| Bank prospects AND profits in a gold bull market |

|

| Please find below a special message from our advertising sponsor, Emgold Mining. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

Banking Profits In A

Gold Bull Market

|

|

The “prospect generator” has become perhaps the most popular business model in the junior exploration sector.

But now Emgold Mining (EMR.V; EGMCF.OTC) has taken that business model and put it on steroids with its “prospect banking” mode of operation.

|

|

If you’re a business owner desperate for money, you know that the banker holds all the cards.

|

Similarly, exploration and development companies will sometimes go to extraordinary lengths in a red-hot mining market to get their hands on properties in the right camps or on trend from big discoveries.

|

One junior exploration company discovered this the hard way, when their development project hit a dead end.

...And then the lesson was reinforced when a big company rushed to ink a lucrative deal on another of their properties.

|

In the process, they developed a revolutionary — and profitable — new business model for the entire industry.

|

Emgold Mining:

Building A Prospect Bank

|

What’s the best strategy for making money for shareholders — quickly and reliably — in the junior mining industry?

|

That’s the question the management team at Emgold Mining (EMR.V; EGMCF.OTC) asked itself in 2018.

|

At the time, the company was emerging from a quiet period after abandoning, in 2016, a common junior sector strategy of advancing a flagship project.

Located in California, it was a great project in a bad location. After years of hard work advancing the project, it had gotten bogged down in the state’s environmental politics and reached a dead end.

To their credit, Emgold’s management decided to pivot into the two most mining-friendly jurisdictions around — Nevada and Quebec.

In the process, it also decided to reinvent itself as a prospect generator, but one with a twist....

|

A New Take On A Proven Model

|

You see, in the typical prospect generator model, the junior uses its geologic expertise to identify undervalued exploration projects.

They then do just enough surface work to entice a joint venture partner into paying the lion’s share of the costs to drill, discover and develop a deposit on the property. In exchange for a majority of the project, that partner then carries the load from then on.

If the JV partner meets with success, the prospect generator usually sees its remaining interest bought out at a premium to trading levels.

The downside of this process is it can be a little passive, and it tends take a long time.

That’s not the plan for Emgold, which has converted the prospect generator model into a prospect banking model, one that looks to buy properties, establish value, find partners and then look for a quick and profitable exit.

|

|

Seizing An Advantage In Two Of The World’s Best Mining Districts

|

It’s a strategy that has allowed the company to quickly and cost-effectively amass a seven-project portfolio (five in Nevada and two in Quebec) in two of the world’s best regions for mining and exploration.

Nevada has a long history of mining, and it continues to be a key pillar of the state’s economy.

The state produced 5.8 million ounces of gold in 2018 and its mining trends continue to be among the most sought-after locales for new metals deposits. The state’s permitting process is fair and relatively quick, and its communities are generally supportive of the industry.

| |

| The story is similar in Quebec. The Canadian province’s section of the gold-rich Abitibi Greenstone Belt has produced multi-million ounces of gold and other metals over the past century, including 2.0 million ounces in 2018.

In a testament to their mining friendliness, both Nevada and Quebec were focused on keeping mining and exploration going despite Covid restrictions.

Now, as we move into this period of Covid uncertainty, safe jurisdictions are going to be more sought-after than ever, as it is possible, even likely, that developing world governments will begin nationalizing assets.

|

Management Proves Concept With Recent Moves

| Two recent deals demonstrate Emgold’s ability to execute this strategy.

The first is the sale of its Troilus North property to Troilus Gold, which holds an eponymously named property (with four million ounces of gold) directly to the south.

After acquiring Troilus North in August 2018 for C$200,000 in cash and 1 million shares, Emgold then sold Troilus North to Troilus Gold in December 2018 for more than C$3 million (C$250,000 in cash and 3.75 million Troilus shares). This, for a property that didn’t even have an established resource yet!

The second recent deal was the company’s sale of its Stewart and Rozan properties in British Columbia to Ximen Mining. That transaction was valued at C$1 million (C$100,000 in cash, 1.275 million Ximen shares and 1.275 million Ximen purchase warrants).

|

Consider this: Emgold’s current market cap is only around C$6 million.

|

In other words, the value that the company received for flipping these projects is almost equal to its current valuation — without even taking the values of its remaining project portfolio into account.

|

|

|

A Rich, Aggressive JV Deal

|

And that portfolio has plenty of inherent value in its own right.

A case in point? The C$22.5 million joint venture deal Emgold signed with Kennecott Exploration on its New York Canyon project in Nevada.

