|

| As the copper price soars toward $6.00 and far beyond, investors are scurrying to find the single best copper play in the junior market.

|

| There’s one easy way to separate the contenders from the pretenders: Which copper companies could multiply in value even if the price of copper stood still?

Under that criteria, one junior copper play stands out above the rest: Kodiak Copper (KDK.V; KDKCF.OTC).

|

| Why? Because all Kodiak has to do is to keep doing what it’s doing — de-risking the major new copper resource it has defined.

And as it does that, its market value should rise to the level of its peers.

A level that stands four to seven times its current market valuation.

|

| Remarkably, the story doesn’t end there. As you’re about to see, Kodiak’s potential isn’t limited to its current copper resource...or the current copper price.

And that greater potential could turn to reality in the weeks and months just ahead.

|

| The Stage Has Been Set

|

| In junior mining, there’s a world of difference between “we think it’s big” and “here’s the resource, here are the tonnes, here are the pounds.”

That difference is called a milestone.

And in early December, Kodiak Copper crossed that milestone by completing a maiden Mineral Resource estimate for seven deposits on its 100%-owned MPD copper-gold project in southern British Columbia. Kodiak Copper Corp.

For the past six years, Kodiak has been building MPD the hard way: consolidating ground, drilling systematically and proving that the project could add up to something far bigger than a “single-zone story.”

Now that work has a foundation that investors can actually model. And the numbers are big:

|

| • Total Indicated Mineral Resource: 82.9 million tonnes grading 0.39% copper-equivalent for 519 million pounds of copper and 0.39 million ounces of gold (Kodiak news release December 9th, 2025).

• Total Inferred Mineral Resource: 356.3 million tonnes grading 0.32% copper-equivalent for 1.889 billion pounds of copper and 1.28 million ounces of gold (Kodiak news release December 9th, 2025).

|

| That’s the kind of tonnage you expect to see in the same neighborhood as real mines. And in Kodiak’s case, it comes with something else investors love:

Room to grow.

|

| The Maiden Resource That Changes the Conversation

|

| Kodiak’s maiden resource covers seven deposits across MPD. Four were previously reported over the summer (Gate, Ketchan, Man and Dillard), with West, Adit and South added last month to complete the initial picture.

And that “picture” is substantial.

|

| Across the Indicated and Inferred categories, Kodiak reports contained metal totaling 2.4 billion pounds of copper and 1.7 million ounces of gold.

But the real shift here isn’t just the headline pounds and ounces — it’s what the market can do with them.

|

| With a resource, analysts and investors can start doing what they couldn’t do with drill highlights alone: They can put pencil to paper on valuation.

And that’s where this story gets interesting.

|

| A Starting Gun, Not a Finish Line

|

| Kodiak’s resource is defined using a 0.2% copper-equivalent cut-off grade. The company also published sensitivity cases at lower cut-offs that are more typical of producing mines in the region — and those cases show materially higher tonnage and contained metal.

Consider this: By dropping to a 0.12% copper-equivalent cut-off, the sensitivity tables show:

|

| Indicated Resources grow 45% to 120.6 million tonnes at 0.31% copper-equivalent (Kodiak news release December 9th, 2025).

Inferred Resources grow 84% to 657.1 million tonnes at 0.24% copper-equivalent (Kodiak news release December 9th, 2025).

|

| Those sensitivity cases show the tremendous leverage of Kodiak’s MPD project.

Leverage to cut-off grade, leverage to metal prices, leverage to recovery improvements, leverage to the drill bit.

In other words, Kodiak has a big Resource now. But it also has multiple levers that can make the “big” get even bigger as the project de-risks and advances.

|

| The Clear Path To A Multiple

|

| There are some key aspects of the MPD project that separate it from the pack for reasons other than sheer size.

For one thing, Kodiak has highlighted the fact that the West and Adit deposits host higher-grade mineralization right from surface, while South is a large bulk-tonnage zone over a full kilometer in length that remains underexplored.

|

| Near-surface, favorable-geometry zones can result in lower strip ratios and provide the kind of early mine plan “starter” scenarios that can turbo-charge project economics.

|

| And those potential economics highlight another aspect of MPD’s potential — and it’s not something the project has, but rather something it doesn’t.

