| The party no one came to…

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

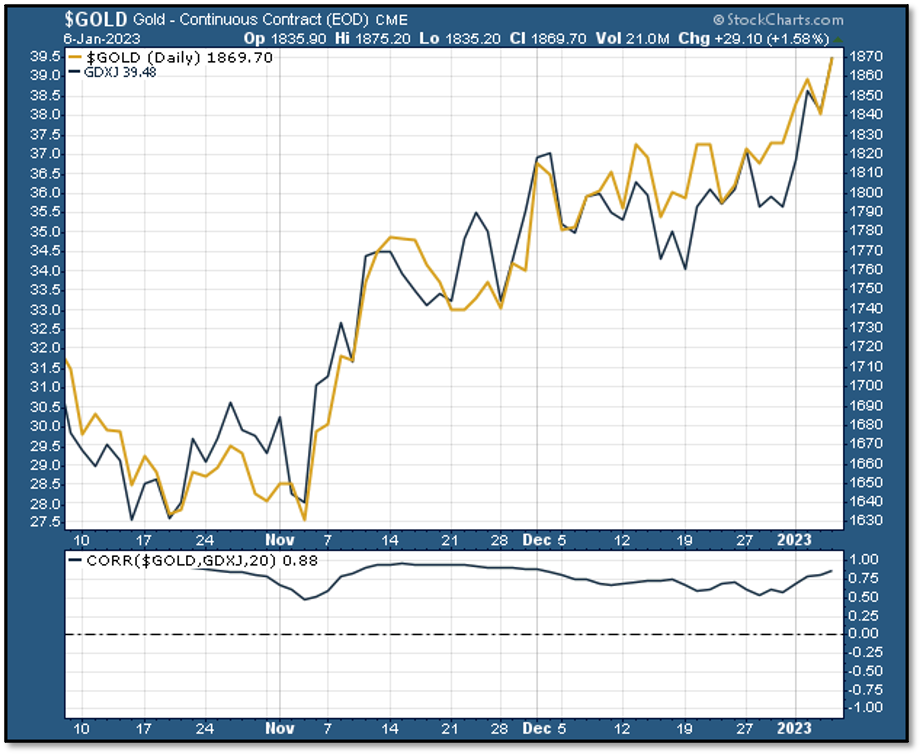

Gold has gained $200 over the last two months, with mining stocks keeping pace...but gold bugs don’t seem to have noticed.

| | | |

In a Golden Opportunities last week, I resorted to my oft-used “Happy New Year” headline to highlight yet another early-year gold rally.

|

As I noted in that issue, gold often bottoms in mid-December and continues to rally well into a new year.

It doesn’t always happen that way, of course, but this year it’s played out largely to script. The big difference this year is that gold didn’t decline into December, but bottomed in early November.

|

In fact, gold is up fully $200 since the lows in early November. This is a great thing but, as I also noted last week, you wouldn’t know it from the dour outlooks being professed by gold bugs in every corner of the Internet.

|

Moreover, many of these gold watchers are bemoaning the fact that, even if gold has been climbing, the gold stocks have refused to respond. But nothing could be further from the truth.

First, consider this chart of gold vs the GDXJ index of “junior” gold producers....

| |  |

Notice how as gold has risen from the November lows (gold line), the GDXJ (black line) has moved in lockstep. The lower panel, showing the rolling 20-day correlation between the two, has remained very high over this time frame, reflecting the close, positive linkage.

|

OK, the nattering nabobs of negativism (thanks, Spiro) say, but the gold stocks are supposed to provide leverage to gold in a bull market. We haven’t seen that at all!

|

Wrong again. Take a look at this performance chart of showing the gains in both gold and the GDXJ index over the last three months:

|  |

As you can see, while gold has gained a bit over 9% over the last few months, the GDXJ index of smaller gold producers has risen over 32%. That’s great leverage, and we could expect this out-performance to continue or increase as the gold rally attracts ever-greater attention from generalist investors.

Importantly, this kind of leverage from gold stocks is precisely the kind of confirmation we want to see to support our thesis that gold is in an established bull market.

The one factor that is a bit disappointing is that the gold/silver ratio, which was generally falling since mid-October, has perked up over the last week or so as gold has outperformed its poor cousin.

|

But another important thing is that gold seems to be finding reasons to rise, rather than excuses to fall. This is another hallmark of a bull market.

|

To wit: Last Friday’s nonfarm payrolls report for December provided a “Goldilocks” number of 223,000 jobs created. While that was about 20,000 more than the expectation, adjustments to the previous two months wiped out that overage.

The report was also filled with mixed signals on the economy, but gold (and, granted, the rest of the asset markets) ignored those and took the win. Gold leaped $32 in reaction.

As I’ve been saying, all that the metals, along with equities and bonds, need is even the slightest indication that the Fed might pause its rate-hike campaign to take off on the back of a surge in speculative buying.

The markets are addicted to easy money, and investors have been trained like Pavlov’s dog to buy, buy, buy on any reading of the tea leaves that hints toward easing (or at least no more rate hikes).

That’s what happened on Friday, as all the markets soared in response to the jobs number. And we can expect further such reactions in the days ahead as the Fed nears the end of its crusade.

Today, gold is up another $10 or so, while silver is up about 10¢ as I write, rising along with gold but, again, lagging a little.

Add it all up, and the balance of the evidence is behind a bull market having begun in gold, silver and the mining equities. Given how far we’ve come (whether many recognize it or not), a consolidation would not be unexpected, and nor should it shake our resolve.

|

The good news is that, while the bull market is identified, the values in the sector are still abundant.

|

We have yet to see the flood of news I expected from the juniors, with many companies choosing to hold onto their results until after the holidays. But I’m confident it’s coming, and we’ll have lots to report in Gold Newsletter over the next couple of weeks.

So for now, stay tuned...try to get a positive attitude on the metals and mining markets...and make sure you’re positioned.

To make sure you’re ready for the gains that this bull market will deliver, you can subscribe to Gold Newsletter here.

| |  |

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |