| GameStopped gold? Here’s the bigger issue everyone’s missing… | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

| Gold Newsletter Preview: | | GameStopping Gold And Silver? | |

While everyone’s talking about silver and gold being the next target of the short-stompers, this stealth factor is escaping everyone’s attention.

| |

Make no mistake: It is different this time.

And I’m not talking about GameStop and the silver shorts becoming the next target of the Reddit mob.

No, I’m talking about a key factor that I feel will be absolutely necessary for the gold and silver bull market to keep rolling on. And we’re just now getting evidence that this powerful driver is about to hit the markets like a ton of bricks.

|

The Missing Ingredient Last Time

|

As the Great Financial Crisis of 2008 took hold and the global financial system teetered on the verge of collapse, the world’s central banks — the Fed foremost among them — unleashed an unprecedented rescue effort.

As they dreamed up ever more novel and larger market backstops and attempted to float asset prices higher on an ocean of liquidity, investors began to snap up gold and silver in anticipation of awesome inflationary consequences.

|

From the depths of the liquidity crunch in the fall of 2008 to the summer of 2011, the price of gold nearly tripled.

|

But the expected price inflation never happened, at least not outside of real estate and the financial markets.

The lack of consumer price inflation led the paper-gold speculators to begin to doubt the gold thesis, and they began to look ahead toward the end of the Fed’s massive quantitative easing efforts.

In fact, the gold-price peak almost perfectly coincided with the Fed’s announcement of QE-3, the “shock and awe” program of asset purchases that would last as long as necessary to whatever degree necessary.

To restate it more clearly, the announcement of QE3 should have been the most bullish announcement imaginable for gold. Yet it began the long gold bear market because Western speculators, seeing no inflation and no hopes of another, bigger QE announcement from the Fed, chose to exit the trade.

|

This is why I’ve maintained that this time, especially considering how large Covid rescue efforts have been, we’ll have to see significant inflationary fall-out to keep the gold bull market rolling.

|

The good news is that we should definitely see significant inflationary repercussions…and in fact are already starting to see them.

|

The Bonfire’s First Sparks

|

The reason why this time will be different revolves around the Covid-19 crisis, its ramifications and the rescue efforts put in place as it developed.

First off, in this crisis most of the fiscal response was aimed for Main Street as opposed to Wall Street. Helicopter money in the form of bribes checks sent directly to voters may not have had the hoped-for effect on spending, but they weren’t without any impact. Other programs like the Payroll Protection Program kept millions on the payrolls and bolstered the balance sheets of many businesses.

But even while government spending sought to keep companies and citizens afloat, millions of businesses were significantly or fully shut down. This affected supplies of many commodities and products across the globe.

So as more and more of the world’s population gets vaccinated and economic activity starts to recover, the now resurgent demand will in many cases run up against restrained supplies.

Not across the board, of course, but in enough cases to pressure prices.

Back in July, for example, I alerted our Gold Newsletter readers that the stochastics for not only copper, but also the major index of all commodities, had turned decisively upward.

|

I took the bold step of calling the beginning of a new bull market in copper and commodities in general. As you probably know, they’ve soared since then.

|

The commodity story is largely one of restrained supplies…but it’s also one of renewed demand. In fact, this is one area that seems to be perking up right now.

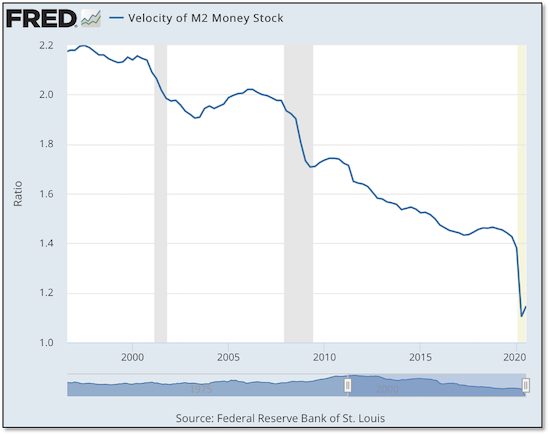

To understand the ramifications for inflation, consider that, as James Rickards and Lyn Alden noted during our recent New Orleans Investment Conference, it’s difficult to have retail price inflation without rising velocity in the money supply. And monetary velocity has been dropping since the turn of the century.

Why? Because the velocity of money is simply the ratio of nominal GDP to the money supply (whichever measure you’re using).

And as the Fed has repeatedly loosened monetary policy in response to successive economic contractions (real or imagined), the effectiveness of these policies has diminished.

|

To use a trite analogy, it’s like the addict building a tolerance to the drug he’s addicted to. It takes ever-greater doses to get the same result.

|

It’s the same with easy money. If the increase in money supply doesn’t create an equal or greater response in GDP, then velocity will fall. Simple mathematics.

And if GDP growth stagnates while the money supply explodes, then velocity will fall off a cliff. That’s precisely what happened after the 2008 crisis, and most recently to an even greater degree in the Covid economic shutdown.

But get this: Economic activity was driven so low in the worst of the Covid shutdown, that any rebound from those “oversold” levels will be that much more significant.

That’s how we get a 33% rate of GDP growth in the third quarter of 2020.

The result is that we’re now getting the first sharp uptick in monetary velocity since 2000, as you can see from the accompanying chart.

|

|

It may not seem like much…yet…but it’s very possible, if not likely, that this is a foreshadowing of significant new inflationary pressures just ahead.

The bottom line is that renewed economic activity — demand — will find supplies of many products and services to be severely constrained. And we’re just now seeing the first signs of the inflationary repercussions.

|

Again, we need to get retail price inflation to keep the gold bull galloping ahead…and it looks like we’re going to get it.

|

This is the key, missing factor that everyone is overlooking.

That’s why I dedicated much of our just-released February issue of Gold Newsletter to exploring this development, as well as examining the recent, curious interplay between Treasury yields and inflation expectations.

This is another important development that has played havoc with gold and silver in recent weeks, and will continue to do so as the markets react to the new inflationary pressures just ahead.

But those looking to make a lot of money, and quickly, will be more interested in the three new stock picks I reveal in this issue of Gold Newsletter:

|

• A brand new royalty company with a twist that I think will make it the next high-flyer in this richly valued sector. (Hint: It’s got some of the most powerful groups in mining behind it.)

• The next big play from one of the most successful junior mining groups out there. And it shouldn’t take much to make this their next huge winner…considering they’re starting out with a big resource averaging nearly 14 g/t gold!

• A “cheapie with a chance” — a company with a large gold project boasting an after-tax value over 13 times its current market cap. And that’s only to start.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| | |

You can get all the details on these new red-hot stock picks — and position yourself for the next bull run now beginning in metals and mining stocks — by subscribing to Gold Newsletter now.

To get a full year of Gold Newsletter…and get immediate access to our exciting February issue packed valuable investment intelligence and details on dozens of exciting junior mining plays…simply click on the link below.

| All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |