| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

Big sell-offs in gold have sent bulls scrambling for answers.

Here’s the most plausible theory....

| |

After bursting higher out of the gate this year, gold has been sold off viciously.

|

As you can see from the following chart, the metal has suffered two very dramatic declines, one of about $50 and then, last Friday, a shellacking for nearly $70.

|

|

The result, as you can see, is that the uptrend from the November 24 bottom has been decisively broken. And with the 50-day moving average declining toward the 200-DMA, a potential “death cross” looms ahead.

Pretty depressing stuff, and this nose-dive has sent newly minted gold bulls and die-hard gold bugs alike scurrying for cover.

And confused them as well.

That’s because the new year began precisely according to form, with a powerful rally that was playing out in perfect symmetry to similar early-year rallies over the past five years.

Moreover, with full Democratic control of the White House and both houses of Congress, it seemed that easy-money policies and fiscal stimulus were about to go on steroids.

So with all this in its favor, how in the world could gold get sold off like this?

|

Immediate Versus Delayed Reactions

| |

A number of gold-market experts have pointed to this big sell-off in gold as prima facie evidence of manipulation. I certainly wouldn’t rule that out but, especially as a factor that could be exacerbating the moves.

|

But you don’t have to look behind the Wizard’s curtain in search of lever-pullers driving this market. You only have to look at a couple of very important, inter-related indicators to get an idea of what’s going on in gold right now.

|

To set up this discussion, remember that the bond market drives everything, and Treasury yields are the immediate response to any significant factor affecting the financial markets.

As part of this, and in specific relation to gold, are real yields — essentially the rate of inflation (or expected rate) subtracted from nominal rates.

History shows that inflation-adjusted yields are the most powerful and consistent factor affecting the immediate gold price. Negative yields are extremely bullish for gold, silver and the entire commodity sector, because they not only indicate easy-money policies, but also negate the holding costs and opportunity costs of commodities, which provide no dividends or yields.

Now one thing is important to realize: In speculator-driven markets (which is just about everything these days), it’s not so much the level of real yields — even when they’re negative — but the direction of the trend.

If negative real yields are falling — getting more negative — then the price of gold is extremely likely to be rising.

What’s happened with gold over the last few days is that nominal yields have spiked as the reality of Democratic control of Washington has set in and the markets face the prospect of a tsunami of spending, debt and dollar-creation.

At the same time, and in a very temporary reaction in my opinion, inflation prospects have not only not kept up with the spike in nominal yields...they’ve actually fallen.

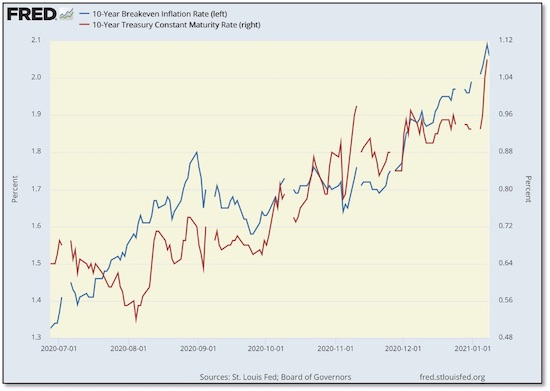

The following chart illustrates this phenomenon clearly.

|

|

As you can see, the 10-year Treasury yield (marked by the red line) catapulted higher in recent days. And to add shock to the awe of this move, it also broke through the key 1% benchmark, which undoubtedly rang alarm bells in trading algorithms around the globe.

If inflation expectations had risen as quickly, the reaction in gold would have been muted at worst, and perhaps even very positive.

But at the same time that Treasury yields spiked, inflation projections (the blue line) dropped.

I believe that this drop in inflation expectations is temporary, and that investors have simply not yet digested the inflationary pressures we’re already seeing in commodity prices and other indicators.

And from a fundamental standpoint, those pressures will only escalate as the oncoming wave of stimulus spending hits the economy.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| |

From these comments, you will undoubtedly conclude that I believe this setback in gold is temporary and that indicators of oncoming inflation will set the bull market back on track.

And you would be correct in your conclusion.

However, I urge you to remember the warning that I’ve been expressing for months, ever since this pandemic began: For this bull market to continue over the long term, we will actually have to see real, bottom-line inflation resulting from these accommodative policies.

Again, I believe we will see the inflation genie released from his bottle. But remember that we did not see inflationary consequences from the 2008 measures, or at least outside of financial and real estate assets.

This time, we’ll need to see the effects of the current policies where the rubber meets the road — in retail prices.

Just something to look out for as this market progresses.

And one other thing: Keep your focus on the horizon, and don’t worry about gold’s daily fluctuations, downward or upward. In this regard, I’ll repeat what I wrote last issue:

|

“...I would reiterate my advice to ignore these short-term moves, as positive as they may be. That’s because the coming days could see anything, from an acceleration of the rally to profit-taking that would erase much of the move.

“We simply can’t be sure what will happen over the days just ahead in these markets…just as we can be very confident of what will happen over the coming months and years.

“Again, the fundamental necessity of very significant currency debasement, combined with the technical evidence, tells us that gold and silver…and the associated mining equities…will trade for far higher levels over the next few years.”

|

I couldn’t have said it better myself!

I’ll close out this issue with a note that, for the record, gold’s dive has been interrupted for now. An early session decline was wiped away and the metal is currently trading about flat on the day.

But again, let’s keep our focus on the long term, and allow the current volatility to sort itself out.

| All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |