|

Dear Fellow Investor,

There’s a big opportunity just ahead in copper.

I’ve been a big believer in the secular electric vehicle and clean energy mega-trends that will pressure copper prices over the long term, but I’ve also become convinced that other factors now present an outstanding short-term opportunity in the metal.

So I enlisted none other than my son, Blake Lundin, who recently earned his Masters in Finance from Tulane University, to write a report presenting the major factors now working in favor of copper.

It’s my pleasure to present Blake’s findings below.

— Brien

The Case for Copper in 2019

Short- And Long-Term Opportunities As Bearish Factors Shift to Bullish

By Blake Lundin

Copper’s known as the “red metal,” but that moniker could also refer to its performance in 2018.

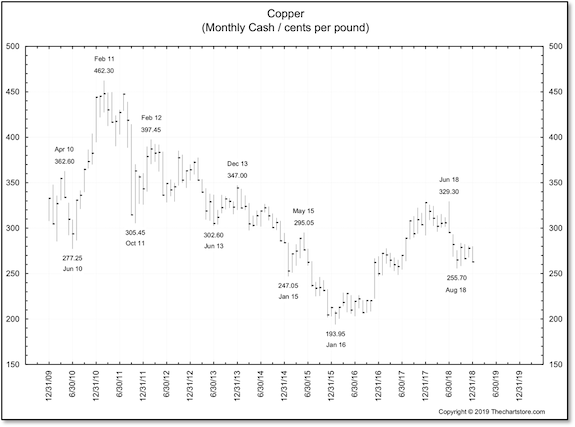

Figure 1 Source: TheChartStore.com

Simply put, the past year has been a rough time for copper, seeing the price fall from around $3.20 per pound at the start of 2018 all the way to current levels around $2.60 per pound. Reasons for this steady drop in price largely involve Chinese industrial growth and trade tensions, as well as a strong U.S. dollar.

However, there are even more reasons to believe that we could see a rebound in copper over the coming months, and perhaps very soon.

Here are the primary factors that, at this point, promise to influence the copper price over both the short- and long-term. As you’ll see, they seem to balance to the bullish side of the equation.

The U.S. Dollar

The U.S. dollar had a very strong year, and because copper is priced in U.S. dollars, the rising greenback was a significant headwind for the metal through 2018. The current sentiment in the futures market is an expectation of the continued rise of the U.S. dollar, but in reality its continued rise is much less probable.

Many of the factors behind the dollar’s rise last year appear set to end in the near future. Firstly and most apparently, the dollar has failed to maintain any upward momentum as many investors now foresee a stall or even reversal in U.S. economic growth.

The Trump administration has a lot to do with the current and future dollar performance. In the heat of the “trade war” rhetoric (as we’ll explore more below), the dollar performed well because the market felt the U.S. would do better than its adversaries.

Then there’s the very fundamental mercantilist philosophy of this administration, which favors a weaker currency to ensure trade advantages. This implies more-interventionist policies aimed toward weakening the greenback if it approaches the higher end of its trading range.

And, most importantly, the actions of the Federal Reserve will have severe implications for the dollar, and in turn copper.

An Important Shift In Fed Policy And Expectations

The Federal Reserve raised its benchmark interest rate four times in 2018 and guided markets to expect continued hikes in 2019. But with each hike came growing criticism from the public and President Trump, along with severe losses in equity markets.

While publicly maintaining its focus on the long-term economy, the Fed did begin to listen to the message that the markets were delivering. Citing a weaker economic environment, the Federal Open Market Committee lowered its projection for hikes in 2019 from three to two.

It wasn’t enough in the market’s view, and equity weakness persisted. The Fed delivered more signals it was listening, to the point that fed futures recently implied a 56% chance of a 25 bps rate cut for 2019 — a dramatic shift from investors’ fairly recent expectations of two to three hikes this year.

However, these results were evident before the release of the blow-out jobs report on Friday, January 4, showing much greater job creation than expected. This would argue for continued rate hikes, but comments from Fed Chairman Powell that very same day showed that he and the FOMC were very willing to reconsider their path in light of any market weakness.

Hiring and wages are typically lagging indicators, however, and other data — particularly ISM manufacturing and services indices — are showing coincident weakness.

The bottom line is that the Fed will now be much more cautious in raising rates. Fewer-than-expected rate hikes should make U.S. Treasuries less attractive, especially if other central banks take a more aggressive approach to raising rates. A move from these dollar-denominated assets will begin to weaken the U.S. dollar, and therefore support prices of copper and other dollar-priced commodities.

The Trade War: A Resolution Is Inevitable And Bullish

As noted, a primary factor behind the strong performance of the U.S. dollar and the underperformance of copper has been the trade tensions that were present throughout 2018. The dollar rose amidst these tensions because investors saw the U.S. faring better than other countries in the “trade war.” More recently though, these tensions have lessened upon reports that trade talks between President Trump and China’s President Xi have progressed.