Kennecott is a subsidiary of Rio Tinto, one of the world’s largest mining companies. When they come in on a property, they typically go big, and they certainly did with New York Canyon.

|

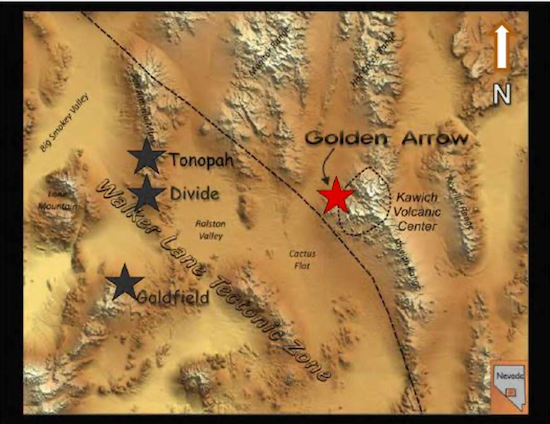

| | Emgold’s Walker Lane Projects | How Emgold came to hold this project is another good example of its property banking strategy.

In management’s search for orphaned assets, it found this copper-moly project that Searchlight Resource Corp. was looking to jettison to focus on its properties in Saskatchewan.

Emgold bought New York Canyon from Searchlight in July 2019, a transaction that included C$350,000 in cash payments and the issuance of C$500,000-worth of Emgold shares.

Kennecott had already been sniffing around the project, staking claims around Searchlight’s property position while the deal with Emgold was closing.

The JV deal allows Kennecott to earn up to a 75% interest in New York Canyon by spending C$22.5 million over 11 years, including a firm commitment to spend C$1 million in the next 12-18 months.

That commitment virtually guarantees news flow for Emgold from this high-profile project over the next year. (And, oh by the way, Kennecott went ahead and picked up the remaining payments Emgold still owed Searchlight as part of this deal.)

|

Recent Takeout Sets High Valuation Bar

|

While Kennecott tests New York Canyon, Emgold will continue to seek ways to build value at Golden Arrow, which is also on the Walker Lane Trend.

Golden Arrow boasts a measured and indicated precious metal resource of 296,500 ounces gold and 4.0 million ounces silver. The inferred resource adds another 50,400 ounces of gold and 1.25 million ounces silver.

|

|

The takeout of Northern Empire Resources provides a great example of what some successful exploration can do for a smallish precious metals resource.

That company’s Sterling project (also located along Walker Lane) had a modest gold-silver resource.

Northern Empire came in, expanded that resource considerably with drilling and was taken out by Coeur d’Alene mines in 2018 for US$117 per ounce of gold resource.

Golden Arrow looks like a project in a similar state as Sterling when Northern Empire bought it, and Emgold’s current market cap suggests a valuation of US$7.25 per gold-equivalent ounce.

Granted, a jump from a US$7.25 to US$117 an ounce valuation would be extreme, but just by virtue of the roaring bull market, Golden Arrow’s resource alone could justify a significant rerating of Emgold’s entire market value.

|

Top 5 Reasons To Invest In Emgold

| Simply put, Emgold’s property banking strategy provides its shareholders with a lot of ways to win. Here are the five that rise to the top:

|

1) A joint venture with a major: Kennecott, a subsidiary of Rio Tinto’s (RIO.NYSE), has agreed to spend up to C$22.5 million on Emgold’s New York Canyon project — the industry giant obviously sees significant upside here.

2) A protected downside: The combined valuations of just its most recent three transactions equal more than Emgold’s current market cap. You could look at it like you’re getting the rest of its portfolio essentially for free.

3) Location, location, location: With properties in Nevada and Quebec, Emgold’s portfolio lies within two of the world’s safest, most mining friendly jurisdictions.

4) Projects next to existing mines: Emgold’s Casa South project in Quebec sits on the southern edge of Hecla Mining’s (HL: NYSE) flagship Casa Berardi operation; its East-West project (also in Quebec) lies close to key projects for Wesdome Gold Mines (TSX: WDO), 03 Mining (OIII: TSXV) and Agnico Eagle Mines (AEM: NYSE).

5) Gold’s set to outperform: Gold has been one of 2020’s top performing asset classes so far — and yet the market continues to undervalue Emgold, which makes it a great potential lever on the yellow metal in the back half of the year.

|

There’s also the potential from more deals down the road as the company continues to employ its property banking model.

Moreover, recent analyst reports suggest that — based on the in situ value of Golden Arrow alone — Emgold could be valued at C$0.40-C$0.50 a share.

If you’re looking for an inexpensive, highly leveraged way to bet that the current gold bull market will roll one, Emgold is very much a buy at current levels.

| |