January 30, 2023

Dear Fellow Investor, |

| For gold bugs, the bad news is that this week’s Fed meeting isn’t likely to provide any positive momentum for the gold price.

|

| Now that everyone knows Powell & Co. will pivot this year, the markets have been bouncing around as sentiment shifts between the Fed’s projection of three rate cuts to the widely-held view of five or six.

The other point of contention has been when the cuts will begin, with some placing bets on the March meeting. However, as our friend Peter Boockvar notes, a cut that soon seems very unlikely considering the still-robust GDP growth, high oil prices amid geopolitical tensions and inflationary pressures still running high in many sectors of the economy.

|

| Thus, Jerome Powell is probably going to push back on the idea that the first rate cut will come as soon as March, and this will be bearish for gold in the near term.

|

| However, there’s also lots of “good” news for gold bulls — factors that will help push gold much higher over the longer term, and perhaps in the near future as well.

|

| The Bullish Drivers For Gold Right Now...

|

| I put the word good in quotes above because the most immediate driver for gold isn’t good in any conventional sense of the word.

|

| Simply put, the tragic killing of three U.S. soldiers in Jordan over the weekend by an Iranian proxy group spawned a safe-haven rush into U.S. Treasurys, the dollar and gold.

|

| Thus, we’re seeing one of those uncommon situations in which bonds, the dollar and gold are all rising together.

When this happens, it’s almost always the result of some geopolitical event. That was the case in October and November, when the Hamas attack on Israel set the markets aflutter. During that period, gold and the greenback showed a positive correlation.

But there was one critical difference back then: A few days after the Hamas attack, Treasury yields rose along with gold. If this were purely a safe-haven event, Treasury prices should have risen, and yields fallen, as investors flocked to the safety of U.S. government paper.

So why did investors shun Treasurys instead, sending yields higher?

|

| Because the other headline back then was the immense amount of U.S. government deficit spending and the tidal wave of debt that the U.S. Treasury would have to float over the coming months.

|

| This prompted the temporary return of the fabled “bond vigilantes” who, because of the deteriorating U.S. fiscal situation, demanded higher yields to offset the greater perceived risk.

Now, these fears were soon once again replaced by greed, and Treasury yields fell in December (even as the gold price rose). And yesterday we saw yields fall once again as the U.S. Treasury announced that it would be borrowing “only” $760 billion in the first quarter, down $55 billion from its last estimate.

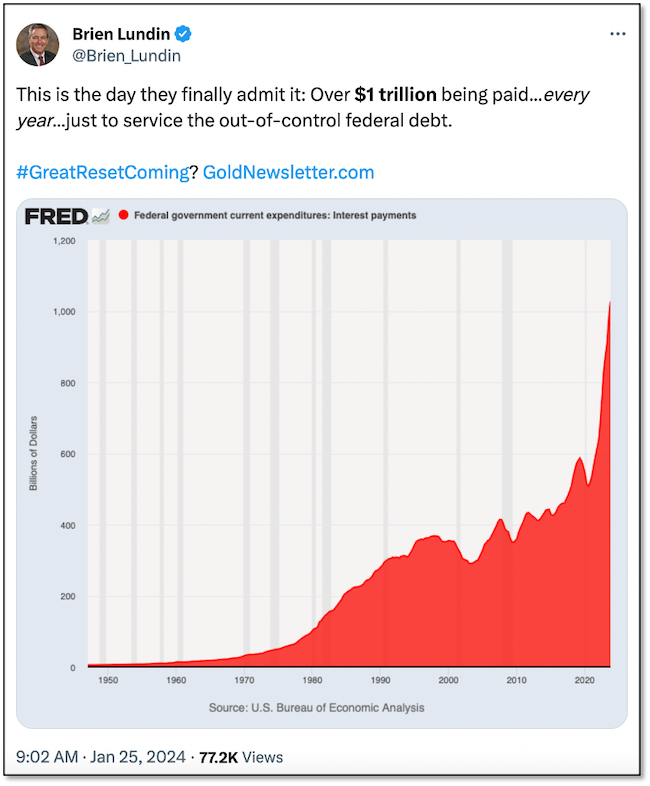

But I believe the sad fiscal condition of the U.S. government will soon return to the headlines, thanks to a recent Federal Reserve report that I summarized in the following tweet/post on X:

|

|

| The just-released update on federal interest expense shows that the U.S. has truly entered a debt spiral, with over $1 trillion now being spent just to service the monumental (and rapidly growing) federal debt.

As you know, I’ve been predicting this event for a few years now. The amount of money we’re spending and the impact on the federal budget is bad enough, but I’ve maintained that politicians could seize on this huge number — which exceeds what we spend on national defense or any single entitlement — and begin talking about defaulting on this massive debt.

We’ll see if it gets that far, but the simple fact is that we cannot afford interest rates at these levels. Even if the Fed cuts as much as the market believes, rates will still remain above 4.0%. And at that level, the interest expense soars toward $1.5 trillion and above.

|

| This means that rates will have to fall considerably, and below the rate of inflation, or the entire house of cards collapses.

|

| In other words, we’re going to need negative real rates going forward, and this will be extraordinarily bullish for gold, silver and mining stocks.

|

| Get More Details On Gold’s Bullish Drivers

— And Why Uranium Stocks Are Soaring —

In Our February Issue of Gold Newsletter

|

| In our February issue of Gold Newsletter — being published on Thursday morning — I’m going to delve into more details on why gold is at an important crossroads right now, with a number of factors conspiring to drive the price higher.

This includes the fact that Western investors are almost completely absent from gold right now, with managed money actually net short (a prime indication of a price bottom) and holdings in the GLD ETF actually falling in recent weeks.

|

| Plus, I’m going to explain how three separate events — a two-year production shortfall from the world’s largest miner...a coup in Niger...and a Congressional bill prohibiting Russian imports — are combining to send the price of uranium soaring.

|

| It’s also sending the share prices of junior uranium companies skyward.

So you’ll also want to read about the remarkable “new” uranium company I’ve uncovered. Formed by the merger of three separate companies, the combined entity will be one of the most dynamic in the entire industry.

More importantly, I think this company’s market value is going to take off in the weeks ahead.

|

| Act Now To Discover All This And More...

|

| Again, I’m providing the full details on all of this in our February issue of Gold Newsletter.

|

| This is going to be one of the most important and valuable issues in recent history, and frankly I don’t believe any serious investor can afford to miss it.

|

| If you’re not currently a subscriber, I urge you to click on the link below to sign up now, so you can get our latest issue hot off the press.

|

| All the best,

|

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

|

| CLICK HERE

To Subscribe To Gold Newsletter

And Receive Our Exciting February Issue

Immediately Upon Publication

|