Base metals prices are inversely correlated to trade concerns. As tensions rise, their prices fall, and vice-versa. Any hindrance in trade will lead to less manufacturing of products and hurt the prices of base metals that are important raw materials. If an agreement were to be reached between the U.S. and China, copper should quickly see significant gains on the back of both a weaker U.S. dollar and anticipation of higher production in China.

Reversals in the factors that caused copper prices to slip in 2018 are not the only reasons to be bullish toward the red metal. There are additional supply and demand aspects to consider, some of them transformative in scope.

Inescapable Demand Growth

Even though we are witnessing slowdowns across the globe, the world continues to grow. New technologies are continually introduced, and the world’s perception of the necessities of modern life constantly evolve. These factors bode well for copper’s demand growth.

Economic growth, particularly in developing economies, boosts demand across the entire spectrum of commodities. But research shows that copper consumption in a growing economy peaks later than other metals. Goldman Sachs notes in a recent research report that while steel consumption in the U.S. peaked in the 1970s, copper consumption didn’t reach its zenith for another 30 years.

While this is a global story, it’s impossible to ignore the elephant in the room that is China. Due to its high level of investment share of GDP, per capita copper consumption in China runs about double the level experienced by other nations at similar levels of income, per Goldman Sachs.

Added to this inexorable growth in base-metals demand are the accelerating mega-trends of clean energy and electric vehicles.

Let’s explore some of these new factors.

The Electric Vehicle Revolution

Electric vehicles (EVs) are becoming more popular each and every year as many people try to be more environmentally conscious and attempt to reduce carbon emissions. An EV uses around 80 kg of copper, or about four times as much copper as a traditional mid-sized internal combustion automobile. With a 50% increase in sales in 2017 over 2016 and still-increasing demand, EVs are exploding in popularity.

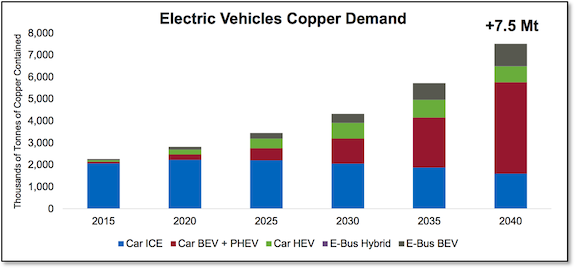

In China, the world’s leader in EV sales, accounting for half of the world consumption, EVs accounted for 2.2% of new car sales in 2017. Going forward, the International Energy Agency forecasts that there will be 125 million EVs in use by 2030, and Bloomberg New Energy Finance projects that by 2040 EVs will hold a 55% share of new car sales. Figure 2 below, from a Teck Resources presentation, shows one projection of the growth in copper usage from the adoption of EVs.

Figure 2; Source: Teck Resources

These projections are supported by recently announced plans from major automobile manufacturers in the EV market. Nearly every major firm in the industry offers an EV, with more, like Mazda, entering the space in response to emission policies in Europe. The EV market covers every subsector of the automobile market. Personal vehicles and forthcoming hybrid and fully electric public transportation buses can supplant most internal combustion vehicles. The market also has both luxury options like Tesla and more affordable cars like Volkswagen’s new $23,000 EV.

As the popularity of EVs grows, the availability of charging stations becomes more important. These charging stations will be a major driver of copper demand from this industry. Think of the sheer number and accessibility of gas stations currently. EV charging stations will become just as prevalent as the popularity of these vehicles grows to rival their internal combustion counterparts.

In short, the growth in EVs is a mega-trend that is potentially transformational for global copper demand. A report from DBS Asia projects that global copper demand for EVs will rise more than nine-fold by 2030, to reach an equivalent of 8.2% of 2017 total demand.

Clean Energy Is Here To Stay

The push for lower carbon emissions also points to an increase in the use of solar and wind energy going forward. Both of these energy sources heavily rely on copper in both manufacturing and energy transmission, and thus growing demand for clean energy will directly impact demand for copper.

The increases promise to be quite dramatic. Glencore projects that demand for metals from renewable energy and grid infrastructure will grow from 40 kt in 2020 to 536 kt in 2030.

Even more noteworthy for the rise of clean energy is the fall of coal, where renewables have partly picked up the slack left by the declining use of this relatively dirty energy source.

Clean energy is becoming more attractive than coal because it has become much cheaper to implement in recent years, rivaling the costs of running a coal plant. For example, the cost of electricity from a new wind farm is $29-$56 per MWh, whereas the marginal cost of running a coal plant is $27-$45 per MWh, according to Lazard.

