Twinning a

40-Million-Ounce

Gold Mine

The fabled Homestake Mine produced over 40 million ounces of gold. Now, upstart Mineral Mountain Resources (MMV.V; MNRLF.OB) is

hot on the trail of a twin of this gold deposit.

Dear Fellow Investor,

The legendary Homestake Mine in the Black Hills of South Dakota, discovered in the late 19th Century, was no ordinary mine.

It produced 40 million ounces of gold between 1876 and 2001.

And when it finally closed in the early 2000s, it wasn’t for a lack of ore. Rather, it was because of low gold prices that it was finally shut down.

But what a legacy it had created. Today we wonder, how did Homestake manage to produce gold for 125 years?

A key was the high-grade and consistent nature of the banded iron formation (“BIF”) mineralization that held the most valuable portions of the deposit.

Miners were able to tap into these large areas of BIF mineralization and mine them at progressively deeper levels.

The source of this mineralization was an ancient volcano, eruptions of which generated large emplacements of BIF mineralization in the area. In fact, Coeur Mining is operating the adjacent Wharf mine to the west of Homestake. So it would seem that the most fertile gold areas in the Black Hills have long been spoken for.

Except maybe they aren’t.

You see, a company called Mineral Mountain Resources (MMV.V; MNRLF.OB) has secured a project to the southeast of Homestake. Importantly, it’s located on the very same structural trend as that historic mine.

Better still, it appears to contain a cluster of the same type of BIF emplacements that contained bulk of the gold at Homestake.

On Trend And With Same Geology As Homestake

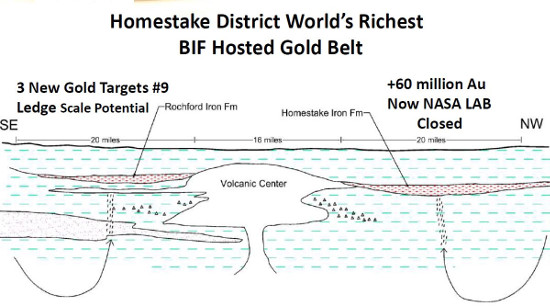

The map below highlights the potential at Mineral Mountain’s Homestake South project.

This map follows the trend of the mineralization in this area of South Dakota along the northwest-to-southeast trend of the key geological structure in the area.

As you can see, that aforementioned volcanic center created BIF emplacements to the northwest and southeast of its core.

Between the Homestake Mine and other mines on the northwest side of this center, the Homestake Iron Formation has been responsible for over 60 million ounces of gold.

Turning to the southeast vector of the trend, we see Mineral Mountain’s Homestake South project lying atop the Rochford Iron Formation.

The company has identified three new gold targets here, all of which have ledge-scale potential.

Testing For Ledges Of Gold

What does that mean? Another graphic, this one of the mineralization mined at Homestake, tells the story.

.JPG)

Each one of the red blobs in this graphic represents an orebody that was identified and then mined from the main ledge at Homestake. Historically, these orebodies contained consistent, high-grade mineralization (8.38 g/t average), regardless of the size of the orebody.

What does that mean for Mineral Mountain?

Just this. If the three new targets it has identified at Homestake South prove to host gold mineralization, the historic consistency of mineralization in the area suggests the company could prove up another “Homestake-scale” mine here.

Drills Are Turning On The Most Promising Target

The most advanced of the Homestake South targets is the Standby Mine target. Prior operators had sunk a 425-foot shaft into Standby after surface sampling averaged 10 g/t over 9.1 meters in outcrop.

In 1982, Getty Oil drilled hole S-1 and intersected the gold zone at Standby at the 600-foot level. Visible gold was noted in the core. In 1986, Homestake Mines intersected 10.23 g/t over 3.94 meters at the 1,500-meter (4,500-foot) level.

Those prior operators left behind the data to build a conceptual model of a potential orebody at Standby. The current, 3D target is 1,000 feet wide, 3,500 feet long and 4,500 feet deep.

Drills are now turning at Standby in a winter/spring program designed to re-drill the Getty hole before then drilling 11 holes down plunge on the target to about 1,200 feet to start.

Results from that down-plunge area of the zone have the potential to light a fire under Mineral Mountain’s share price.

This is a 1,500-meter area of the Standby target that has been unexplored to date. Consistent high-grade results, combined with the area’s history of hosting massive gold deposits, should draw investors to Mineral Mountain like moths to a flame.

That’s why time is short to get in on this story before it really takes off. The 12-hole, 4,300-meter program at Homestake South is underway at this very moment, and the first assays from this effort are expected soon.

The Time Is Now

In junior exploration investing, nothing super-charges an investor’s portfolio like owning a “discovery” story.

Assuming the past serves as prelude at Homestake South, the results from the current drill program on the project could represent the leading edge of a new world-class discovery in South Dakota’s Black Hills.

Do your due diligence, but if you have a taste for discovery plays, few companies are swinging for the fences with more gusto than Mineral Mountain Resources.

CLICK HERE

To Learn More about Mineral Mountain Resources.

|