|

No one said the market was fair.

|

Certainly, in a world where it the market was fair, Kingfisher Metals (KFR.V; KGFMF.OTC) would already have had its day in the sun.

|

This is a new company that hit the market in March 2021 with three, district-scale projects and a young, hungry management team laser-focused on discovery.

|

That focus homed in on Kingfisher’s Goldrange property last year, and one of the first holes from that program produced a headline assay of 6.88 g/t gold, 13.6 g/t silver and 0.28% copper over 9 meters.

In a better gold market that hit (on a greenfields project, no less) would have sent Kingfisher’s share price due north.

But because the gold market was struggling to find its sea legs when the company released that result in November, it was a discovery hole that went largely unnoticed.

The upshot?

You have a chance to buy into this story below the price some savvy institutions paid — just as the rest of the assays are about to be released from Goldrange and as Kingfisher Metals gears up for an ambitious drilling program in 2022.

|

|

In an industry where gold grades below 1 g/t get mined, a 6.88 g/t gold intersection over 9 meters is rich indeed.

And that’s exactly what Kingfisher generated from Hole 7 drilled in its 14-hole program on Goldrange’s 3 kilometer-by-2 kilometer Cloud Drifter Trend target.

|

One other reason the market may have misjudged this hit is that it was drilled on the side of a mountain.

|

As a result, the reported depth of the hit looked deeper than the actual, accessible depth of around 150 meters.

Management believes the mineralization encountered by Hole 7 is open all the way up to surface. It just needs to drill some more holes to validate that theory.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

A Greenfields Discovery…On A District-Scale Project

|

Though the nearby Langara zone at Goldrange saw some hand mining in the 1930s, the project is largely unexplored.

That’s part of the plan with Kingfisher. Its management team is opting for greenfields projects rather than reheated, brownfields projects.

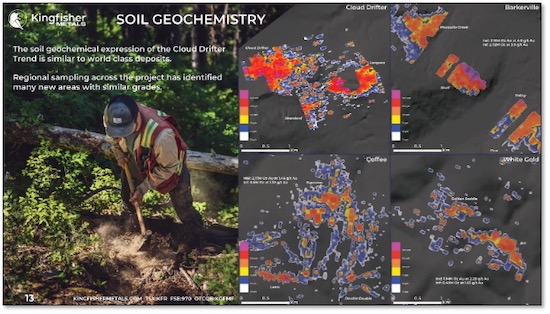

Kingfisher is using modern exploration methods to define new targets on Goldrange. That effort included a successful soil and rock sampling effort in 2020 that outlined a broad area of gold mineralization on the Cloud Drifter Trend.

|

|

| The Goldrange project’s Cloud Drifter Trend lights up a soil geochemistry map in a way that looks similar to other big, recent gold discoveries.

|

The map above that compares Goldrange’s soil results to other big gold discoveries makes clear this area is a target-rich environment.

|

On Trend With One Of BC’s Highest-Grade Gold Mines

|

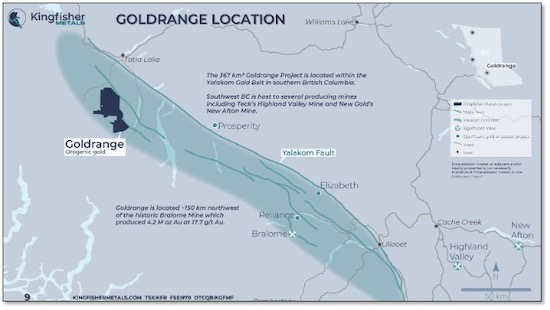

And while it’s a greenfields project, Goldrange is on trend with the Bralorne Mine, home to one of the highest-grade gold deposits ever mined in British Columbia (4.2 million ounces at 17.7 g/t gold).

|

|

| Kingfisher’s Goldrange project is on trend with Bralorne, historically British Columbia’s highest-grade mine (4.2 million ounces at 17.7 g/t gold).

|

Goldrange hasn’t yielded the kind of data that suggests it could be the next Bralorne…at least not yet.

|

But the initial hit at Cloud Drifter is a good start, and assays from 10 more holes from that target that should hit the market shortly after you’re reading this report.

|

Those assays not only give Kingfisher more bites at the discovery apple, but they also are just the start of what promises to be an aggressive drill program in 2022.

The company has just shy of C$5 million in its treasury, a wealth of targets still to test at Goldrange and a management team determined to prove up value.

|

Tight Share Structure Likely To Deliver Leverage

|

With a market cap of around C$25 million and only 83 million shares outstanding, Kingfisher Metals has the kind of share structure that could fairly be called tight.

That’s a big advantage if the remaining assays and/or this year’s drilling validates the discovery hole Kingfisher has made at Goldrange.

Companies with tighter share structures respond more robustly to good news from the drill bit than more-diluted companies.

Better still, right now you can buy into Kingfisher Metals at bargain-basement levels.

It’s a gift made possible by a fickle gold market and investors’ inability to appreciate the importance of the discovery Kingfisher has already made at Goldrange.

|

The market might not be fair, but it does serve up profitable opportunities...if you know where to look.

|

And that’s why smart investors will take a look at Kingfisher Metals at current trading levels.

|