| Potash Developer Uniquely Positioned For A Booming Market | | Please find below a special message from our advertising sponsor, Brazil Potash. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. | | Contact Us | Privacy Policy | View in Browser | Forward to a Friend | |  | | In The Sweet Spot For Potash Profits | | | Located nearby a prolific agricultural region, one potash developer expects to shorten product shipping times from 100+ to 2.5 days, cutting costs roughly in half.

Its name is Brazil Potash (GRO.NYSE-A) and its Autazes project all alone could supply up to 20% of Brazil’s annual potash demand…and make investors a bundle in the process. | | | | A severe fertilizer supply crunch has countries around the globe looking to domestic sources of key commodities like potash. | | Consider this: Brazil imported ~98% of its potash in 2021 from an international market dominated by Canada, Russia and Belarus.

That dependence leaves Brazil’s $167 billion agricultural sector completely vulnerable to price volatility, geopolitical risks, and supply disruptions | | And that’s where Brazil Potash (GRO.NYSE-A) comes in. | | The company has a project in the Amazonas Basin in northwest Brazil that expects to produce up to 2.4 million tons of potash annually.

That puts its vast potash resource within easy barging distance of one of the world’s most prolific agriculture regions. | | As you’re about to see, that location gives Brazil Potash a huge competitive advantage over its larger competitors with projects in other parts of the world. | | Brazil Potash’s Autazes project has the potential to generate an eye-popping ~$1 billion per year in earnings over its mine life of at least 23 years, and the company has received all of the construction licenses that it expects to be required to initiate the construction of the Autazes project.

That makes this the perfect time for investors to take a close look at Brazil Potash. | | Amazonas Basin Location Provides

Huge Competitive Edge | | As one of the largest agricultural exporters in the world, Brazil plays a pivotal role in global food production, responsible for 1 in every 10 meals consumed worldwide.

Yet, despite being an agricultural powerhouse, Brazil faces a critical supply chain problem. Brazilian farmers consume over 20% of the world’s seaborne potash, yet they pay a steep premium due to long-haul shipping costs and supply chain inefficiencies.

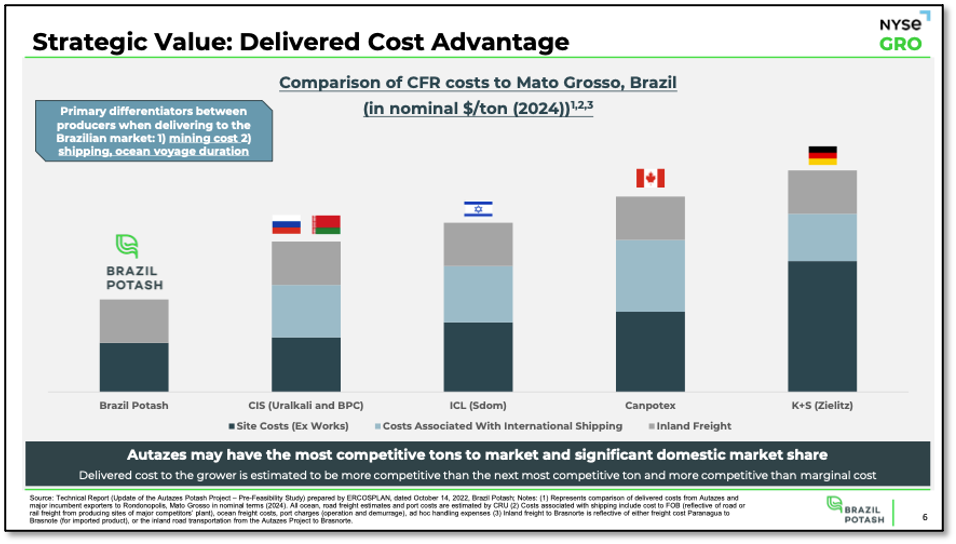

As the chart below indicates, much of the cost of potash is related to shipping it across long distances. |  | | Brazil Potash (NYSE-A:GRO) is positioned to change that. Strategically located near one of the world’s most productive farming regions, Autazes offers a clear competitive edge over legacy potash producers.

