|

| In mining stock investing, nothing pays like discovery. |

| Even in bad markets, companies that make significant discoveries tend to see their share prices soar.

And in good markets like the current one for gold, where generalist investors are just starting to pay attention to junior mining plays?

Well, the rewards can be extraordinary. |

| That’s the opportunity that Astra Exploration (ASTR.V; ATEPF.OTC) offers gold bugs right now. |

| Astra controls the La Manchuria gold-silver project in Argentina’s Santa Cruz province — a project that, amazingly, hosts known instances of high-grade mineralization that are open for expansion in multiple directions. |

|

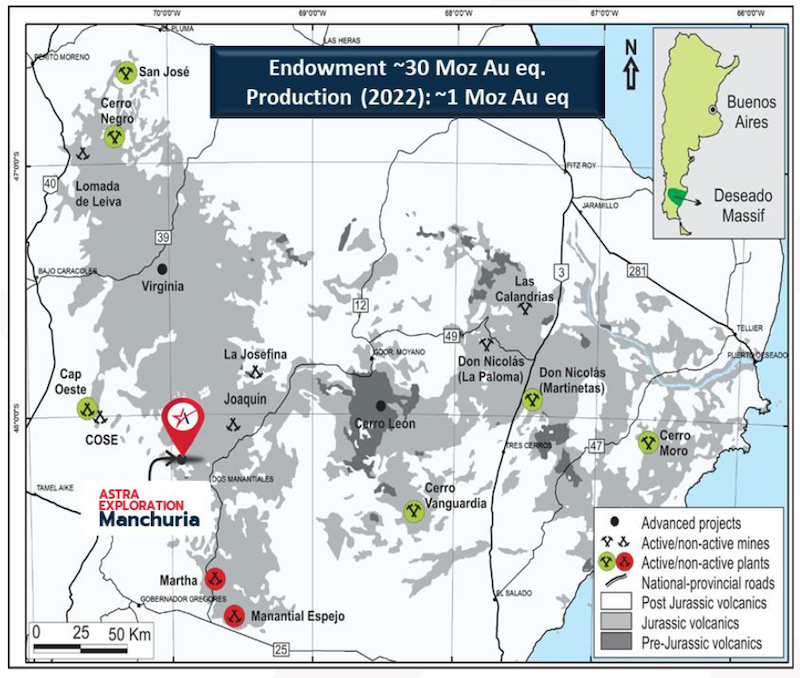

| Click image to enlarge Astra Exploration’s La Manchuria project is located in Santa Cruz, one of Argentina’s most active provinces for mining. |

| As you’re about to see, Astra’s review of La Manchuria’s project data has convinced its team that there’s a high-grade plumbing system at depth that generated the relatively small, open-pittable resource near surface. |

| A drill program to test that theory is underway at this very moment, and success could spark a big run on Astra Exploration’s stock. |

| With Astra’s market value largely back-stopped by that existing resource...and two Chilean projects open to joint venture deals...turning drills mean investors who want to bet on a high-grade gold-silver discovery at La Manchuria need to start doing their research quickly. |

| Following The Trail Of High-Grade Gold |

| Astra Exploration picked up La Manchuria last year from a company that had focused on the near-surface mineralization there. |

| As mentioned, Astra’s geologists see the opportunity to tag into the high-grade feeder system at depth. Remarkably, previous drilling only tested the Main zone at La Manchuria to 160 meters depth. |

| In fact, the previous focus of defining a near-surface gold resource is likely the reason that high-grade patterns in the main zone were not addressed.

