| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. |

|

Historically, the destiny of all government currency is extinction.

|

|

I often talk in these pages about the importance of keeping our focus on the big picture — the secular trends that will make the day-to-day market fluctuations disappear into irrelevance.

In terms of the future of the U.S. dollar, and in fact all fiat currencies, we can look toward the horizon and see their eventual and inevitable destruction. The view is clear ahead because it’s also clear behind: The story playing out now is merely a retelling of the same script performed over and over throughout human history.

I was pleased to see my friend Rodney Stevens present a particularly cogent review of that script in a recent edition of his newsletter, The Disciplined Speculator. His report clearly explains the irreversible path lying ahead for the dollar and the U.S. economy, and reveals the investments that can help protect your wealth during the process.

With Rodney’s permission, we are reprinting his report here for our Golden Opportunities readers. I hope you enjoy Rodney’s views, and consider subscribing to his letter (see his contact information following the article).

— Brien Lundin

|

|

| The Disciplined Speculator

Weekly Market Commentary | | |

|

Historically, the destiny of all government currency, or money, is extinction. In its first creation, it is usually pegged to some asset such as gold, then it becomes unpegged to have a more flexible monetary policy and then monetary policy gets unhinged from the economy. Once unhinged from the economy, it is usually only a matter of time before stagflation sets in, followed by hyperinflation, which makes the money extinct, followed by deflation. Then the whole

process starts over again. Hyperinflation is usually triggered by a random economic implosion either brought on by government incompetence, war or revolution. The implosion begets a collapse in tax revenues and the country looks like a terrible credit risk. Cut off from international lenders, the government is left with a gaping hole in its budget and no way to fill it and so it falls into a debt trap. For politically weak governments, the temptation to substitute an inflation tax for actual taxes is enormous when debt can no longer be paid.

The U.S. has so far evaded hyperinflation since decoupling the value of the dollar from gold in 1976 because it has never had any problem selling its debt due to its highly productive economy. More recently, the Fed’s quantitative easing (QE) and repurchase (repo) operations have not been anything to worry about in terms of sparking stagflation because replacing interest-bearing Treasury bonds with bank deposits which pay an equivalent interest rate does not incentivize banks to lend. However, QE has a limit. QE is possible only as long as there are bonds being held by banks. And while QE has lowered interest rates on sovereign debt and prevented a fiscal crisis up till now, it has come at the cost of distorting the global economy and causing a debt spiral.

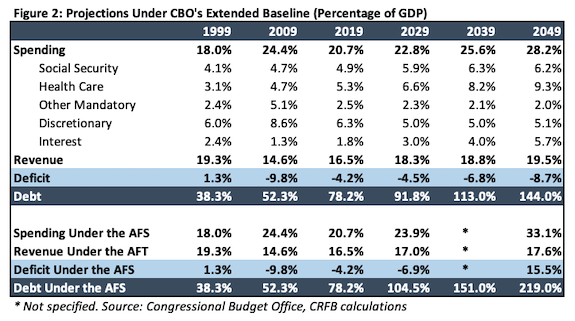

The recovery from the market crash of 2008 has been the result of an unsustainable credit expansion. Below is a table showing the June 25, 2019 Congressional Budget Office’s (CBO) Long-Term Budget Outlook, confirming the budget’s unsustainable long-term trajectory. Under current law, the CBO projects debt will exceed the size of the economy by 2034, reaching 144 percent of GDP by 2049. Under the Alternative Fiscal Scenario (AFS), which assumes extension of expiring tax cuts and spending increases, debt will exceed the size of the economy by 2028 and reach 219 percent of GDP by 2049. As of this writing, government debt as a percentage of U.S. GDP is already at 105%.

|

|

|

Put another way, the growth in nondiscretionary spending (social security, health care, and interest on the debt) will account for 123 percent of the growth in spending relative to GDP through 2049. By 2041, spending in these three areas will cost more than all available revenue. Such levels of debt are historically unprecedented and have rarely been seen internationally without some kind of crisis. A debt spiral, in and of itself, is likely to slow economic growth and reduce future wages and incomes by crowding out productive investment.

Based on the CBO’s forecast, the U.S. credit expansion, though unsustainable, can continue for many years before causing a debt trap. But if an economic implosion occurs due to some other event a number of years from now, a debt trap could be expedited. Indeed, the next economic implosion could be the big one. Already the rising ratio of debt-to-GDP is increasing to a level that could cause a loss of confidence if a random economic implosion occurs. An economic implosion

can occur for many reasons such as policies that: a) kill growth (such as in a trade war), b) deliver too low inflation or deflation (such as when inappropriately raising interest rates) and/or c) further raise risk characteristics and thus the cost of refinancing the debt. Otherwise, it could be caused by an external random shock such as: foreign dumping of Treasuries back into the U.S., the elimination of the dollar as the petrodollar, Chinese social revolution, global warfare, etc.

|

|

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner, as the result of a voluntary abandonment of further credit expansion, or later, as a final and total catastrophe of the currency system involved.”

-- Ludwig von Mises, Human Action [1949]

|

|

Usually, inflationary policies are chosen over abandoning further credit expansion because deflation is a much worse alternative than inflation. But ultimately, deflation is unavoidable after an inflation spiral makes a currency worthless. If we are indeed heading for a global reset, the creation of a new currency may initially be pegged to gold, or conceivably even bitcoin (i.e. Gold 2.0), and then the cycle starts over.

Leading up to the next economic implosion we expect to see a much larger bubble in stocks and bonds and new all-time highs, primarily for gold and other inflation hedges such as bitcoin (Gold 2.0). The bubble will be driven by long-term interest rates ultimately dropping to zero as the debt burden puts a drag on the economy (that’s right, the Fed has not finished dropping rates yet). As can be seen in the long-term chart of Treasury bond prices (TLT) which follows, declining long-term interest rates have caused the continuation of the bull market in the TLT and we expect this trend to continue.

|

| The price of gold and other inflation hedges is driven by a declining real rate of return on money. The real rate of return should continue to decline as the Fed drops interest rates faster than inflation in an attempt to boost the economy. When

long-term rates drop to zero, real rates should decline further as debt monetization policy kicks in. Treasury Inflation Protected Securities (TIP) directly measure the real rate of return on the U.S. dollar and can be bought as an inflation hedge. The TIP is currently in a strong bull market, implying the real rate of return on money in the U.S. is indeed declining.

|

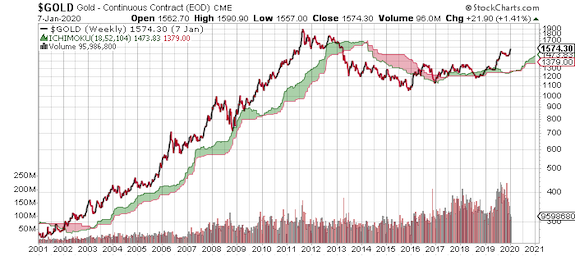

| In further support of our “investment” thesis, gold has recently entered into a new cyclical bull market. Below is the long-term weekly price chart of gold and its Ichimoku cloud (parameters 18,52,104). When the price is below the cloud, gold is in a bear market and when the price is above the cloud, gold is in a bull market. Note that the bull

market beginning in 2002 and ending in 2013 continued even through the market crash of 2008, which we expect might be the same for the next market crash. Accordingly, gold was successful in providing portfolio insurance, since, unlike stocks, its price drop in the crash of 2008 came nowhere near its price when the 2002/2013 bull market began. Gold is back in a cyclical bull market since decisively breaking above the cloud in 2019 and portfolio insurance is needed once again.

|

| One can easily get exposure to gold through the SPDR Gold Shares ETF (GLD), shown on the shorter-term, one-year, daily chart which follows. Now that gold has decisively entered into a bull market, one can take a position after its price recovers from a correction move. The chart of the GLD shows that the price of gold has

just recovered from a correction move that started in September of 2019 (thanks in part to President Trump’s reckless Middle East policy that has brought the U.S. to the brink of war). As can be seen, the price of the GLD has broken above the daily Ichimoku cloud, indicating the corrective move within the bull market has ended. Buying should be done in accordance with the Trading Discipline explained at the end of this article.

|

| Bitcoin is a superior inflation hedge to gold (so long as there is electricity to transfer it), yet it is highly undervalued relative to gold (gold’s market cap is $8T compared to bitcoin’s market cap of $132B). Bitcoin can be conveniently purchased through the Greyscale Bitcoin Trust (GBTC). Bitcoin has also entered into a cyclical bull market, and, similar to gold, the next buying opportunity will come when it too breaks above its daily Ichimoku cloud.

|

| If we are right on the current trajectory of the global financial system, it is now more important than ever to pay off debt, or have positive net worth before stagflation sets in. Furthermore, the buy-and-hold strategy for a portfolio of investment-grade stocks will no longer be appropriate because when the stock market crashes next time, it may take

over thirty years to recover since there may no longer be any policy tools to support the economy. Accordingly, when the market threatens to enter into a bear market, it is becoming increasingly more important to step aside until the danger is over. The best way to enter and exit the market is simply through owning a market index ETF, such as the SPY, that gives market exposure, but can be traded like a single stock.

When the next implosion happens, stock and bond values could be wiped out (with no hope of recovery for over thirty years). With the collapse in the economy, inflation hedges will temporarily decline, and Treasury bonds will temporarily head higher as deflation sets in. But then inflationary monetary policies will destroy Treasury bond valuations and lift inflation hedges to new all-time highs. In the event of hyperinflation,

one might convert any gold-backed or bitcoin-backed financial vehicles into physical gold and “physical” bitcoin (meaning physically storing one’s own private keys that allows one to move bitcoin on bitcoin’s blockchain). Physical storage is more easily accomplished with bitcoin than with gold because it can be moved electronically and stored on paper. Physical ownership prevents any potential theft from fiduciaries or confiscation of the assets by governments.

Despite our stark forecast for the future, governments of the world will do everything in their power to continue to let the good times roll. Accordingly, we expect stellar financial returns in most sectors (less so for industrial commodities which are driven by the global economy) in 2020 and potentially for a number of years. Furthermore, for as long as they remain in bull markets, it remains a wise strategy to own the

market (SPY), Treasury bonds (TLT), gold (GLD) and bitcoin (GBTC) as a good diversification strategy. Additionally, both gold and bitcoin provide a degree of portfolio insurance since their returns are not well correlated with the market or with each other. Going forward, we will monitor when to get in and when to get out of these four asset classes to help financially survive the next economic implosion, whenever it might come.

|

|

• Start by purchasing 20 percent of one's position on a breakout to new highs or on a bull market dip.

• If the price continues to go up, buy an additional 20 percent near the first purchase price.

• If the price keeps rising, buy another 20 percent.

• If it keeps rising, corrects, and continues to rise, buy the final 40 percent at a higher price than the last purchase. Note that averaging up is dangerous, and so it must be done near the same price as at the beginning of the move.

• If short selling, use the same positioning strategy, but average down, rather than averaging up.

• Have a stop loss 5 to 10 percent below each successively higher price support zone (or above each support zone when short selling) and close the trade like a robot if the stop loss is triggered.

• A stop loss need not be triggered. Have a price stop and a time stop. Feel free to close the initial position if not performing as expected from the beginning of the move.

• The maximum loss per trade should never exceed 3 percent of one's total speculative capital. The maximum loss is calculated based on one's stop losses.

• Have a concentrated but diversified portfolio, representing three or four sectors as unrelated as possible.

• If one is lucky enough to double one’s money on the position, one should automatically sell half of the position and, at some point, park the proceeds into a long-term investment portfolio such as the SPY.

|

|

Disclosures

This is a free weekly newsletter. Please contact Rodney Stevens at 604-765-8657 or e-mail me at rjstevens73@gmail.com to be placed on the email subscriber list.

The author does not purport to tell or suggest which securities readers should buy or sell for themselves. The author assumes no responsibility or liability of any kind for the use of the information contained herein. Statements in the author’s publications are made as of the date stated and are subject to change without notice. The opinions, views and/or comments shared on any forum by other participants are not endorsed by the author and the author assumes no responsibility or liability for any trading and/or investment results that you may obtain by using such information.

It should not be assumed that the methods and techniques presented will be profitable or that they will not result in losses. The indicators, strategies, columns, articles and all other features from other companies linked to this product are provided for informational and educational purposes only and should not be construed as investment advice. Such setups are not solicitations of any order to buy or sell. Accordingly, you should not rely solely on the information in making any investment. There is a very high degree of risk involved in trading securities. You should always check with your licensed financial adviser to determine the suitability of any investment.

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |