|

| Multi-million-ounce gold potential. |

| It’s not easy to find. But if you’re going to make a gold discovery, it always makes sense to swing for the fences for something that will grab the market’s attention.

And now, finally, attention is being paid to recent drilling on a project in a part of the world known for major discoveries. |

| It’s West Point Gold’s (WPG.V; WPGCF.OTC) Gold Chain project in northwest Arizona. And it’s a project that wasn’t garnering much attention...until a recent company reorganization accompanied by remarkable drill results. |

| Located along the southeastern end of the legendary Walker Lane trend that runs along Nevada’s border with California, Gold Chain lies within Arizona’s North Oatman district, home to several headline-making gold projects and a recently operating gold mine.

And, as you’re about to see, Gold Chain has a head start on a potential million-ounce gold discovery and a land package that could host much more.

The best news? Drills will soon be turning on the project— and along an established trend that has been yielding eye-popping gold results while few were looking. Bottom line: You now have a chance to get in ahead of the crowd. |

| A Solid Base With Extraordinary Results |

| Gold Chain is a project that has hosted small-scale high-grade gold mining between 1905 and 1920 and then a small-scale open-pit gold mine in the 1980s.

The project lies to the east of Lake Mead and the northeast of the town of Bullhead City, Arizona. It has access to power lines, a highway and cell phone towers. The Moss Mine lies to the south.

More importantly, Gold Chain’s Tyro Main zone shows the potential to host a major gold resource along a trend that has been traced for 800 meters with drilling and with a surface expression of over a kilometer. |

| |

| Click image to enlarge The Tyro target at the Gold Chain project has multi-million-ounce potential, as proven by drilling over most of a kilometer-long target. |

| The problem: Previous drilling results on this target were extraordinary...but given little attention in a depressed mining stock market.

This was recognized by a group of talented and experienced mining excecutives who reorganized the company, merged with another junior company to build up an impressive portfolio of projects throughout Arizona and Nevada...

...And rebranded the “new” venture as West Point Gold.

With the money raised in the process, West Point has embarked on a short-term goal of using drilling to convert the previous results at Gold Chain into a compliant resource that the market will take note of.

Their success seems likely, and soon, when you consider what the drills have been turning up.... |

| Big Gold On A Big Trend |

| Recent drilling at the end of last year on Gold Chain, and from 2023 by the company's previous incarnation, have delivered some extraordinary results.

Consider Hole 23-28 drilled on the Tyro Main zone. That hole returned an eye-popping 85.3 meters of 6.23 g/t gold, including 9.1 meters of 51.1 g/t gold.

Other assays of note include Hole 23-23 (44.2 meters of 2.01 g/t gold) and Hole 23-08 (3.1 meters of 10.7 g/t gold).

Those are thick intervals of high-grade gold, and they should have sent the company’s share price flying. But a lousy market, and little marketing of the results, left the company treading water.

Thus the new effort under a new team. And the latest results have confirmed all of the intial excitement at Gold Chain. |

| West Point’s follow-up drill program in November delivered longer intervals of mineable grade gold, including Hole 24-30 (52 meters of 1.53 g/t gold including 36 meters of 2.02 g/t), Hole 24-31 (50.7 meters of 0.53 g/t), Hole 24-32 (16.1 meters of 1.35 g/t gold) and Hole 24-34 (42.1 meters of 2.5 g/t gold, including 11.7 meters of 5.94 g/t). |

| Those are extraordinary results for a project on the Walker Lane Trend.

Bottom line: The Tyro Main zone at Gold Chain looks well postioned to host a large and very valuable bulk-mineable gold resource. |

| Vast Untapped Potential |

| Exciting as that short-term potential is, Gold Chain’s longer-term possibilities are even more intriguing. |

|

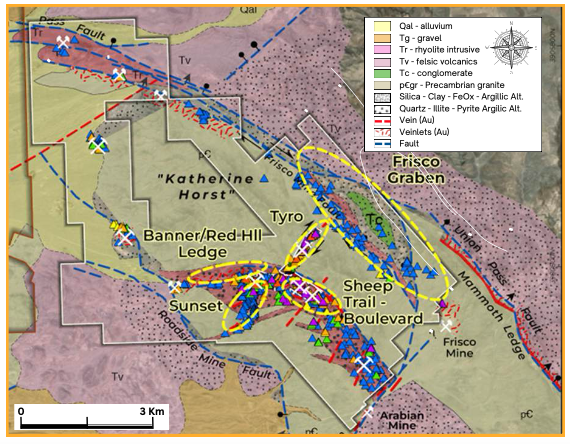

| Click image to enlarge In addition to the potential gold resource at Tyro, Gold Chain has two large targets in Frisco Graben and the Banner-Sheep-Trail trend. |

| As you can see from the map of Gold Chain above, Tyro (at 1.4 kilometers in strike) covers just a small portion of the overall property. |

| It is bordered on the northeast by the Frisco Graben, a massive target spanning 4 kilometers by 750 meters. |

| Based on preliminary surface work on the Frisco Graben, West Point believes it could host a low-sulphidation gold system at depth, one that is possibly the engine for the gold mineralization at Tyro.

How big could this be? Consider this: A similar discovery along the Walker Lane trend in Nevada allowed AngloGold Ashanti to grow the four-million-ounce resource it bought through the acquisition of Corvus Gold to more than 10 million ounces. |

| The other key target on Gold Chain is the Banner-Sheep Trail trend, which hosts multiple small-scale mines that were past producers. That 10-kilometer-long trend is outlined by a pronounced geophysical target and high-grade samples all along the trend. |

| Frisco Graben and Banner-Sheep Trail give West Point Gold a shot at multiplying the identified potential at Gold Chain. |

| Drills Will Be Turning Soon... |

| With all this potential firepower, West Point Gold is woefully undervalued. |

| That could change with the 3,000-4,000 meter program the company is about to begin at Gold Chain. |

| That program will include initial testing of step-out targets, including Tyro Extension and Frisco Graben. West Point will also conduct additional drilling at the Tyro Main zone.

Given the remarkable results that the Tyro Main zone has generated, you could say that these are “high confidence” drill holes. |

| Short-Term Potential

And Long-Term Value |

| As great as the potential is for results at Gold Chain to light up the market in the days just ahead, it only scratches the surface of the deep value with West Point Gold.

Consider that West Point also boasts other company-making exploration projects, including.... |

| Jefferson Canyon — featuring 145 historic drill holes, highlighted by 41.2 meters of 6.4 g/t gold and 402 g/t silver and a four-square-kilometer gold-in-soil anomaly. This project is so similar to Kinross’ 20-million-ounce Round Mountain mine nearby that the major has joint-ventured it from West Point Gold. Jefferson North — lying along trend with the Round Mountain and Gold Hill, this project is awaiting necessary permits to advance it. |

| With all this value...and with drills beginning to turn at Gold Chain along proven trends... tomorrow may be too late to start doing your due diligence on West Point Gold. |

| CLICK HERE

To Learn More about West Point Gold Corp.

|