|

Dear Fellow Investor,

Gold’s been on the move since the day after the Fed’s December 19th rate hike.

If you were reading Golden Opportunities in the weeks before that rate hike, you knew that gold was likely to rally.

And if you were reading Gold Newsletter, you got specific stock tips to take advantage of that predicted gold rally — stocks that have risen as much as 58% in the six weeks since.

I fully expect gold to continue this rally, as the Fed has moved from tightening to a pause...and the next move on any economic weakness will be to begin easing once again.

Still, gold’s near-term future has long seemed the most uncertain in comparison with its long-term prospects. That’s because of one over-arching, inescapable issue that will demand far higher gold prices.

The Debt And Interest Rate Conundrum

In my recent speeches I’ve focused on the problem of America’s massive and growing debt in an era of rising interest rates.

I begin by showing the now-famous chart of the Gross Federal Debt, as drawn by Ron Griess of TheChartStore.com, which I use in most of my presentations. I won’t repeat it here, but will note that it shows the trend-line growth of U.S. federal debt since 1900 is 8.7539%.

Would that we could invest in something with such a high and consistent rate of growth.

Following that chart, I review a number of bullet points under the title “Dirty Little Secrets on the Federal Deficit and Debt.” Here they are:

• The federal deficit for 2018 came in at “only” $793 billion.

• Yet for the fiscal year 2018 ended September 30, the federal debt had grown $1.2 trillion.

• The difference is about $400-$500 billion in “off budget” spending, thanks to an accounting system that would put private companies in jail.

• As a result, the debt is growing much more quickly than most realize — and the growth is accelerating: The debt grew $1 trillion in just the last six months of fiscal 2018!

• Analysts are decrying the fact that the federal debt will grow to $30 trillion in the next 10 years.

• In fact, at its historic trend line growth rate, it will reach $30 trillion by 2022!

In other words, the federal debt is already out of control. The future is now.

So what are the implications of this massive debt growth?

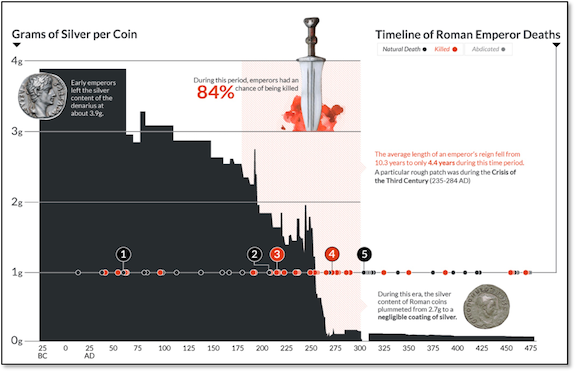

To help explain, I present a chart from the excellent Visual Capitalist website depicting the debasement of the Roman denarius and the decline of the Roman Empire. (Hint: They were coincident.)

My point: What we’re going through, and are about to go through, is nothing novel. It’s the same dilemma that countless nations and civilizations have faced throughout human history: Governments overspend their means, either via wars, entitlements or excesses, and build unmanageable debts.

The prescription in every instance has been the same — the underlying currency is debased to decrease the cost of the debt.

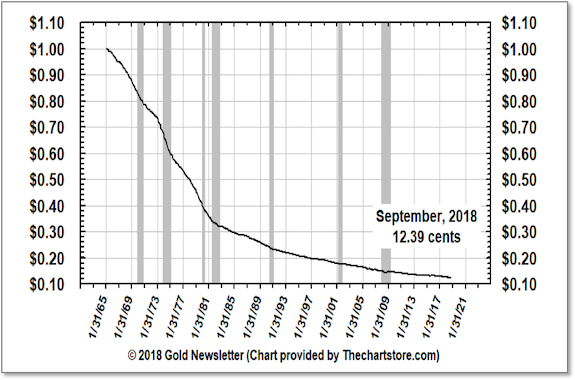

To those who might say it can’t happen here, consider this chart (also courtesy of The Chart Store), of the purchasing power of the U.S. dollar since 1965, not coincidentally the year that silver was removed from U.S. coinage.

Purchasing Power of the Consumer Dollar

As you can see, the dollar has lost about 87% of its purchasing power during that timeframe, which is remarkably similar in degree and timing to the most severe decline in the value of Rome’s denarius.

It not only can happen here, it’s happening right now.

And it’s going to get worse. I’ve been researching the costs of servicing the U.S. federal debt, and of course the numbers are enormous and growing. Everyone knows that.

But it’s very difficult to quantify the effect of rising interest rates on those costs — assuming that the Fed could ever reach the levels it desires. To get some idea, I considered only the federal debt owned by the public, but related the interest costs of the expanded debt, including off-budget items.

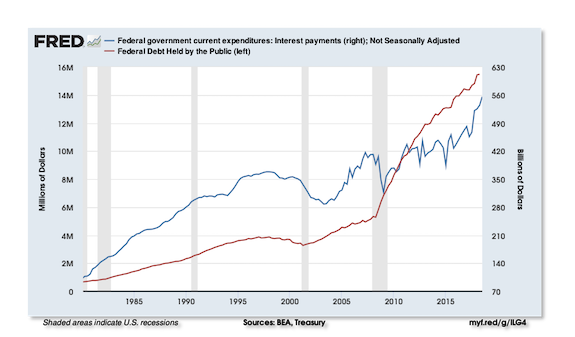

Plotting the federal debt held by the public against the federal annualized interest expense yields the accompanying chart from the Federal Reserve’s own FRED site.

As you can see, the debt exploded after the 2008 financial crisis and during the resulting Great Recession. Still, in that era of zero interest rate policy, federal interest payments remained somewhat in check.

But look at how those interest costs begin to rise after the Fed began hiking rates in December 2015. And once the Fed began raising rates to the tune of three to four hikes a year, interest costs began to explode to the upside.

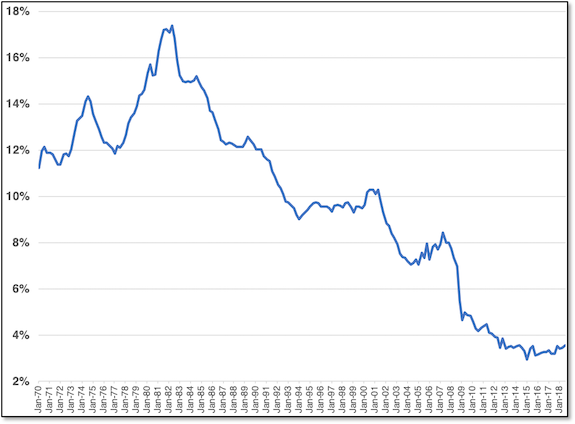

Now consider the next chart, in which I plot the “effective interest rate burden” on the federal debt. Notice how interest rates fell precipitously, from around 8% service costs before the 2008 crisis, to only about 3% as the Fed got the fed funds rate down to zero.

Note also that the effective rate is around 3% to 4% above the fed funds rate during “normal” times.

Effective Interest Rate Burden

Again, after the Fed began to raise the fed funds rate in December 2015, this effective rate on our debt service began to rise. The issue here is that if/when the Fed gets the fed funds rate to the 3.0%-3.5% range, our effective interest rate cost on the federal debt will rise to 6% to 7%, or more.

What does this mean to the bottom line?

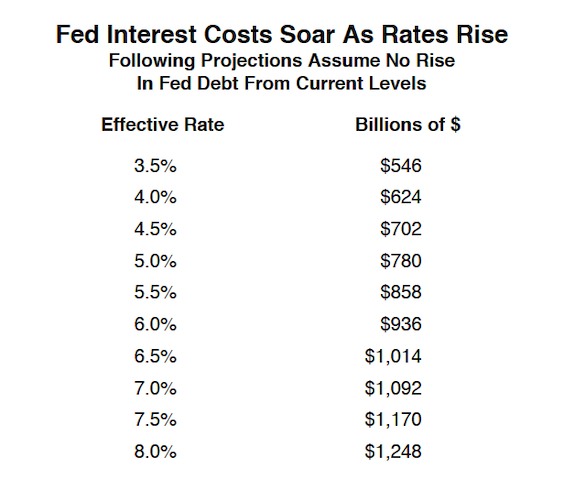

The following table shows the federal budget costs at various effective interest rates on our debt service. Note that this reflects only the federal debt held by the public and assumes no increase from current debt levels.

As you can see, once the effective rate on servicing our debt gets to the 6% to 7% range, which will happen if/when the fed funds rate gets over 3%, we will begin paying about $1 trillion in debt service alone.

That will dwarf every other single line item in the federal budget — including defense, welfare, social security and more.

In my opinion, paying a trillion dollars a year simply to service the debt, with much of that money going directly to China, will not be politically palatable. American citizens will demand some very significant devaluation of the dollar, if not an outright default on much or all of this debt.

Now consider this. The fed funds rate is currently 2.5%. My research shows that a rate of 3.0% could be the tipping point.

The Fed had signaled its intent to hike rates at least three times this year, but violent stock market volatility in December led it to put its program of quantitative tightening on hold.

What the numbers I’ve just walked through show is that supposed “normalized” interest rates are impossible in any case.

Even if the economy and the stock market strengthened considerably and the Fed felt it could begin raising rates once again, higher rates — combined with ever-greater deficit spending — would force us into completely unmanageable debt-servicing costs.

We’re only about 0.5% — or two rate hikes — away from levels that would imply around $1 trillion in annual interest expense!

Again, these numbers are conservative in that they don’t factor in the current rate of growth in the debt, with deficits themselves now running around $1 trillion annually. Nor does it factor in the cost of the debt service itself, which will add another $1 trillion or so in spending every year.

As you can see, things rapidly spin out of control from that point on. That’s why we will never see previously “normal” interest rates again, without some major monetary reset in the interim.

This will be the primary factor driving gold prices higher over the coming years.

And that’s why every serious investor needs to make sure they’re properly allocated to the sector now.

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|