| Is Tesla poised to rescue gold? | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

| Is Tesla Poised To Rescue Gold? | |

It’s possible…but there are valid reasons to hope they don’t.

| |

On Monday Tesla disclosed in its financials that it had bought $1.5 billion-worth of Bitcoin.

|

The price of Bitcoin surged in response.

|

It’s obvious that Tesla CEO Elon Musk has a lot of influence in the markets. In fact, awhile back he simply added “#Bitcoin” to his Twitter profile and the cryptocurrency quickly jumped 20%.

As Bloomberg columnist Matt Levine recently wrote, “the way finance works now is that things are valuable not based on their cash flows but on their proximity to Elon Musk.”

Somewhat buried in all the hoopla over Tesla’s purchase of Bitcoin was a note in the filing that the company could also purchase gold and other alternative assets in the future.

And that immediately spawned speculation of what such a purchase would do for gold.

| | Golden Opportunities continues below... | | SPONSOR: | | Clearing The Way For

High-Grade Gold Production

Ximen Announces Term Sheet For US$5 Million

To Fund Development Of Kenville Gold Mine |

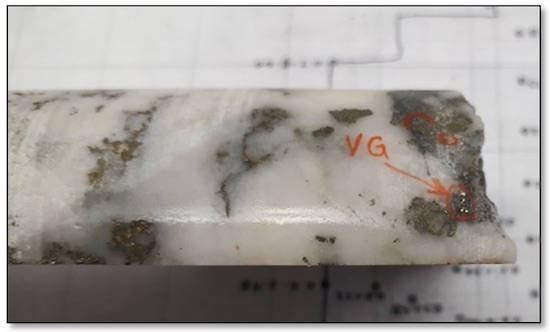

| | Photo showing example of visible gold (VG) in drill core intercept from 2009-2012 drilling. | Vancouver, B.C., February 10, 2021 – Ximen Mining Corp. (TSX.V: XIM) (FRA: 1XMA) (OTCQB: XXMMF) is pleased to announce that it has signed an indicative term sheet with an arm’s-length, Swiss-based metals trading firm to provide US$5.0 million of financing in the form of a secured gold loan for the planned development of a 1,200-meter decline and extraction of a 10,000-tonne bulk sample at the Company’s Kenville Gold Mine property.

“This non-dilutive financing is an important milestone as we continue moving forward on the development of the Kenville Gold Mine towards production,” said Christopher R. Anderson, Ximen’s President and CEO. “Following months of discussions, we are extremely pleased to have come to terms with a sophisticated firm that understands our industry and is providing us with the final stepping stone to satisfy our cash flow requirements.” | | Click Here To Get The Exciting Details | |

Certainly, if Tesla announced that it had bought a significant amount of gold…or, heaven help us, if he added “#Gold” to his Twitter bio…the gold price would immediately catapult higher.

Of course, the gold market is, still, much larger than Bitcoin, and therefore harder to move. There are also big players with lots at stake in their Comex positions who would flood the market with fictitious, newly created paper gold to swamp the rally.

That said, the gold price is moved not by gross demand, but by buying pressure at the margin. A slight shift in buying pressure over selling pressure could allow the price to clear some important technical hurdles and attract trend-following buying.

As we’ve seen before, it doesn’t take much of a shift in sentiment to spawn a gold rally.

More importantly, Musk is highly regarded as a thought leader among younger investors. His entrance into the gold market would lead countless millions around the world to explore the argument for higher prices.

And of course, that argument is compelling and, essentially, irrefutable.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Choppy Markets, But Some Trends Emerging

|

Right now, the metals markets remain choppy. On the release of the January CPI numbers today showing the headline rate at the expected 0.3% gain, but the core rate well below consensus at 0.0%, gold leaped about 1% higher and silver leveraged the move.

|

Yet after the early enthusiasm, both metals were driven down…along with the broader U.S. stock market. As usual, the drops in gold and silver defy simple explanation, as both Treasury yields and the U.S. dollar also fell.

|

Regardless, after dipping slightly into the red, gold has recovered and poked into the green just a bit as I write. As I commented in our last issue, simply refusing to fall is a major, and welcomed, shift in sentiment.

The bottom line is that gold’s behaving much better at this moment.

At the same time, copper is rocketing higher, further justifying our call of a new bull market in late July and bolstering the argument for a general commodity bull run.

The lesson from today, as usual, is to ignore these short-term fluctuations and keep focused on the fundamentals that will drive gold and silver prices far higher over the years to come.

And maybe, just maybe, Elon will echo those arguments at some point and give us a nice leg up.

| | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |