|

Dear Fellow Investor,

It started with some unusually frequent gold finds by metal-detector prospectors in Western Australia's Pilbara district.

Novo Resources saw the potential and began staking claims down dip of the apparent discovery.

Then, in July of last year, it released initial trench results from its Purdy's Reward target that electrified the market.

Those results would eventually send its share price soaring from C$0.80 a share to over C$8.00 a share.

Why the excitement?

Simply put, if Novo's geologists are right, these trench results may represent the leading edge of a massive conglomerate horizon of gold.

And for ready proof of what this style of gold mineralization can signify, one need only look to South Africa's Witwatersrand Basin...which means this single discovery could rewrite the history of global gold production.

The Next Wits Basin?

The initial edge of the Witwatersrand Basin ("Wits Basin") was discovered in 1886 on a farm west of Johannesburg.

Further exploration would establish that this conglomeratic zone continued at depth. The overall Wits Basin formation would eventually be traced over an elliptical area roughly 300 kilometers long and 150 kilometers wide.

And while gold was only found on the northern and western edges of the basin, there has been plenty of it.

How much?

How about 1.5 billion ounces, or roughly half the gold ever mined on the planet!

And the Wits Basin continues to produce a large portion of the world's gold from mines that have followed that surface conglomerate mineralization to depths as much as four kilometers.

Striking Similarities

Like the gold-hosting portions of the Wits Basin, the deposit areas defined on the Purdy's Reward and Comet Well portions of Novo's Karratha project are ancient alluvial gold deposits.

The gold discovered by those metal detector prospectors were there due to the erosion and river placement of gold nuggets in a delta that led into a long-ago sea.

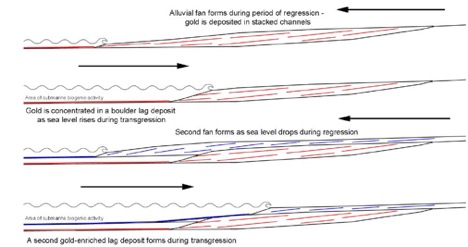

In this geologic model, gravels are washed seaward from rivers during low stands of sea level and are then reworked as the level rises and falls, creating an environment where gold is trapped and concentrated.

How Near-Shore Marine Alluvial Deposits Are Formed

The fact that the sea action concentrates the gold washed into the ancient river delta is critical; other types of alluvial deposits tend to be sporadic, lacking the continuity to be outlined and mined effectively.

That's what makes the Purdy's Reward discovery potentially so exciting.

If Novo and Artemis Resources, its 50-50 partner on Purdy's Reward, can verify the continuity of the mineralization, the model suggests that they may be able to simply mine the conglomerate layer that contains these gold nuggets to depth.

Just like those uber-prolific gold mines in the Wits Basin.

A Smart-Money Magnet

Already backed by industry legend Eric Sprott, the July trench results from Purdy's Reward (weighted-averaged of 67.08 g/t gold) would eventually attract a C$56 million private placement from Kirkland Lake Gold. That was good for a 17.66% stake in Novo.

Major Newmont Mining also holds a 4% stake in the company, and the Creasy Group holds a 7.51% stake. And that's not including the 50-50 agreement with Artemis Resources on Purdy's Reward.

Junior mining companies do not typically attract this level of support out of the gate.

The fact that Novo has over C$75 million in cash and securities in its treasury speaks volumes about the massive potential the smart money sees in its Pilbara region holdings, which now span 12,000 square kilometers.

Plus: A Proven Resource At Beatons Creek

In addition to its flagship Karratha project, Novo also owns an advanced-stage exploration project in Pilbara called Beatons Creek.

The project is another nuggety deposit that consists of 299,000 ounces of measured and indicated gold and 259,000 ounces of inferred gold.

Compared to the potential at Karratha, that resource may seem like a drop in the bucket, but Beatons Creek could provide some initial early-stage cash flow for Novo as it explores Karratha at depth.

A Second Bite At The Apple

After racing to a price of C$8.40 a share in October 2017, the stock has retreated back to the C$3.50 level, as early investors have harvested profits.

This is great news for those who weren't into the Novo story early, as it gives you a second chance to own a piece on what could be the biggest gold discovery in recent history.

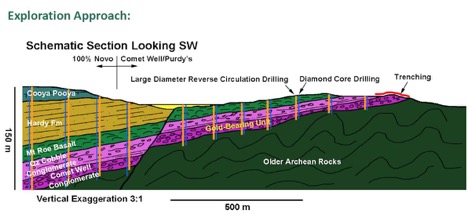

The next step for Novo is to confirm the mineralization at Purdy's Reward and the adjacent Comet Well target (also a joint ventured project).

And if they're successful, this stock could take off like a rocket.

The plan for both targets is to twin previous diamond-core drilling with wide-diameter (17.5") holes that will more accurately determine the average grades of the conglomerate layer, given that its mineralization is nuggety, rather than structurally controlled.

The upshot?

Novo Resources has the money and the game plan to determine just how big a discovery it has on its hands.

Moreover, the company is priced for another big run if the upcoming results begin to confirm Karratha's potential as the world's next Wits Basin.

If that happens, investors will likely be buying Novo at prices double or triple current levels and not blinking an eye.

And that's what makes the second bite at the apple offered by current prices so tantalizing.

CLICK HERE

To Learn More About Novo's Karratha Project

|