| Two million of ounces of gold — rediscovered… |

|

| Please find below a special message from our advertising sponsor, Revival Gold. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

A Massive

Gold Re-Discovery

|

|

An established strategy for success in the junior mining sector is breathing new life into a “brownfields” gold project and then finding much more gold than was originally thought.

With its Beartrack-Arnett project in Idaho, tiny and well-managed Revival Gold (RVG.V; RVLGF.OTC) is executing that strategy to a tee.

|

|

The best place to look for gold is where you’ve already found it.

|

|

It’s a cliché in the gold exploration world, but one that often proves deadly accurate. The reasons for that are relatively straightforward.

|

|

If a prior operator has already found an area of gold mineralization with the makings of a profitable mine, chances are good that more gold may lie nearby, or below, the initial resource.

Plus, mines built during periods of relatively low gold prices often leave a substantial amount of gold in the ground, determining that the cost of mining those additional resources isn’t justified by the price of gold.

It’s a scenario that leaves an opening for a smart operator, in a period of rising gold prices, to come in and breathe new life into a brownfields project.

It’s exactly the strategy that tiny Revival Gold (RVG.V; RVLGF.OTC) is executing with its Beartrack-Arnett property in north-central Idaho.

And — as you’re about to see — that strategy could begin to pay off in a very big way very soon, when the company is expected to make a major announcement.

But first, let’s take a look at what Revival already has....

|

|

A Two-Million-Ounce Head Start

|

|

The Beartrack property in the area is a past-producer. It generated 600,000 ounces of gold via heap leaching during the 1990s before low gold prices shuttered the operation.

What was left were indications of a significant sulphide resource, which can be valuable in the right gold price regime, but which is more expensive to process than the oxide ore that provided Beartrack’s initial production.

Plus, the mining pits at Beartrack lie along a line of mineralization that has been traced for at least five kilometers. Not only have resources been shown to lie at depth, but they have also been outlined in areas south and north of the historic pits.

|

|

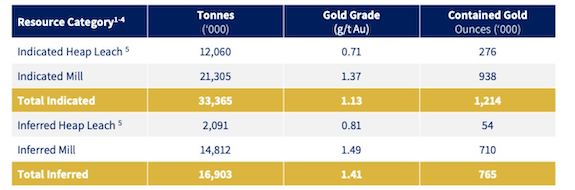

| Maiden Resource Annouced May 2018 |

| In all, the most recent resource estimate for Beartrack, released in May 2018, pegged its resources at 1.2 million ounces of indicated gold and 765,000 ounces of inferred gold.

|

|

In short, by acquiring an option on Beartrack, Revival begins the race for gold discovery with a major head start.

|

|

And that’s doesn’t even count the ready potential for oxide ore provided by the adjacent Arnett project, which the company has acquired to supplement production from Beartrack.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

|

In-Place Infrastructure In A Safe Jurisdiction

|

|

And that head start goes beyond the ounces already in the ground on this project. Beartrack also comes with much of the facilities needed to quickly restart a heap leach operation there.

Power, water and road access are all in place to jumpstart operations and the local community, which saw Beartrack successfully mined in the 1990s, is supportive of a return to mining in the area.

And that brings up a key asset these properties possess: location in a mining-friendly jurisdiction.

|

|

In a world where resistance from the local community and the relevant government authorities can spell doom for a project, Idaho was rated by the Fraser Institute as one of the better mining destinations on the planet.

That bodes well for Revival’s ability to either put a mine into production itself, or to attract a mid-tier or major producer to take out the project, likely at multiples of Revival’s current market cap.

|

|

A Been-There, Done-That Management Team

| If you were going to pick a management team to lead a brownfields revival project, you’d be hard-pressed to pick a better team than the group at the helm of Revival Gold.

The company is led by Hugh Agro, a mining engineer whose resume includes past executive roles with Placer Dome and Kinross. At Kinross, he was that company’s executive vice president of strategic development and was a key member of a team that helped grow Kinross 10 times over during the last cycle.

Another key player is board chairman and director, Wayne Hubert. Wayne took Andean Resources from a $100 million market cap to Andean’s sale to Goldcorp for $3.5 billion in 2010.

Revival Gold’s VP of Exploration is Steve Priesmeyer. A 30-year mining industry veteran, Mr. Priesmeyer’s most recent success was the delineation of a 30-million-ounce silver resource at Soltoro’s El Rayo project.

Revival’s on-the-ground team in Idaho is led by General Manager Pete Blakeley. Having spent 10 year with prior Beartrack property owner Meridian Beartrack, Mr. Blakeley is intimately familiar with this project and this area.

|

|

The Fuse Is Lit:

A Potentially Market-Moving Report Is Imminent

| Having spent the last two years drilling both Beartrack and Arnett, Revival Gold is on the verge of releasing a major new resource estimate for the projects that has the potential to surprise the market to the upside.

You see, the Haidee area within Arnett has a non-compliant resource of some 400,000 oxide ounces, and Revival Gold’s drilling is expected to bring half of those ounces into the combined 43-101-compliant oxide resource at Beartrack-Arnett. Plus, Beartrack itself may have more oxide ounces to contribute.

Those oxide ounces are key, because they are heap-leachable and therefore relatively inexpensive to process.

If Revival can eventually outline a half to one million-ounce oxide resource on Beartrack-Arnett, it should have scale to underpin a sustainable and profitable operation that can unlock the value of the more capital-intensive mill operation needed to process the sulphide ore that lies at depth at Beartrack.

|

|

Significant progress toward that million-ounce goal, especially in the currently bullish environment for gold, could easily propel this tightly-held stock upward.

|

|

So, there’s a potential short-term win here to go with the tremendous long-term potential that Beartrack-Arnett and Revival Gold offer investors.

With a risk-reward profile firmly buttressed by the company’s existing two-million-ounce resource, now is the perfect time to build a position in this well-managed gold developer.

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |