| Gold rockets higher, but... | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | Contact Us | Privacy Policy | View in Browser | Forward to a Friend | | .png) | | Gold Rockets Higher.

But... | | | Gold powers through $2,800 to new record highs, but the reason for the immediate spike could be dangerous.

PLUS: Great insights on gold and gold stocks from our friend Adrian Day. | | February 3, 2025

Dear Fellow Investor, | | First, the good news: Gold took aim at the old record highs late last week, and quickly burst through that ceiling as well as the key $2,800 level. | | It has continued to move higher today, gaining over $20.

Now, the (potentially) bad news: The primary driving factor behind this latest surge in gold is the emerging tariff war President Trump is launching on Canada, Mexico, China and much of the rest of the world.

The threat of 25%, or greater, tariffs on Mexico and Canada has ignited fears of inflation, while also raising the chances for a recession that would force the Fed to accelerate its monetary easing. | | It’s great to see gold rallying, but what we’re seeing is fast money flooding into gold because of the tariff kerfuffle. The risk here is that, when/if this issue subsides, that money will quickly exit and send the gold price tumbling. | | Evidence of the motivating factors behind this move came this morning, when Mexico announced steps to address the administration’s concerns and Trump immediately postponed the imposition of tariffs on the country for one month. Gold quickly lost some of its gains on that news.

Beyond the short-term drivers and risks, however, the long-term picture for gold remains quite bright. This year, especially, a lot of “chickens” will come home to roost in the U.S. and global economy — particularly with about $10 trillion in Treasury securities that will demand refinancing at current rates. Many of these issues were deftly addressed in a great update this morning from my friend Adrian Day, who is one of the most experienced and insightful analysts around. With Adrian’s kind permission, I’m sharing his full comments in this week’s Global Analyst below. I think you’ll find Adrian’s analysis to be compelling and particularly valuable. (Note: I also suggest you take advantage of a special subscription rate for Golden Opportunities readers — only $250/year for his weekly service. Just email globalanalyst@adrianday.com, or call 410-224-8885, and use the special offer code “GOLDEN.”) | | Golden Opportunities continue below... | | | SPONSOR: U.S. GOLDMINING INC. (NASDAQ: USGO) |  | | | | Demand for copper, a vital component in the construction of electric cars and wind turbines has been surging. According to the International Energy Agency, existing mines and projects under construction will meet only 80% of copper needs by 2030, highlighting the scarcity of supply which can drive prices even higher.

An Executive Order enacted by President Trump on January 20th titled, “Unleashing Alaska’s Extraordinary Resource Potential” was applauded and welcomed by U.S. GoldMining Inc., an exploration and development company focused on advancing the 100%-owned Whistler Gold-Copper Project, located 105 miles (170 km) northwest of Anchorage, Alaska, U.S.A. This initiative has the potential to significantly benefit the mining industry and the state of Alaska by fostering new investments, streamlining the resource development permitting process and ultimately delivering significant economic growth to Alaska. The future potential mine development of the Project and Alaska’s proposed West Susitna Access Road are well-placed to benefit from the regulatory certainty provided by the Executive Order.

The Whistler Project consists of several gold-copper porphyry deposits with indicated mineral resources containing over 1 billion pounds of copper, 3.9 million ounces of gold, 19 million ounces of silver and exploration targets within a large regional land package comprised of 377 State of Alaska mining claims (100%-owned by U.S. GoldMining) totaling approximately 53,700 acres (217.5 square kilometers). See its most recent annual report on Form 10-K for further information regarding its estimates. | | Click here to learn more about U.S. GoldMining Inc | | | | | The Perfect Set-Up

For Gold Stocks | | By Adrian Day

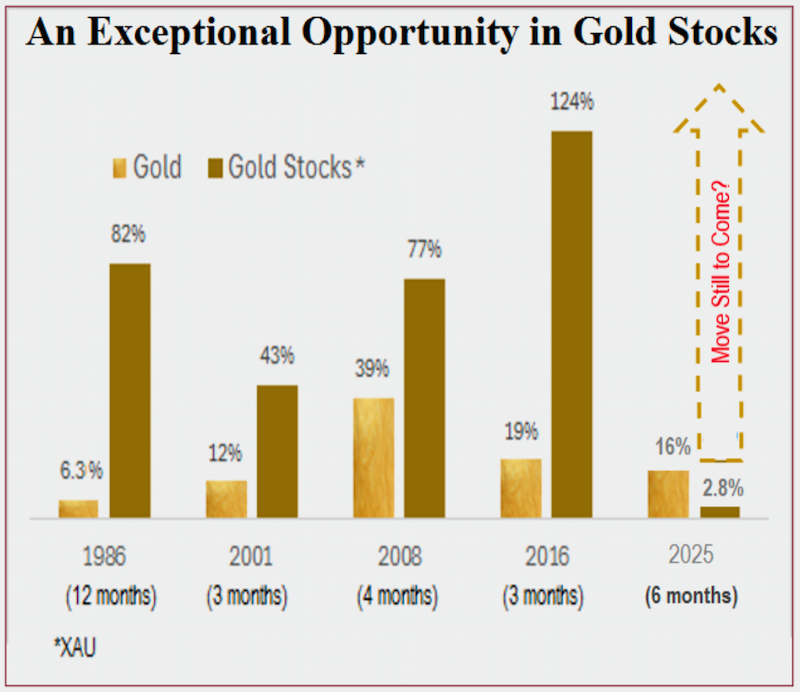

Excerpted from Global Analyst No. 946, February 3, 2025 | | This is a most opportune time to be buying gold stocks. The gap between gold and gold stocks has never been wider. Incredibly, valuations remain low even as gold itself hits record highs. This is so even as margins are expanding with the major miners generating increasing cash flow. Gold is extremely under-owned, while sentiment remains poor.

However, signs of a change are coming. So this is a most opportune time to buy gold stocks, with tremendous opportunity ahead. | | The East has been leading while the West has lagged | | For the past two plus years, the macro-economic environment–-with high interest rates, low and declining inflation, a strong economy, and reasonably strong dollar––has not been attractive for gold investments.

But gold moved up for other reasons: central banks buying to diversify their reserves in the face of dollar weaponization, and Chinese investors and consumers buying on concerns about their economy and the fragility of the banking system.

Meanwhile, Western investors have been selling. In the past couple of weeks, physical gold has been rushing into the U.S. in anticipation of tariffs, to meet demands from large banks to settle COMEX contracts. Otherwise, it is mostly traders and large institutions who have been buying. The buying has not reached the ordinary retail investor or small institution. Indeed, the GLD, the largest U.S. gold ETF has shown only three days of positive inflows during all of January, and only six since Thanksgiving. | | Economic conditions are shifting in gold’s favor as Fed changes policy | | Now the macro economic environment in North America is changing in gold’s favor.

Starting in September, the Federal Reserve has embarked on a rate-cutting cycle, albeit a cautious one. The first rate cut after a hiking cycle has long been the spark that causes Western investors to buy. However, optimism about what a second Trump term would mean for the economy muted any impact on gold from the Fed’s move.

That optimism will fade as tariffs take hold, and the underlying economic reality comes to the fore. Inflation remains stubborn and importantly above the Fed’s own target. The last six months of inflation data shows a clear trend up. Many important indicators point to a slowing economy and a jobs market less healthy than the headlines suggest. |  | | For the Fed to cut rates before inflation has been conquered, as it has done, is the most attractive scenario for gold to do well.

It’s not only the Fed that is cutting rates, but the same is happening in Europe, Britain, Canada, and most of the world, and they are all doing it before inflation has been quashed.

The last two years have been but prologue; now the curtain is going up and the play is about to begin as Western investors start buying. | | Gold stocks have performed well, but lagged gold | | Though gold has been strong for the past two years, the gold stocks have lagged. Neither central banks nor Chinese investors want to buy western gold stocks. And strong broad stock markets, led by tech stocks, meant that North American investors have not been looking at gold stocks. In January, neither the GDX nor the GDXJ has seen a single day of net inflows; indeed, the GDXJ has seen no inflows for three months, with $495 million in net outflows over that period.

It must be noted the XAU index is up 37% in the last 12 months. That is significantly more than the S&P for the same period (23%). Yet you would never know it from the financial media. At some point, someone will notice. (This one- year return for the XAU is identical to that of bullion, once again demonstrating the lack of leverage the stocks have so far exhibited in this bull market.)

The S&P is now losing momentum as the erstwhile market leaders start to falter. Meanwhile, the gold miners have had the highest cash flow growth of any segment of the stock market over the past year. Soon investors will start to notice, especially if the “Magnificent Seven” stocks stumble. | | There is potential for extreme moves due to low ownership | | And despite record gold prices, when valuations usually get extended, gold stocks today are selling close to multi-decade lows. Agnico Eagle, the third-largest miner, for example, is trading at a multiple of less than 10 times its cash flow. This is in its lowest decile in its history. The entire XAU is close to a multi-decade price-to-cash flow low.

For most of the past year, gold stocks did indeed move up, but never exhibited the traditional leverage we see at the beginning of a bull market. The fact that we did not see gold stocks dramatically outperform over the past two years as gold appreciated over 70% is simply due to who was buying and why.

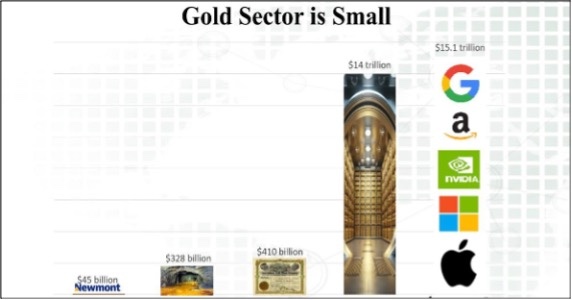

Now that the Fed has embarked on a rate-cutting cycle, and the S&P is faltering, we will see investors look to gold and gold stocks. With average gold exposure among U.S. investors under half a percent––compared with a 50-year average close to 2%-–the potential for significant buying exists. |  | | The largest gold miner in the world, Newmont Corp., has a market cap of only $48 billion. The market cap of the 100 largest gold companies is just over $400 billion. The value of one year’s gold production is $328 billion, while all the gold ever mined in the history of the world is about $14 trillion. Meanwhile, just five U.S. tech stocks have a market cap over $15 trillion. | | And given that the entire gold equity market worldwide has a market cap of only about $500 billion, compared with over $15 trillion for just the top five U.S. tech stocks, it would not take much of a shift to see the gold stocks move up dramatically. We should see the kind of leverage that gold stocks have historically demonstrated at the onset of every gold bull market.

This is a rare confluence of record gold prices and low gold stock valuations, and an excellent time to step up investing in this space.

(Note: Golden Opportunities readers can take advantage of a special subscription rate for Adrian Day’s Global Analyst of only $250/year of his weekly service. Just email globalanalyst@adrianday.com, or call 410-224-8885, and use the special offer code “GOLDEN.”) | | CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the Gold Newsletter Youtube channel. | | | | | | © Golden Opportunities, 2009 - 2025 | | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411 | | | |