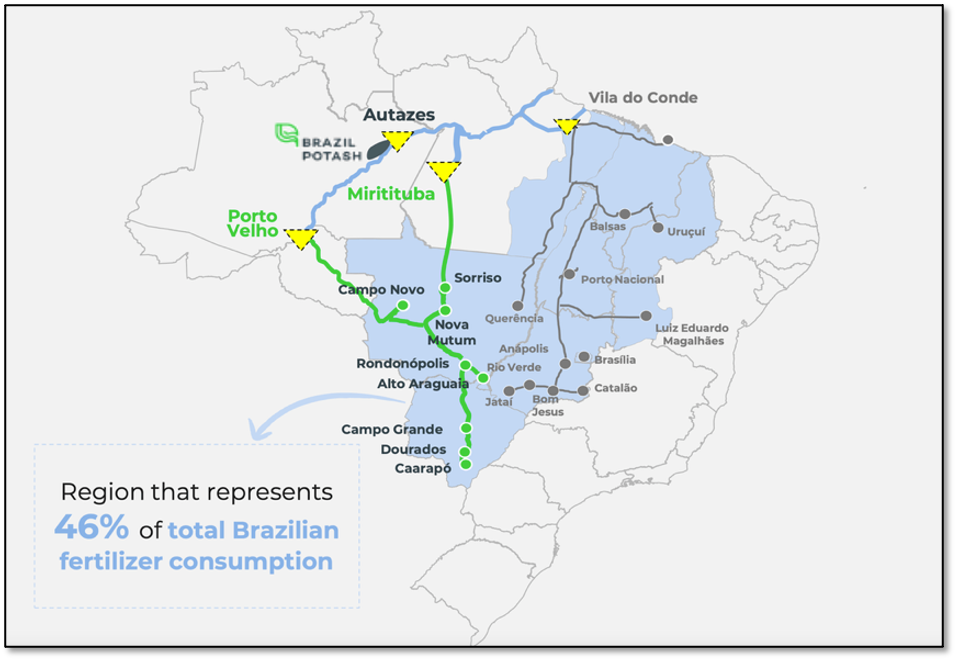

As this map makes clear, Autazes is located within easy shipping distance of the main farming regions in Brazil, which accounts to 46% of Brazilian fertilizer consumption. |  | | Brazil Potash’s Autazes project’s location in the country’s Amazonas Basin puts it within easy inland shipping distance of its main agricultural region. | | The transit time for shipping potash from Autazes is estimated to be just 2.5 days as opposed to the 100+ day shipping timelines for potash from Canada or Russia. | | That dramatic difference in shipping times translates into big savings... and a huge advantage for Brazil Potash by cutting costs roughly in half. | | The company believes that the resource at Autazes is large enough to meet roughly 20% of Brazil’s demand for potash, with a projected production of up to 2.4 million tons of potash annually. And while the mine is initially expected to operate for 23 years, this estimate is based on exploration of only ~5% of the project’s basin.

With further exploration, management believes the resource could potentially support production for multiple generations. | | Run By Industry Titans | | In a strong signal of how lucrative the opportunity at Brazil Potash could be, the company drew the leadership of Mayo Schmidt. He is the former Chairman and CEO of Nutrien — the world’s largest potash producer.

Schmidt has first-hand experience scaling billion-dollar operations, and he has a deep understanding of the potash market. Under his guidance, Nutrien’s annual revenues shot up from $9 billion to $28 billion, a 318% gain.

He is the founder and former CEO of Viterra Inc., a company he built from a ~$40M regional cooperative to a global business with ~$800M in EBITDA over a 12-year period prior to being acquired by Glencore.[ii]

He’s held senior positions in ConAgra Grain, General Mills, and Hydro One Limited - Canada’s largest utility. And he served on Agrium’s board of directors, overseeing a transformative merger with Potash Corporation to form Nutrien that catapulted the company to global recognition. | | The chance to take over a company and a project that could supply up to 20% of Brazil’s potash demand was simply too good for him to pass up. | | He’s joined by an advisory board that includes the former Attorney General of Brazil, the former Minister of Agriculture, and the former Senator of the largest farming region in Brazil and SALIC’s (Saudi Agriculture and Livestock Investment Company) former head of Agriculture Supply Chain Investments.

Schmidt shepherded Brazil Potash through a $30 million IPO in November 2024. Such was Wall Street’s enthusiasm for the company’s story.

That interest has already begun to materialize. In November, Franco-Nevada, one of the world’s largest royalty and streaming companies, secured an option to purchase a 4% royalty on gross revenue in exchange for the payment to Brazil Potash of cash consideration of $1,000,000—a move that underscores institutional confidence in the long-term viability of the Autazes project.

The project’s clear logistical advantage was not lost on Franco-Nevada. While established producers may have the size, expertise, and resources - when it comes to the economics of selling potash into Brazil, they are at a major transportation distance and resulting cost disadvantage. The moment this new source of potash enters the supply chain, Brazil Potash could capture market share. | | A Growing Pipeline Of Partners | | After 14 years of exploration, ~$250 million invested, and mine construction set to begin, the project is at a pivotal moment. Key permits are in place, marking a major step toward full-scale development. A dedicated onsite processing plant will enable rapid refinement and distribution.

Brazil Potash is now securing strategic partnerships to pave the way for future planned production.

The Amaggi Group, a soybean producer with ~$10 billion in annual revenue, has already agreed to a 550,000 tons per year offtake agreement with the company. Another firm, Swiss-based fertilizer trader Keytrade, has entered into a memorandum of understanding for potential offtake of up to one million tons per year of potash from the project.

And to further cement their logistical advantage, Brazil Potash has secured a 15-year shipping agreement with Hermasa, which includes exclusive river barge transport rights. This ensures a consistent supply chain to Brazil’s major farming regions.

More partners are in the works, and it looks like Brazil Potash is uniquely positioned to build an in-demand, Brazil-centric mine at Autazes. | | Potash Companies Can Trade

At Up To Nine Times EBITDA | | With key permits for construction of Autazes obtained, offtake agreements rolling in and a 15-year river barge agreement in place, Brazil Potash is set up to dramatically shorten the supply chain for the country’s agricultural sector.

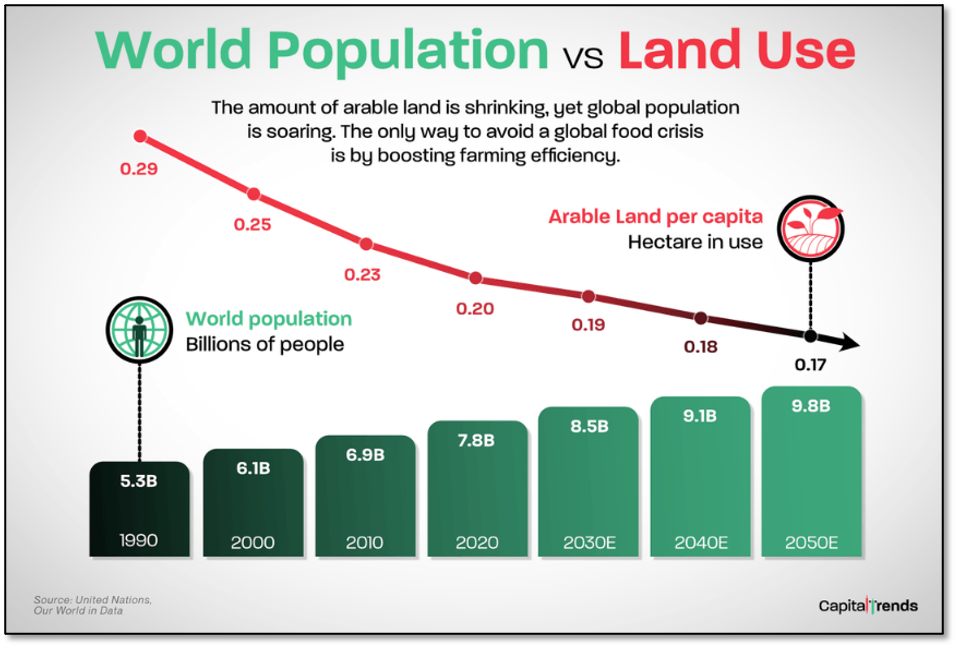

The importance of this project extends even beyond Brazil’s borders. That’s because, as the world’s population grows toward 9.8 billion people in 2050, the world’s arable land per capita will steadily drop. |  | | The world’s population is growing while its per capita amount of arable land is shrinking, which puts a premium on yield-increasing fertilizers like potash. | | To feed that surge in population, the agricultural sector will have to do more with less land...and that means using fertilizers like potash to increase yield. | | No wonder potash companies are predicted to trade at as much as nine times EBITDA in the course of the next market cycle. | | Autazes is projected to generate ~$1 billion annually in EBITDA over its at least 23 year mine life, and Brazil Potash is currently trading at just under $100 million. The upside potential with Brazil Potash is obvious.

The company is closing in on making a production decision on Autazes, making now a great time to do your research. | | CLICK HERE

To Learn More about Brazil Potash Corp. | | | ISSUER-PAID ADVERTISEMENT. BRAZIL POTASH CORP., or the “Company,” has or will pay Jefferson Financial Inc. (“Publisher”) in cash $7,500 for marketing services, including advertisements. This advertisement is part of those issuer-paid marketing services. This compensation should be viewed as a major conflict with Publisher’s ability to be unbiased.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured company and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, government regulations concerning potash production, the size and growth of the market for potash, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc. | | | | © Golden Opportunities, 2009 - 2025 | | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411 | | | |