| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

The minutes from the Fed’s December meeting were just released, and they show the central bank is suddenly afraid of inflation.

As I’m about to show you, that’s actually good news for gold bugs…

| |

Gold rallied over the last couple of days, essentially regaining all that it had lost on Monday’s sell-off. And then the Fed minutes were released.

|

Amazingly, the minutes showed that Federal Reserve officials and economists had apparently just discovered the rampant price inflation that everyone else had been talking about for months.

|

That took away gold’s gains for the day…but I believe the news was actually bullish for gold if we look just a bit further down the road.

|

You see, the Fed’s discovery that the inflation genie is out of the bottle led it to confirm an accelerated schedule of QE tapering, and the first rate hike as early as this March.

As I noted, this sent gold falling from its daily highs. But it also sent the U.S. stock market tumbling.

That’s one reason why the Fed won’t be able to get too far down the road of tightening monetary policy: The markets won’t let it.

The last time Chairman Powell tried this, in 2018, a 20% fall in the stock market forced him to reverse field.

Then there’s the second, inescapable barrier that will prevent the Fed from raising rates much at all: the Federal debt.

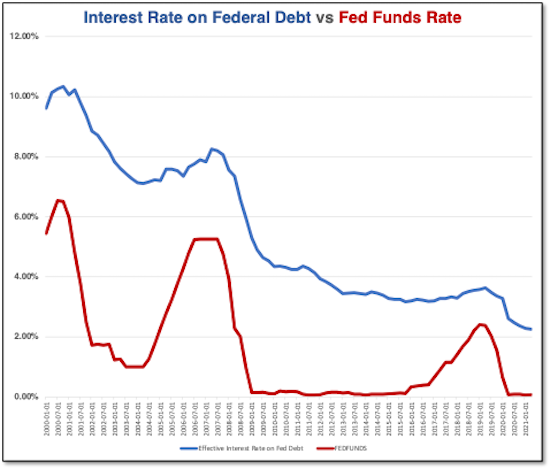

As you can see in the chart below, which shows my personal calculations of the effective interest rate on the federal debt (simply reported interest payments divided by debt held by the public), the interest rate on the debt is usually about 2% above the fed funds rate.

|  |

Here’s where it gets interesting….

Remember that the last time the Fed tried to raise rates, it had a goal of at least 3.0% on the fed funds rate. But the stock market pitched a fit and forced it to stop at just 2.5%.

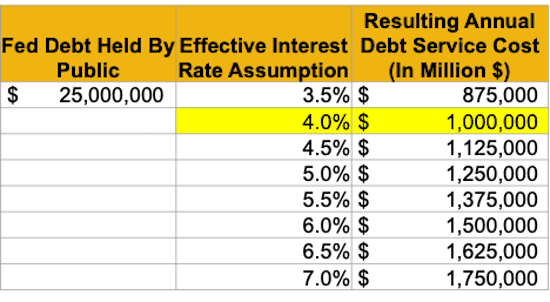

But now the federal debt is much larger. So let’s consider the repercussions with today's debt levels if the Fed raises the fed funds rate to, say, just 2.0%.

|  |

Assuming debt held by the public will be $25 trillion at that point (it could be much larger), a 2.0% fed funds rate implies an effective interest rate on the debt of around 4.0%.

…And that would translate to debt service costs…every year…of $1 trillion.

|

That would overwhelm government spending on defense and every category of entitlements.

|

And, in today’s political environment where there’s talk of forgiving student loans, of a guaranteed “universal basic income” for every citizen, would we be surprised to see a serious discussion of defaulting on this debt burden?

Any such talk would send the U.S. dollar crashing…and gold soaring.

|

The Day Of Reckoning Is Coming — Soon

|

Thus, the Fed’s move to raise rates sooner would only bring this day of reckoning that much closer.

And the initial rally in gold would be right around the corner. Gold has shown that it rallies on Fed rate hikes, particularly the initial one. The Fed’s initial rate hike in December 2015 ended gold’s long bear market, and the metal posted a strong rally for months afterward.

|

Bottom line: Gold bugs should be encouraged by how the Fed has suddenly discovered inflation, and their plans to tighten monetary policy sooner.

|

Because that only means they’re going to fail that much quicker…and gold’s day in the sun will arrive that much sooner.

| |

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |