Two Paths To Profits

With the possibility of near-term production and growth via exploration, PPX Mining’s (PPX.V; SNNGF.OB) Igor project in northern Peru gives investors two potential ways to win.

Dear Fellow Investor,

Sometimes great stories in the junior mining space give us more than one way to profit.

That’s certainly the case with PPX Mining, a junior explorer with a project in northern Peru that offers both near-term production and exploration blue sky.

And yet both the company and its Igor project have largely missed the market’s attention.

That’s in the process of changing, however, as PPX is moving headlong towards a production decision on the Callanquitas underground deposit at Igor. In a matter of weeks, Callanquitas will have a prefeasibility study out on that deposit’s silver-gold resource.

At that point, analysts will be able to put pencil to paper on the project’s economics and PPX will be able to move into the construction phase for a mill at Igor.

So, in fairly short order, the company will be able to prove to the market that it has a way to monetize the higher gold and silver prices that look to be just around the corner.

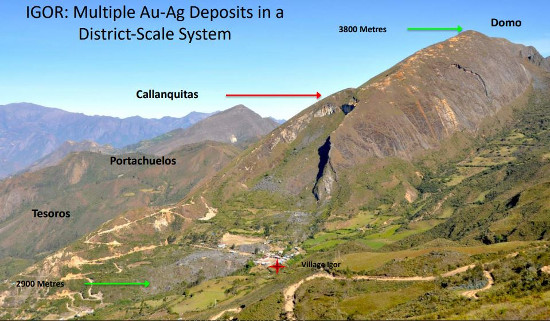

But it gets better: Igor boasts no less than three additional areas of mineralization that give PPX the opportunity to grow via the drill bit as well.

It’s this combination of a production story and a district-scale exploration story that makes PPX Mining a compelling value at current trading levels.

Tracking Toward Production

With a 730,500-ounce inferred gold-equivalent resource, Igor’s Callanquitas target is primed to begin monetizing higher gold and silver prices in the near future.

PPX has mined and processed over 20,300 tonnes of bulk sample from Callanquitas to help it quantify project economics. It has 10-year community agreements in place on the mine and is shepherding the resource through the permitting process.

The prefeasibility study will include an updated resource estimate for Callanquitas and will forecast the economics of a 350-tonne-per-day underground mining operation.

Recent drilling on Callanquitas has identified more areas of high-grade mineralization, led by Hole 87 (5.5 meters of 8.46 g/t gold and 104 g/t silver) and Hole 86 (12.6 meters of 8.34 g/t gold and 207 g/t silver).

Those are the kind of grades that should help boost the economics at Callanquitas. And they are over and above the lower-grade, but larger, area of mineralization being outlined at Portachuelos.

PLUS: Big Exploration Upside

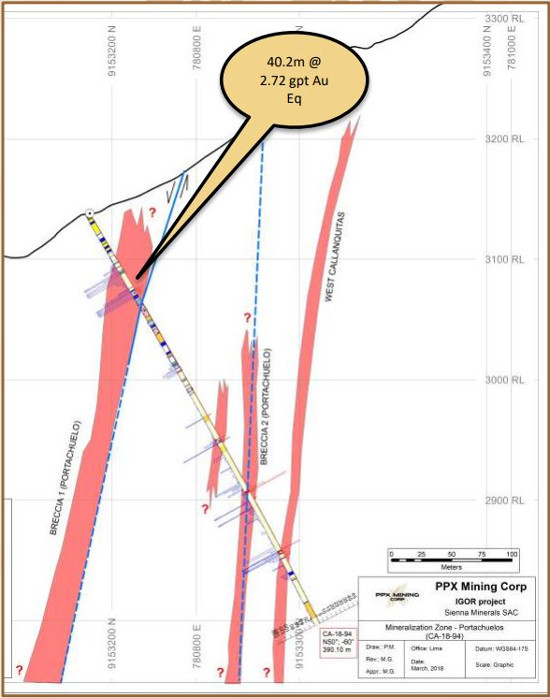

Located 800 meters south of the Callanquitas resource, the Portachuelos target gives PPX the opportunity to add an open-pittable resource to that higher-grade underground resource.

The large scale of the mineralization at Portachuelos has already been confirmed — it has been traced for 1,000 meters along strike and to depths greater than 300 meters. The good news is that it’s also relatively shallow, and its multiple stacked zones of mineralization make it extremely amenable to open-pit mining techniques.

The upside on this target is remarkable, with drilling indicating that Callanquitas and Portachuelos actually connect. This gives the target over 1,800 meters of potential strike...and it remains open along strike and at depth.

The highlight hole so far from Portachuelos is Hole 94, which cut 40.2 meters of 1.18 g/t gold and 115.4 g/t silver (2.72 g/t gold equivalent). That’s a long-intersection of very mineable grades, one that also included elevated copper levels of 0.68%.

Simply put, the Portachuelos target has all the markings of the kind of large porphyry-style deposits that populate the northern Peru copper-gold belt.

Tesoros And Domo Add To District-Scale Potential

Igor’s expansion potential doesn’t stop with Portachuelos. The project’s Domo and Tesoros targets are intriguing in their own right.

At Domo, PPX has identified northeast-trending structures and related mantos that host high-grade gold and silver mineralization.

Exploration highlights at Domo include 25 high-grade channel samples ranging between 16.0 g/t and 50.4 g/t gold. Plus, a historic drill hole cut 2.8 meters of 12.6 g/t gold and 303 g/t silver (16.6 g/t gold equivalent).

There has been even more historic work at Tesoros, where 17 drill holes totaling 1,769 meters were completed. This is an area of production that dates back to Peru’s Colonial era.

Key intercepts from the historic Tesoros work include hole 7A (2.0 meters of 8.0 g/t gold and 113 g/t silver) and Hole 9D (75.2 meters of 3.1 g/t gold and 109 g/t silver). A comparison of these holes with underground samples has provided strong indications that the mineralization may be continuous.

Perfectly Positioned For The Next Bull Market

PPX Mining is that rare bird in the junior mining space — a company with identified resources that allow it to benefit from advances in metals prices...plus exciting exploration potential.

With its Callanquitas mine advancing toward production, PPX should hit its stride just as the precious metals markets are hitting theirs.

This combination of near-term production and exploration expansion make now the perfect time to build a position in PPX Mining.

CLICK HERE

To Learn More about PPX Mining

|