| My LSU Tigers Win the Big One Just in Time for a New Gold Idea in 2020 |

|

| Please find below a special message from our advertising sponsor, GoldMining Inc. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

Gold prices have been on a great run since the summer of 2019 and recently traded over $1,600.

With the table set for higher prices for the foreseeable future, I met with GoldMining’s (GOLD.TO; GLDLF.OTC) Chairman Amir Adnani to discuss the improving market and why his company is particularly well-positioned for this move.

|

|

As my beloved LSU Tigers kept winning game after game this year, I began to believe that the stars were aligning in our favor.

I’m getting the same feeling about gold.

|

|

It’s one of the topics I had the opportunity to cover, while still basking in the glory of my LSU Tigers winning the National Championship, in a recent meeting with GoldMining’s Chairman Amir Adnani.

And it’s a key reason why I wanted to give you an opportunity to view his presentation from the same day.

It’s important that you view this presentation for yourself, but let’s quickly review some of the high points....

|

|

Bank of America recently reported that gold majors’ project pipelines have declined by over 40% since 2012, and currently the industry’s gold resources are at a decade low.

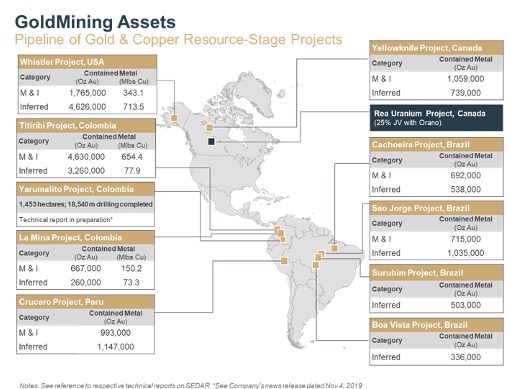

GoldMining’s very first acquisition of a resource stage project was in 2012 and they never looked back, taking full advantage of the seven-year bear market in gold by building a large, diversified portfolio in five countries in the Americas.

|

|

Take a look at these facts: the company managed to accumulate properties with global reported resources of 10.5 million measured and indicated gold ounces and 12.4 million inferred gold ounces. (See GoldMining’s website for details on resource estimates and reference to respective technical reports on SEDAR, to understand the specifics on the company, the resource estimates and its properties.)

|

|

| And it amassed that portfolio for a fraction of the historic value of the companies that previously owned GoldMining’s projects.

What does this mean to you? Because GOLD bought the projects at such depressed levels, it is positioned well to capitalize on improving gold markets.

Let’s take a look at the kind of upside potential that presents....

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Here’s Why GoldMining’s Portfolio Size and Diversification is Unique for a Junior Company

|

|

As Amir clearly shows in our video, at the peak of that rally, GoldMining was valued over twice its current valuation — and since then the Company has more doubled its project portfolio.

How do companies like GoldMining offer such leverage to gold?

To understand the dynamic at work, here’s a little history....

Back in the early 1990s, my mentor Jim Blanchard pioneered the “optionality play” business model that GoldMining Inc. follows. With the help of Rick Rule, Jim re-purposed a company called Silver Standard Resources, tasking it with finding world-class, in-the-ground silver resources at the bottom of the market.

While each company is unique and subject to its own factors and past results of one company don't indicate future stock performance of another — what is clear is that this is a model that has delivered results in the past.

And the results? Silver Standard was able to leverage this model and create significant value for its shareholders. It still exists today as mid-tier miner SSR Mining.

My point? GoldMining Inc (GOLD.TO | GLDLF: OTCQX) is following the same business model, but in gold. And I believe an optionality play with the sheer size and diversification of gold resource portfolio like GoldMining is simply un-paralleled, and I don’t think you could re-assemble this property package today.

Not only that, but GoldMining has all of the same potential options ahead of it that Silver Standard enjoyed — it could spin off projects into new companies, joint venture, monetize, or develop the projects themselves, and/or capitalize the royalty potential of its massive gold resources.

If you want an overview of my views on the gold market, and why I see GoldMining as a key way to play rising prices, I encourage you to invest the time to view this fascinating conversation with Amir that I recorded while I was in Vancouver recently and then review GoldMining’s public filings to learn more about the company.

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| |

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $5,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |