|

August 18, 2025

Dear Fellow Investor,

|

| It’s getting interesting again.

|

| Over the past couple of weeks, I’ve been writing about some important changes afoot in the broader markets as well as metals and mining.

For mainstream investors, we’re seeing a renewed focus...or better said, obsession...with Fed policy. The September FOMC meeting looms large, with disappointing jobs numbers arguing for a cut and inflation numbers arguing against one.

|

| With the Jackson Hole conclave of central bankers coming later this week, we can expect the hype and bluster to be turned up to 11 on CNBC and Bloomberg.

|

| Not only the broader markets have been driven by these shifting winds lately, but also gold and silver. Any shift toward a rate cut helps boost gold, and vice versa.

On top of that, the rumors of a gold tariff recently sent gold bouncing higher and lower as confusion reigned. At the end of it all, the gold price sat virtually unchanged, with the biggest damage being the distraction from what has really been driving this bull market.

|

| You know that story — how the intersection of ever-easier money, ever greater debts and spiraling debt-service costs...combined with dollar weaponization...have been sending global actors from individuals to sovereign nations flocking to gold.

|

| I won’t waste much time on that here today. Rather, I’ll focus on another subject: how the metals and miner markets are rapidly evolving at the moment.

|

| Step By Step...

|

| To understand this evolution, and identify the opportunity it's presenting, let’s see how it’s progressed so far.

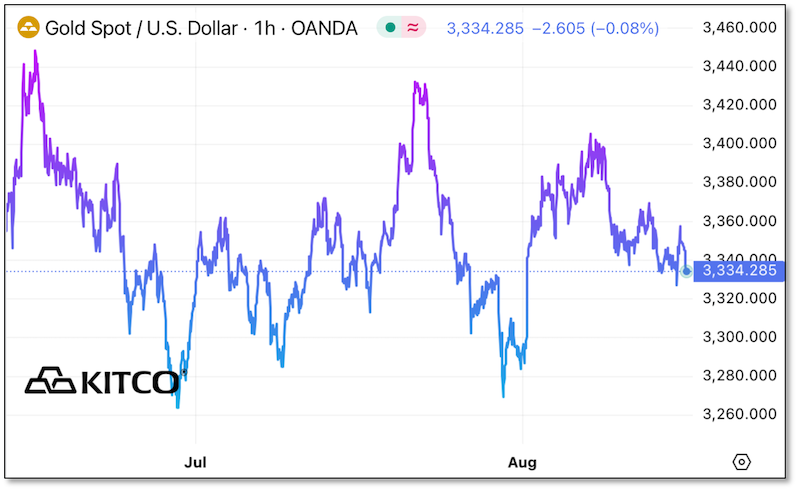

First off, as I’ve been noting in recent issues, gold is trying to pull out of its summer doldrums, but the progress has been halting, and the price remains stuck in a trading range at this moment.

|

|

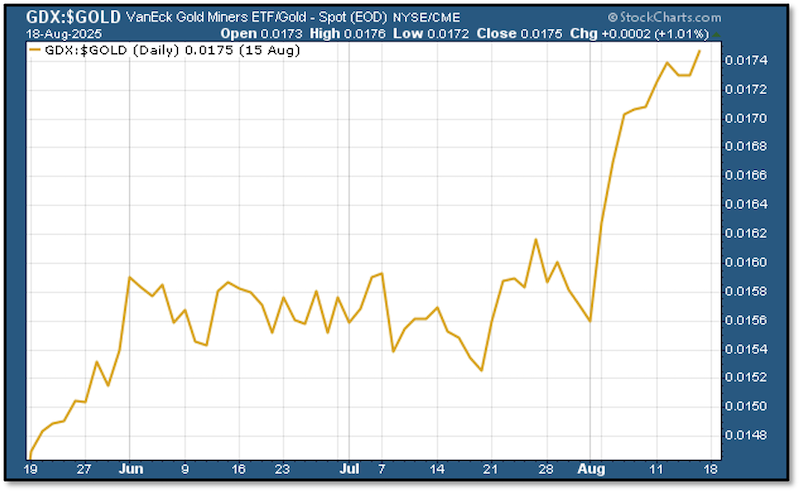

| While gold remains stuck in the mud for now, we have been seeing Western investors moving into the sector, and doing so through mining stocks.

Consider the following chart of the GDX mining stock index versus gold itself.

|

|

| As you can see, it seems as if the advent of August fired a starting gun for investors to buy gold stocks.

|

| Of course, the other sector that historically offers leverage to gold, but which has lagged the metal because central banks don’t buy it, is silver.

|

| Here too, this typically leveraged market is now outperforming gold, as you can see by the falling gold:silver ratio:

|

|

| The gold:silver ratio has actually been falling since late spring. But, again, August seems to have refocused investors on gaining leverage to gold before the yellow metal truly breaks out.

Now we get to where I see an opportunity.

Consider this chart of the Toronto Venture Index (which is an imperfect but usable proxy for junior mining stocks) to the GDX index of major mining companies.

|

|

| You’ll note that the junior sector was outperforming the major miners from mid-April through mid-July, but have now fallen behind.

Despite this falling ratio, I can tell you that, anecdotally, the junior mining sector has remained quite ebullient this summer. Companies have been able to raise money easily, and on their terms.

Coffers are full, at least for the better companies, and the money has been going into the ground.

Despite these positives, then, the window remains open to buy the top juniors at relatively low valuations.

|

| The “Generational Opportunity”

|

| I’m convinced that the current situation in junior mining stocks represents a generational opportunity — the kind of opportunity we haven’t seen since the early 2000s.

The difference is that 25 years ago, gold was in the dumps along with silver and the miners. You needed lots of courage to bet on a bull market.

But today, the hard part’s done. Gold is at record highs and headed higher. And now the junior miners and silver are finally beginning their big responses.

|

| This is not the kind of opportunity you can let pass. And you don’t have to, because I’m joining my friends David Morgan, Dana Samuelson and Russ Gray tomorrow evening in a fascinating webinar hosted by Bronson Hill.

|

| We’re going to examine this bull market from top to bottom, discover what the key drivers have been, where it’s going and what areas offer the best opportunities right now.

I strongly recommend that you sign up for this valuable presentation by clicking the link below.

|

| All the best,

|

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

|

| CLICK HERE

To Register For The

“Don’t Miss The Precious Metals Boom”

Webinar With Brien Lundin, David Morgan, Russ Gray, Dana Samuelson And Bronson Hill

Tuesday, August 19th, 4:00 Pacific/7:00 Eastern

|