The record shows that copper prices are closely correlated with the infrastructure spending of the world’s most populated developing countries. Here we see that both China and India are spending increasingly more on renewable energy and other infrastructure that will lead to higher demand for copper.

Specifically, India has set spending goals to increase their focus on renewable energy, while China has already committed to very significant renewable energy investments, spending three times as much as the U.S. on the sector in 2017 alone. With the world’s two largest populations, these nations obviously require a great deal of energy — and tremendous clean energy infrastructure — to sustain that need.

Beyond clean energy, things that were once considered luxuries are now considered necessities for citizens of developing nations. Refrigeration, air conditioning/heating, power, etc., are all upgrades these people will want and need to meet modern living standards. All of these upgrades, across these massively large populations, will require tremendous amounts of copper.

Additional Support From Falling Inventories

Right now there is enough copper to adequately meet market demand. With the demand increases mentioned earlier, though, a copper shortage could come into play that would propel prices much higher.

Mining companies in recent years have been forced to face ever-decreasing copper grades in their deposits. If a mine is showing increasingly lower grades, their costs to produce copper will increase, forcing prices higher as a result.

As grades in current mines continue to decline, new projects will need to be developed — and discovered — to cover the coming demand increases. The issue is that spending on exploration has slowed considerably over the past few years, and the supply of current greenfield projects is lacking. New copper discoveries can take anywhere from 10 years to as much as 20 years to begin production, leaving no doubt that the aforementioned demand increases will bring supply shortages.

Inventories are already falling worldwide. A quick look at the warehouse stocks of the New York, London, and Shanghai exchanges shows that inventories in all but the London exchange have been falling. If inventories are not able to keep up with demand and if mines are not able to pick up the slack, there will be a surge in copper prices.

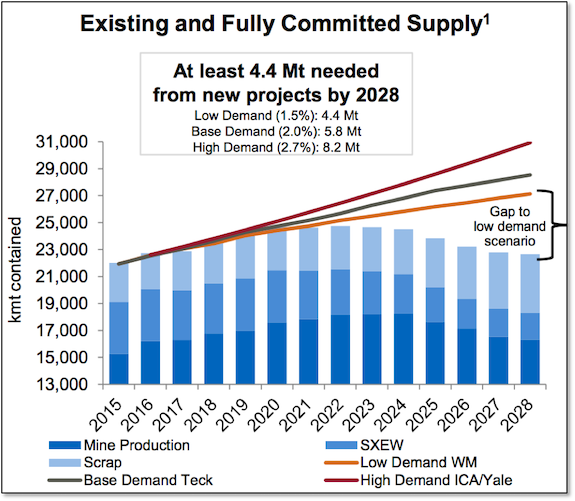

Figure 3; Source: Teck Resources

In Figure 3, another projection from Teck, the gap between demand and available supply is presented clearly. Even in their low-demand projections, a considerable supply deficit will emerge in the near future. Moreover, this gap will persist, taking into account the lead time it takes to bring new mine projects online.

Can Copper Make A Comeback In Both The Short And Long Term?

As mentioned earlier, copper prices are currently depressed by issues that can reverse in the near future — perhaps the very near future.

Trade tensions that have been present throughout much of the past year are possibly lessening as talks between Presidents Trump and Xi progress. Base metal prices benefit greatly from freer trade, and the results can present themselves soon if a deal comes to fruition.

These trade talks can have a secondary effect of sorts on copper prices as well. The dollar has been supported to a great extent by expectations the U.S. will fare better than other nations in the trade war. If the trade talks progress, this support for the dollar is greatly diminished. And in addition, the ongoing shift toward more-dovish Fed policy will also serve to weaken the dollar.

All else being equal, a lower dollar pressures the price of copper higher.

Short-term price increases are good, but the future looks even better when you consider the long-term supply and demand factors for copper. New technologies in automobiles and clean energy promise major increases in copper usage. EVs and their corresponding charging stations are surging in popularity and require much more copper than internal combustion engines and gas stations. Also, clean energy installations are growing rapidly worldwide due to their environmental advantages and falling relative costs.

In addition to these new technologies, infrastructure upgrades by populous nations should greatly increase copper usage going forward. Things we may take for granted like air conditioning, refrigeration, and electricity are copper-intensive and will increase demand for the metal as developing nations grow. These demand factors will support the copper price for years to come.

A great deal of supply will be necessary to meet the demand needs these technologies and infrastructure upgrades will bring. The problem is, copper ore grades are decreasing and exploration spending has been relatively low in recent years. Mines take a long time to come online, so if current mines and inventories aren’t able to cover the coming demand, these deficits will force prices to higher levels until new production emerges.

In short, there are important reasons why the price of copper can rise in the short term, and even more reasons to believe the price will continue to rise well into the future.

|