| It’s a waiting game right now…

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

After last week’s big sell-off in the metals, gold and silver are slowly creeping back upward.

The big catalyst ahead is the Fed’s first rate hike, probably next month, and disappointing jobs reports don’t seem likely to derail their schedule.

| |

Gold bugs got a ray of hope this morning when the ADP jobs report came out with stunning numbers:

|

Instead of the expected 180,000 jobs created in the private sector in January, the report showed a loss of 301,000 jobs.

|

This was a remarkable reversal, and you can’t blame a gold bull for feeling that it would force the Fed to postpone their plan to begin raising interest rates next month.

But alas, the loss of jobs is almost entirely due to the rise of the Omicron variant...and with that wave already on the decline, the markets (and the Fed) quickly shook it off.

I expect a similarly negative nonfarm payrolls report on Friday, and a similar reaction to it by the markets.

| |

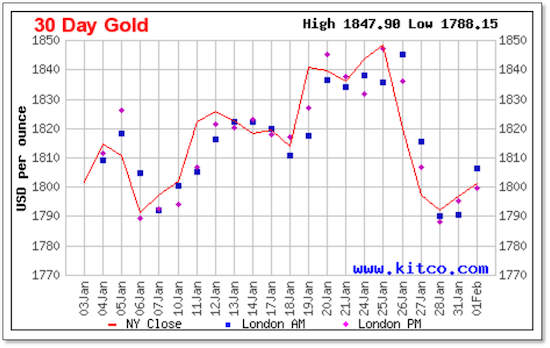

Still, as you can see from this 30-day gold chart, the yellow metal has been posting a slow-but-steady recovery since last week’s big sell-off.

|  |

To that rebound in the chart above, you can add another $5 gain in the gold price today, giving us some breathing room above the $1,800 level.

Last week’s decline was largely related to month-end options expiry and the typical games that are played in the paper-gold futures market around that event. The futures don’t reflect the actual supply-demand dynamics for the metal in normal times, and they especially don’t when traders are creating millions of ounces of ghostly gold via keystrokes to force the price lower.

Still, that’s the way the global price is set, and we have to live with it for now.

We do have something to look forward to, however, and that’s the actual Fed rate hikes — the very event that traders are using to short gold right now.

The record shows that the shorts abandon their trade once the anticipated event occurs — they sell the news — and this releases the pressure on the metals. If history plays out as before, the beginning of the Fed’s rate-hike campaign will mark the start of a metals rally.

|

It’s only a few weeks away at this point, and I’m confident it will be worth the wait.

|

In the meantime, I’m talking with lots of junior mining companies with big exploration plans for the next few months. A rally in gold, silver and copper will certainly help their shareholders, but some of these companies are positioned to make big advances regardless of what the metals do.

Make sure you’re subscribed to Gold Newsletter to get my latest recommendations and on-going coverage of these exciting juniors.

| |

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |