|

Dear Fellow Investor,

A junior gold exploration company is busily delivering some of the most astounding high-grade gold results most investors have ever seen.

But get this: These results aren't coming from a new discovery. Instead, they're the result of the "re-discovery" of a legendary gold mine.

And it just got even better, as Skeena Resources (SKE.V; SKREF.OB) just signed an option to acquire yet another of the richest gold mines in history....

...Where they've announced the discovery of a major high-grade gold zone that was completely overlooked!

Building Upon A Golden Legacy

Where's the best place to find high-grade gold? At a mine of course.

But not just any mine. If you had your pick, you'd undoubtedly choose one of the richest gold mines in history.

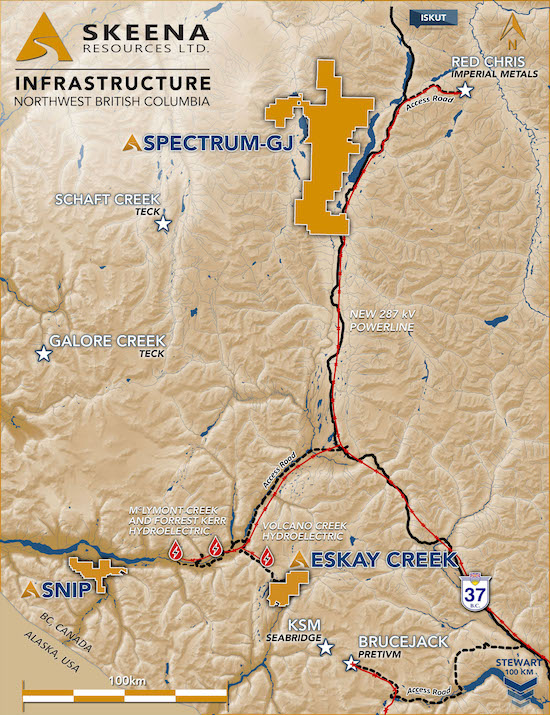

Which is precisely what Skeena Resources did. Twice. They snapped up two of the highest-grade mines anywhere in the world: Snip and Eskay Creek.

These storied projects helped put the Golden Triangle area of British Columbia on the map in the 1990s and 2000s. Snip produced 1.1 million ounces of gold between 1991 and 1999 — at an average grade of 27.5 g/t. Eskay Creek produced 3.3 million ounces of gold and 160 million ounces of silver between 1994 and 2008 — at average grades of 45 g/t gold and 2,224 g/t silver.

There are high-grade deposits...and then there are monsters like these.

Acquiring these projects is one thing. But now Skeena's taking the next step: proving that the best place to find high-grade gold is at a high-grade mine.

Consider the results that Skeena's getting from their initial underground drilling program to prove how much gold is left at Snip. They include eye-popping assays like 91.56 g/t gold over 3.82 meters, 44.10 g/t gold over 1.50 meters and 341.0 g/t gold over 1.5 meters (that's 11 ounces per ton!).

And these results aren't isolated. Out of the 62 holes Skeena completed for this first underground drill program at Snip, no less than 59 of the holes intersected significant gold mineralization.

But if Snip is a past-producing mine, why was so much gold left behind?

Two simple reasons: 1) low gold prices (averaging $350/oz), and 2) lack of infrastructure in northern British Columbia when the mine was in production in the 1990s meant that extremely high cut-off grades were needed for the mine to be economic.

The mine produced 1.1 million ounces of gold from 1991 until 1999 at an average gold grade of 27.5 g/t. But high operating costs and ever-falling gold prices meant cut-off grades that started at 12 g/t gold when the mine opened rose to a staggering 24 g/t gold in the last few years of operation.

Given today's substantially higher gold prices and the vast improvements in infrastructure in the area (including two new hydroelectric facilities located only 17 kilometers away), the prospects for redeveloping the Snip mine have improved dramatically. And Skeena is already proving that significant high-grade mineralization was left behind.

With 20,000 meters of drilling planned for Snip in 2018, the high-grade results will keep rolling in over the coming weeks.

Take All That Potential

...And Double It

As if Snip wasn't enough of a reason to be excited about Skeena, they went ahead and signed another deal with Barrick for the celebrated Eskay Creek mine in December.

Eskay Creek was once the world's highest-grade gold mine and fifth-largest silver mine, producing 3.3 million ounces of gold and 160 million ounces of silver at average grades of 45 g/t gold and 2,224 g/t silver.

Over the 14-year life of the mine, approximately 2.2 million tonnes of ore was mined, with cut-off grades ranging from 12 g/t-15 g/t gold-equivalent for mill ore and 30 g/t gold equivalent for direct shipping ore.

With cut-off grades at an ounce per ton, it's easy to see why Skeena thought Eskay Creek had amazing potential. Especially since the property is endowed with excellent infrastructure, including all-weather road access and yet another hydroelectric facility located only seven kilometers away.

Although they only recently secured the option to acquire the mine, Skeena has already been hard at work.

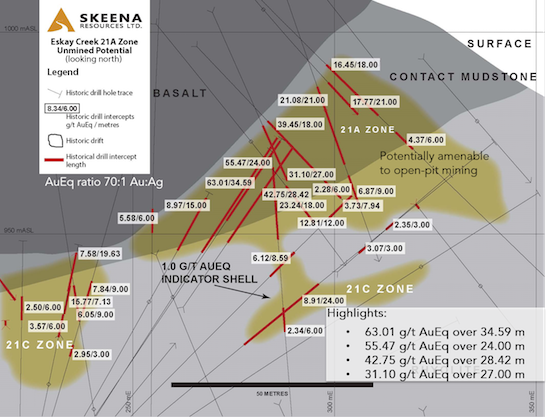

The company just finished analyzing the 700,000 meters of historical drill data they inherited and the results are remarkable.

The most exciting prospect is the 21A Zone — a significant zone of near-surface, high-grade gold that was never mined!

Interestingly, the 21A Zone was where the original discovery at Eskay Creek occurred but, again, it was never mined due to the falling gold price when the project was in operation.

The 21A Zone boasts impressive historical intercepts like 63.01 g/t gold equivalent over 34.59 meters, 55.47 g/t gold equivalent over 24.00 meters and 42.75 g/t gold equivalent over 28.42 meters, just to name a few. These truly are world-class intercepts that Skeena will aim to duplicate when they start drilling this summer.

With underground drilling starting up again at Snip within the month and surface drilling at Eskay Creek this summer, the news flow from Skeena will be steady and golden.

And it's a good bet that high-grade gold results — especially as gold itself continues to run higher — will lead to higher share prices for Skeena.

Bottom line: If you like gold (and why wouldn't you?), you simply won't find a company boasting higher-grade gold than Skeena Resources.

That's why I recently added Skeena Resources as a recommendation in Gold Newsletter...and why I firmly believe that every gold investor needs to seriously consider buying this stock. And right now — before the drilling begins.

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

CLICK HERE

To learn more about Skeena Resources.

|