That’s a preliminary economic assessment (PEA).

|

|

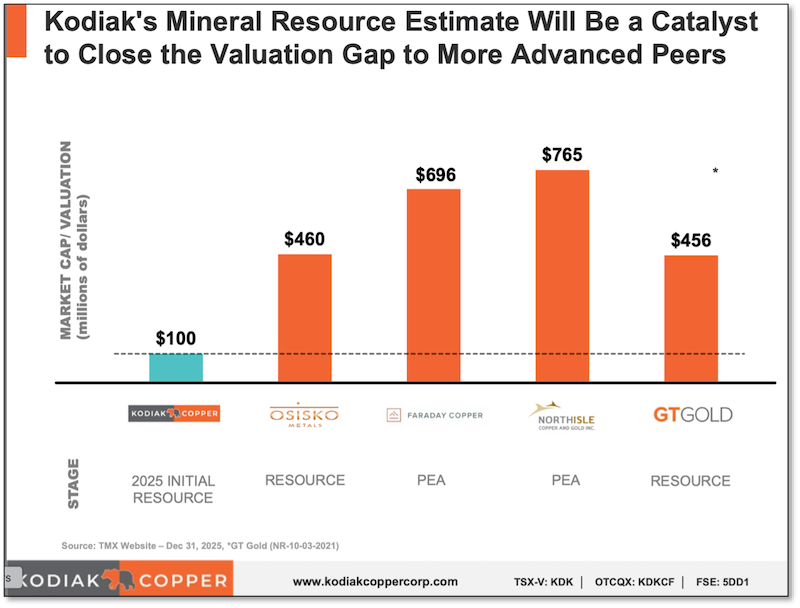

| Companies with copper projects similar to MPD, but who are at or working towards the PEA stage, trade from 4.5 to over seven times Kodiak’s current market value — showing the clear path to much higher valuations.

|

| While Kodiak hasn’t announced plans or timing for a PEA, it’s one of the obvious steps along the path of continuing to de-risk the MPD project.

|

| Here’s the key: Kodiak’s current market valuation is only around C$100 million. And companies with similar projects — but are more advanced — trade for four to seven times as much.

|

| This is why Kodiak is that rare opportunity that doesn’t need anything — except continuing along its path — to provide discovery-type profit potential.

And speaking of discoveries....

|

| Scratching The Surface At MPD

|

| Now for the part that makes Kodiak different from many “resource stories” that slow down after the first estimate.

MPD is not “drilled out.”

|

| In fact, far from it: All seven deposits remain open for expansion within and beyond the current pit shells, in multiple directions and at depth.

And still that’s just the start. There are as many as 20 under-explored targets across the large MPD property that remain to be tested.

|

| Over the coming months, Kodiak plans on not only expanding the Resources in the seven deposits, but also on testing the many underexplored targets.

It’s obvious that the current Resource, as large as it is, is only the start.

|

|

| Kodiak Copper’s MPD project boasts no less than seven distinct deposits open for expansion, plus about another 20 identified targets ready for detailed exploration.

|

| The Best Of Both Worlds

|

| If you’re looking for a way to play today’s red-hot copper market, it’s hard to imagine an opportunity that offers the obvious clear development path to higher valuations plus the exploration potential of so many identified targets.

And it’s all going to come together much more quickly now, as Kodiak is positioned with roughly C$8 million in its treasury to support its upcoming work, including drilling for resource expansion and target testing.

The bottom line is that big copper discoveries are hard to come by. Permitting is harder. Costs are higher. Timelines are longer.

That’s exactly why the market pays up for copper projects that check three boxes:

|

- Scale

- De-risking progress

- Clear runway to the next value inflection point

|

| Kodiak just checked the first box in a way the market can quantify. Now it’s moving through the second and lining up the third.

|

| And as the market does what it typically does — reward projects as they move from Resource to PEA, and from PEA to more advanced studies — then Kodiak’s current valuation looks less like a ceiling and more like an early chapter.

|

| Because the story is no longer “maybe.”

It’s “here’s the Resource...and here’s what we’re going to do next.”

As Kodiak continues to check the boxes, the time to start looking at this solid copper play is now, before it can reach the same valuation as its peers.

|

| CLICK HERE

To Learn More About Kodiak Coppper

|