| Huge head start on high-grade gold

| | Please find below a special message from our advertising sponsor, 1911 Gold. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| |  | | Huge Head Start

On High-Grade Gold

| | | The two periods when junior gold companies spin off the biggest gains are during exploration and when they’re ramping up to production.

With C$300 million in on-site infrastructure...a 1.1-million-ounce high-grade resource...and 63,000 hectares of proven production and exploration targets...1911 Gold (AUMB.V; AUMBF.OTC) provides both exploration and upcoming production potential.

The best part? Despite all these advantages, 1911 Gold is still valued at just C$26 million.

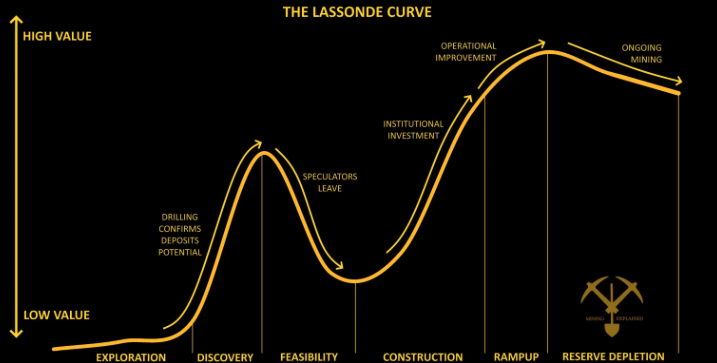

| | | | The Lassonde curve highlights two periods in a junior miner’s lifecycle when investors make the most money.

| | Popularized by renowned mining figure Pierre Lassonde, the curve (see below) charts a miner’s value trajectory from pre-discovery, to discovery, to mine development, to mine construction and on to mine production.

|  | | The two most lucrative times for a junior miner are typically pre-discovery to discovery and during mine construction.

| | Investors who buy into an exploration company typically make good money when/if the drills turn up new discoveries...

...And those who buy as a new mine is being built often see the company’s value increase dramatically as it nears first production.

You can find literally hundreds of juniors at either stage or in-between. But what you can’t readily find is a company that offers both avenues to potential big gain.

| | But that’s exactly what 1911 Gold (AUMB.V; AUMBF.OTC) offers with its Rice Lake project in Manitoba.

| | As you’re about to see, 1911 Gold has consolidated an entire gold-mining district in Manitoba that includes 2.3 million ounces of past gold production and a current, 1.1-million-ounce, high-grade gold deposit to build on.

Moreover, the True North mine on its Rice Lake project has a fully permitted mill and tailings complex that gives it a huge head start on its junior developer brethren.

| | An Operable, Fully Permitted Mill,

Camp and Tailings Facility

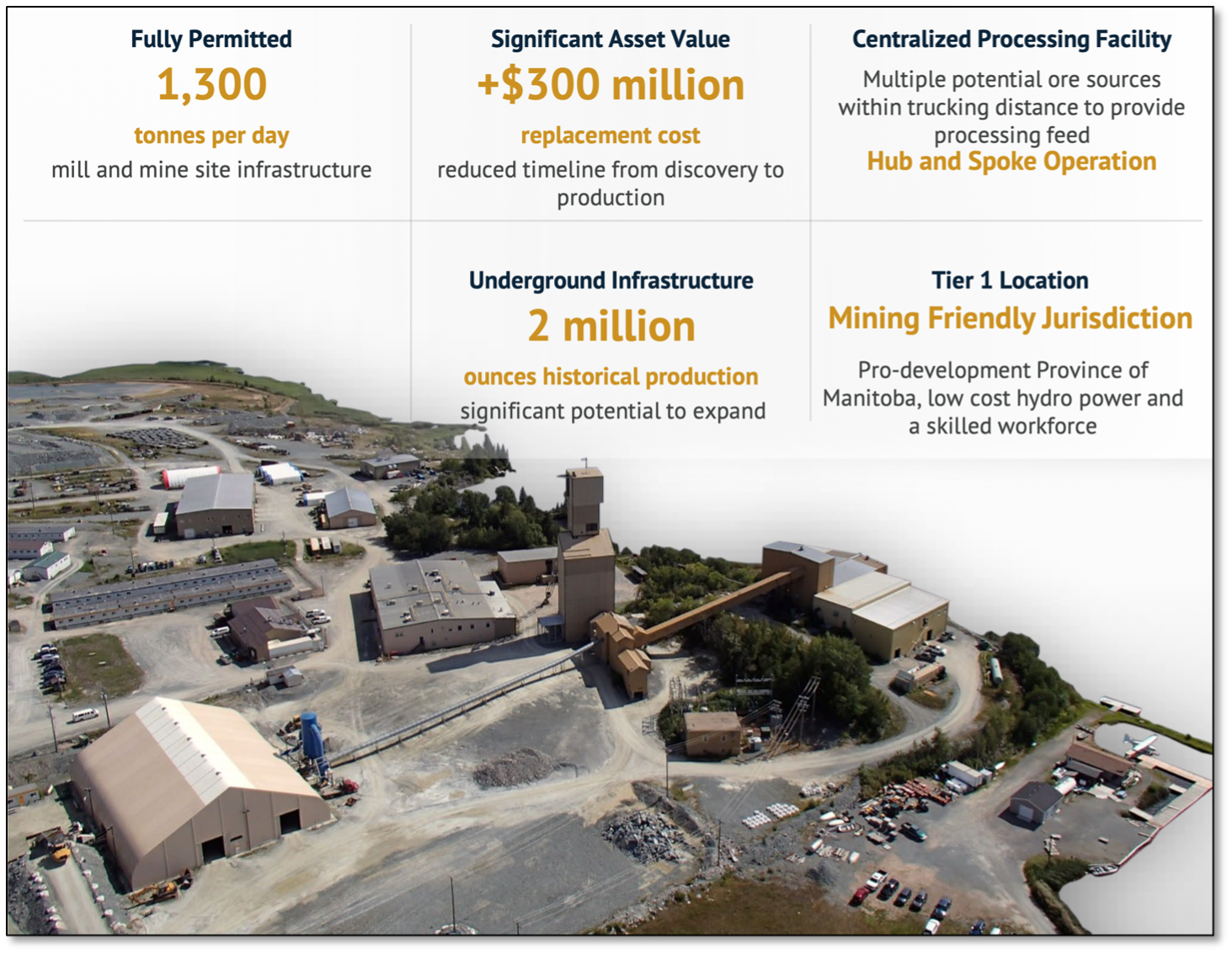

| | Building a mill, camp and tailings facility is usually a major capital expense item for any company considering building a mine.

In 1911’s case, those items are already taken care of, thanks to a facility at True North that includes a 1,300-tonne-per-day mill (readily expandable to 2,300 tpd), a tailings facility, surface infrastructure and an underground shaft and ramp access.

|  | | The replacement value for the on-site infrastructure at True North is estimated at C$300 million.

| | Comparable facilities would require 10+ years to permit and over C$300 million in capital.

The infrastructure is in place because True North was a past producer. As mentioned, the Rice Lake area has generated 2.3 million ounces of gold over a 50-year period.

| | A Million-Ounce,

High-Grade Gold Resource

| | The mine also comes with a 1.1-million-ounce, underground gold resource.

According to a recent update, True North includes a measured and indicated resource of 499,000 ounces gold at 4.41 g/t and an inferred resource of 644,000 ounces gold at 3.65 g/t.

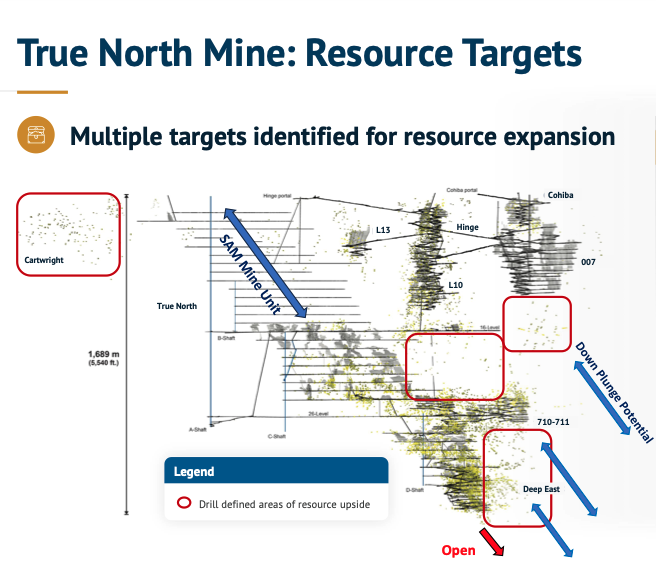

And that resource seems destined to grow considerably. As you can see below, the underground resource already has a number of target areas for obvious expansion.

|  | | The True North underground resource has a number lightly drilled areas with identified mineralization that promise to significantly expand its high-grade gold resource.

| | Those targets are within the current True North Mine but outside the current mine areas, providing significant scope to expand resources within the current mine footprint.

In addition, the recent resource update has highlighted several additional drill targets that may be ripe to host gold mineralization.

The company plans additional drilling on these areas, which have yielded significant intercepts.

| | Nearby Historical Resources

| | In addition to the resource expansion opportunities at True North, the company’s larger Rice Lake project hosts three additional historical high-grade producers. These include:

| | • The Ogama Rockland deposit, with an historical resource of 337,000 ounces of 8.17 g/t gold and historic production of 45,000 ounces gold at 11.2 g/t gold.

• The Central Manitoba mine, which produced 160,000 ounces of gold at 12.6 g/t historically.

• The Gunnar mine, with 100,000 ounces of past gold production at 11.9 g/t gold.

| | As you can see, this is an area famed for high-grade gold. In all, the Rice Lake district, which 1911 Gold has consolidated for the first time, spans 63,000 hectares.

Moreover, the historic resources outside of True North are all within trucking distance of that mine’s facilities.

And all of this is only the start, as the company has identified multiple new, large gold targets on the property.

| | Severely Undervalued — For Now

| | Add in the C$310 million in tax pools that True North provides 1911 Gold, and you have a company — which currently sports just a C$26 million market cap — that looks severely undervalued.

| | Again, the replacement value of the on-site infrastructure alone is worth C$300 million. And that doesn’t even include the million-ounce, high-grade gold resource at True North or the satellite deposits.

| | As you can see, both True North specifically and Rice Lake generally have tremendous room for expansion.

Consider: Just 20% of the Rice Lake property gave historic owner San Gold a C$1 billion valuation in 2011 and 2012, during the last gold cycle.

With planning underway to expand the underground resource at True North and a preliminary economic assessment due next year, 1911 Gold’s days of being undervalued likely won’t last for long.

Now is the time to do your due diligence on this undervalued gem.

| | CLICK HERE

To Learn More about 1911 Gold Corp.

| | | | | © Golden Opportunities, 2009 - 2024

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |