| Is gold the next GameStop? | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

| Is Gold The Next GameStop? | |

One is a speculative bubble fueled by short-covering and a buying frenzy, while the other is the world’s most enduring store of value — but there are more similarities than you might imagine.

| |

GameStop is dominating the financial headlines these days. At some point down the road, so will gold…and for some of the same reasons.

|

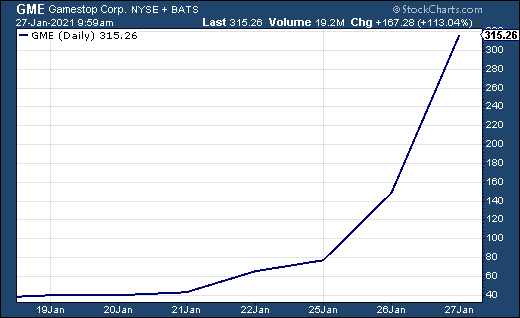

The first thing you need to know (if you don’t already) is that GameStop has multiplied more than five times in price over the last week in a short-covering frenzy that’s been simultaneously fueled by pile-on buying from Robinhood traders and Reddit promoters.

This chart doesn’t do justice to the parabolic rise:

|

|

Yes, this is a classic, blow-off speculative bubble, and it won’t end well for the unsophisticated traders jumping onto the bandwagon.

|

So how can I possibly compare this to gold — the world’s most enduring store of value and the safe harbor for savers over millennia of currency depreciations?

|

Because the GameStop phenomena is being fueled by the absolute necessity for short-sellers to buy, at any price, and very little of the company’s stock is available on offer.

And that’s precisely the phenomenon I expect to happen, at some point, for gold and silver.

| |

I recently ran across this tweet:

| |

|

I quickly replied that “This is not a crazy prediction.”

In fact, I find it very likely to happen. We’ve seen numerous instances in recent years where physical bullion inventories were overwhelmed by surges of demand.

You had to pay tremendous premiums above melt value, if you were fortunate enough to locate any coins or bars available for sale.

That’s the difference between gold and silver and plain old commodities.

Unlike oil, copper or other commonly traded commodities, gold isn’t significantly used in the creation of any product other than forms of itself (bullion). It’s not consumed in any manufacturing process that greatly eliminates supply from the market.

So usage in products doesn’t provide a baseline of buying. Its demand is entirely emotional — based on fears, and worries about the declining purchasing power of the underlying currency.

For other commodities, falling prices spur increased usage/demand. For gold, the opposite result is often found, particularly in the West. A dropping price can reassure savers that everything’s fine with the currency, and dampen the enthusiasm of trend-following speculators.

As the gold price falls, demand often falls alongside.

On the other hand, unlike commodities where supply and demand dynamics require years to significantly change, the demand for gold can explode in quick fashion as the populace suddenly realizes their currency is being rapidly depreciated.

These fears spread like falling dominos, and all of the available bullion is snapped up. Like GameStop, gold can go “no offer,” and the price can catapult higher.

I fully expect this to happen at some point in the years just ahead, and for the demand to crater the fractional-reserve model of the paper gold and paper silver schemes.

But it’s important to remember that we don’t need a major crisis in confidence or a massive surge in demand to overwhelm bullion inventories. This has already happened a number of times over the past dozen years, for one reason or another.

The lesson here is to buy gold and silver…while you still can.

| | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |