blackrock hope that further drilling will shorten the project’s payback period.

|

| Bottom line: Tonopah West is the highest-grade silver development project in the world, and it’s got a great chance to get even better.

|

| Gold’s moving higher...silver is providing the kind of leverage it’s famous for...and Blackrock Silver is poised to heap even more leverage on top of that, thanks to its proven high-grade resource and more drill results on the way.

Timing is everything, and this is obviously the right time to investigate what Blackrock Silver could do for a metals portfolio.

|

| CLICK HERE

To Learn More about Blackrock Silver Corp.

|