Those assays included the following impressive results: |

- 20.5 meters of 10.4 g/t gold and 810 g/t silver

- 1.60 meters of 257 g/t gold and 4,237 g/t silver

- 4.0 meters of 26.3 g/t gold and 3,156 g/t silver

- 2.0 meters of 52.6 g/t gold and 3,274 g/t silver

|

| In addition to the opportunity at depth, Astra interprets the strike of the highest-grade vein at the Main Zone to be different than previously modeled, as the map below demonstrates. |

| |

| Click image to enlarge Astra will drill Vein 7 along the yellow line in the map of above, which indicates the actual strike of the vein as opposed to the previous interpretation. |

| The red line is the previously defined strike of Vein 7, and the yellow line is Astra’s interpretation of the actual strike of that vein. |

| If Astra is right, this new understanding will open up an opportunity to extend the vein along strike to the northwest and to the southeast under post-mineral cover. |

| Simply put, Astra’s current drill program could begin to establish a significant, high-grade epithermal gold-silver deposit at La Manchuria within days. |

| An Area Renowned For Massive Epithermal Gold-Silver Deposits |

| La Manchuria lies within a macro geologic region known as the Deseado Massif. |

| This region is host to world-class epithermal gold-silver mines like Newmont’s Cerro Negro and AngloGold’s Cerro Vanguardia. |

| Despite the presence of these mines, the Deseado Massif is still considered a young exploration region.

Past M&A activity in the region includes Goldcorp’s purchase of Andean Resources for C$3.4 billion and Yamana Gold’s acquisition of Extrorre Gold for C$413 million.

La Manchuria’s geologic similarities to Cerro Negro and its potential to host a Tier 1 gold deposit of its own make Astra Exploration a premier takeout target if the drills hit paydirt. |

| Backstopped By Optionality... |

| The great thing about Astra Exploration is, even though it is a drill hole play, the risk that usually attends such plays is largely mitigated by the existing resource at La Manchuria.

That small, open-pittable resource consists of 53,900 ounces of indicated gold equivalent and 92,400 ounces of inferred gold equivalent. |

| All by itself that resource has potential to be a low capex asset with strong economics at current metals prices, plus it has organic growth potential and a small environmental footprint. |

| More importantly, the resource gives Astra the optionality of fast-track production, potentially aided by the presence of nearby mills in need of ore. |

| …And Two Large, Chilean Projects |

| Also mitigating Astra’s risk is the potential of its two large Chilean projects: Pampa Paciencia and Cerro Bayo.

Of those two, Pampa Paciencia is the most advanced, with a location in northern Chile near deposits hosting 17.6 million tonnes of copper, 3.6 million ounces of gold and 277 million tonnes of molybdenum. |

| Pampa Paciencia is highly prospective for high-grade gold and for copper as well. To drill it effectively, though, Astra may consider a joint venture partner that can fund an extensive program there. |

| Cerro Bayo is another of the company’s Chilean gold projects, this one located in the prolific Maricunga trend. Though at an earlier stage that Pampa Paciencia, Cerro Bayo is another project that could attract a joint venture partner to underscore Astra’s market value. |

| A Short Window To Act |

| But it is undoubtedly the ongoing drill program at La Manchuria that will provide the potential short-term catalyst for Astra Exploration’s share price.

The company has C$1.3 million in the bank right now, which should be more than enough to finance the current drill program, and they have the financial backing of Michael Gentile and his network. Michael Gentile currently owns almost 17% of Astra.

But they won’t stop there: A soon-to-close C$1 million financing and the likely exercise of up to C$1.67 million of in-the-money warrants will provide Astra with enough money to quickly embark on a phase II program. Those warrants are held by Astra’s management and Michael Gentile’s network, who also intends to participate in the financing. They’ll have no shortage of targets, as La Manchuria has the potential to not only host high-grade mineralization along strike and at depth on the Main zone, but also to host more mineralization on the Eastern zone. |

| With high-potential, high-confidence and high-grade targets on a drill program that’s just begun...plus established assets to back-stop its market value...Astra is just the kind of gold play that junior mining investors dream of. |

| The first results from the current program should hit the market in May, making now the time to start doing your due diligence on Astra Exploration. |

| CLICK HERE

To Learn More about Astra Exploration Inc. |