| This tidal wave will drive gold higher… | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

| A Tsunami Of Spending Just Ahead | |

Gold isn’t behaving very well right now, but the tidal wave of spending on the way should float the metal to much higher levels.

| |

Last week I showed how interest rates, in response to the prospect of an oncoming tidal wave of stimulus spending, had spiked higher.

|

And gold plummeted in response.

My key point was that this was a temporary, knee-jerk response. Eventually, this massive spending spree would lead to higher inflation.

And although the market response to these inflation signals would lead to a bumpy road for gold, that road would be heading higher.

This week, I want to give you an idea of just how much spending is heading our way.

| |

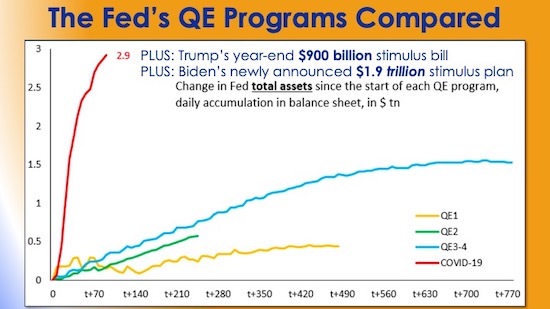

I’ve been featuring the chart below for months in my presentations. The events of the last few weeks — and especially President-Elect Biden’s speech of last week — made it necessary to add the comments you see at the top.

|

|

Let’s take it from the beginning.

Remember when the Fed announced QE1 during the 2008 Great Financial Crisis? It was unprecedented — the central bank actually buying Treasuries and Mortgage-Backed Securities, and doing so at the mind-boggling rate of tens of billions of dollars a month.

Over the next year-and-a-half or so, the Fed added nearly $500 billion to its balance sheet!

Yet even that wasn’t enough. They doubled down with QE2, adding yet another $500 billion or so, in only half the time.

But things got crazier still. The Fed felt it had to announce QE3 — unlimited quantitative easing — lasting as long as necessary and to whatever degree necessary.

This was full, pedal-to-the-metal currency creation. And by the end of it, an amazing $1.5 trillion had been added to the Fed’s balance sheet.

This had gone from mind-boggling to mind-numbing. A level of Fed intervention that was completely unprecedented in both concept and degree. Surely, we’d never see anything like this again?

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| |

Then came the Covid-19 pandemic and the global economic shutdown.

Now, ever since the Fed had begun its aborted campaign to “normalize” rates after its years-long quantitative easing and zero-interest-rate policies, I had been very vocal in saying that they would have to return to QE.

At some point, I predicted, the markets were going to force the Fed to start lowering rates again and even restart QE.

And in fact, the Fed started doing just that in late August of 2019.

But then the pandemic forced them to take everything to an entirely new level. As you can see from the chart above, the Covid-19 QE dwarfed anything seen in the response to the Great Financial Crisis.

In only a matter of a few weeks, the Fed had duplicated everything it had taken years to do post-2008.

But now it’s getting really crazy…

| | |

Consider those two comments I added to the chart.

Late last year, President Trump signed a last-minute stimulus bill adding another $900 billion to the spending.

That’s not chicken feed. But then last week, Biden trumped Trump with his plans to add yet another $1.9 trillion in stimulus!

|

In the span of just a few weeks, the entire Covid stimulus effort — which itself had shattered every previous record — was essentially doubled.

|

We need to face the fact that there isn’t a shred of fiscal prudence left in Washington. It’s very likely that even Biden’s plans are merely a down payment on what’s to come.

And this is why we need to remain bullish on gold.

Quite frankly, I’m not pleased with gold’s performance in recent days. Rather than finding reasons to rise, it’s been finding excuses to fall. And that most definitely is not how an asset behaves if it’s in a bull market.

So I’m not bullish for the near term.

|

But given the tsunami of spending on the way, and the fact that sentiment for gold is bottoming, I’m confident that we’ll see much higher prices for gold and silver this year.

|

The key is to keep our eyes on the prize…and the repercussions from the massive spending spree just ahead.

| All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |