| The “real” story on gold… | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

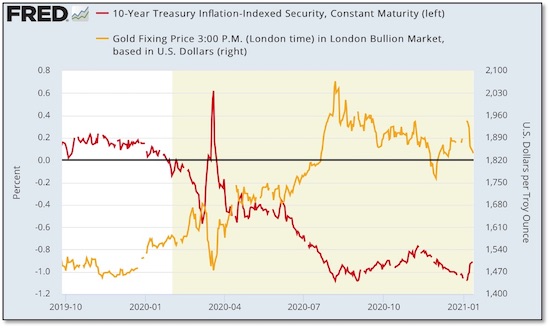

When looking for a driver of gold prices, look no further than real rates.

| |

A couple of days ago, I alerted you to the reasons for last week’s big sell-off in gold.

|

As you’ll remember, I provided charts and data pointing to a spike in Treasury yields as the precipitating factor behind gold’s weakness.

Bond investors reacted to the prospect of unified Democratic control in Washington, and the tsunami of fiscal spending and debt creation that will likely result, by demanding higher yields for dollar-denominated sovereign debt.

|

The issue for gold is that Treasury yields responded more quickly, and to a much greater degree, than inflation expectations. Thus, real yields — rates adjusted for inflation — were unable to keep up with the spike in Treasury rates.

|

As you can see from this chart, real rates are perhaps the most closely correlated factor for gold.

|

|

Note that when real rates (marked by the red line above) are negative, it creates a very bullish environment for gold, because it negates the holding and opportunity costs of gold (which offers no yields or dividends).

But more important than real yields being negative is the direction of real yields.

Simply put, when real rates are falling, the price of gold is rising. And vice versa, as we saw late last week. Note how that brief uptrend in real rates at the end of its trend line coincided with the steep drop in the gold price.

| | |

But I’m writing you today to alert you to a change in this trend. To be sure, it’s been brief, but may still be very important.

You see these charts are only updated as to the official close of trading. And yesterday after the close, we saw the 10-year yield not only halt its dizzying rise, but actually drop a basis point. Today it’s continued to fall.

|

And while gold is essentially flat in today’s trading, it had an outsized reaction to the small drop in yields yesterday, gaining about $10 in late trading.

|

This is important because higher inflation is on the way, and the markets are going to react to that inflation.

That will, of course, mean much higher gold prices. But there’s an important caveat to this reality….

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| |

While we can rest assured that the price of gold should be much higher three, four or five years down the road, we can also be confident that it will be a bumpy ride along the way.

That’s because the price of gold won’t be the only thing reacting to rising inflation.

Interest rates and Treasury yields will be rising along with inflation expectations. And when they temporarily outpace the decline in real yields, gold will suffer.

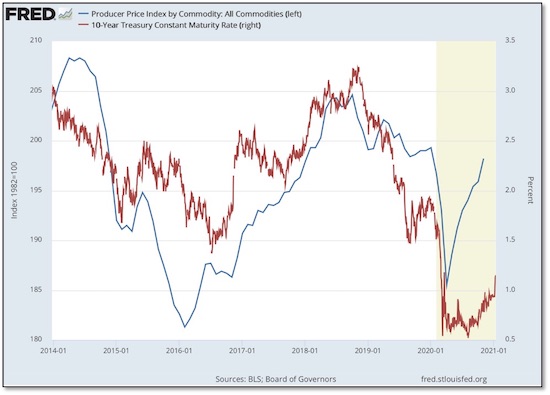

This chart tells a powerful tale:

|

|

Note how commodity prices (the blue line) correlate so closely with the benchmark 10-year Treasury yield. When the bond market sees inflationary pressures building, as in this measure of commodity prices in the Producer Price Index, it reacts.

The lesson here is that we’ll see times like last week, when gold is buffeted by rogue waves in the flow of economic data.

|

And when those days come, we need to remember that the tide is actually flowing powerfully in gold’s favor.

|

Rather than get shaken out by these market fluctuations, we need to hold steady…or even look at these as buying opportunities.

| All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |