Gold looks primed for a bull run, and companies with production and near-production stories will likely deliver significant leverage on rising prices.

It’s an environment that suits up-and-coming gold producer Bluestone Resources (BSR.V; BBSRF.OB) perfectly.

Dear Fellow Investor,

It’s interesting times for gold bugs.

The Fed appears on the cusp of ending its regime of interest rate hikes. Depending what happens with an increasingly precarious U.S. economy, it may even have to consider a return to quantitative easing.

Right now, we’re learning just how a potential pause — or even a full stop — in rate hikes will impact the gold market in 2019. So far, the results are promising, with gold recently breaking through the key $1,300 mark and moving higher.

If history is any guide, we’ll see a seasonal boost for gold that reinforces the secular trend. And if the Fed does indeed have to start lowering rates, it’ll be “Katy, bar the door” for the yellow metal.

So how does an investor maximize returns on gold’s bull run?

Maximum Leverage On Gold

Again, recent history makes clear that the companies that do best initially in a renewed gold bull market are those with projects that are either in or approaching production.

That’s because when general investors begin to rotate back into this sector, the first companies off the shelves are those that have the potential to directly monetize increases in gold prices.

In that environment, companies with compelling, development-stage projects will shine.

In other words, companies exactly like Bluestone Resources.

A Very Special Situation

Thanks to a unique market opportunity, in late 2017 Bluestone was able to swoop in and snap up the high-grade Cerro Blanco project — where previous owners had already spent US$230 million in drilling and development — for a relative song.

The project had been put into limbo when the previous mining group made a decision to exit Guatemala.

That rash move was a boon to Bluestone — especially after mining major Pan American Silver made a clear endorsement of the country with its C$1.1 billion purchase of Guatemala-based Tahoe Resources.

The result is that Bluestone gained a project worth hundreds of millions of dollars...and one that now projects to provide hundreds of millions more in cash flow.

Compelling Economics

Cerro Blanco certainly looked like a great project as Bluestone took control and started providing the market with outstanding drill results. But it was hard to say how valuable it was until a few days ago, when the company released a comprehensive feasibility study.

The results of that study were nothing short of exceptional...and paint a picture of a high-grade, low-cost deposit that promises to become a very profitable mine.

Using a gold price of $1,250/ounce and a silver price of $18/ounce, the study projects an after-tax NPV of $241 million (C$309 million) and a rich after-tax IRR of 34% for Cerro Blanco.

The mine would produce 146,000 ounces of gold annually and kick off a sizeable $91 million in cash flow per year during its first three years of production.

That’s remarkable — especially when you consider that the company will spin off the equivalent of its current market capitalization in free cash, each and every year, for those first three years.

Better still, in a market where high-capex projects can be hard to finance, Cerro Blanco’s initial capital costs are a very manageable $196 million and its payback period is just 2.1 years.

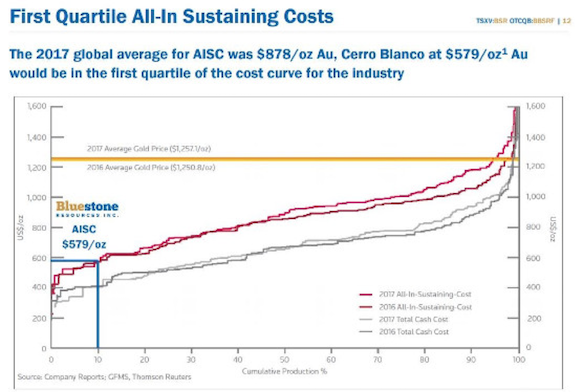

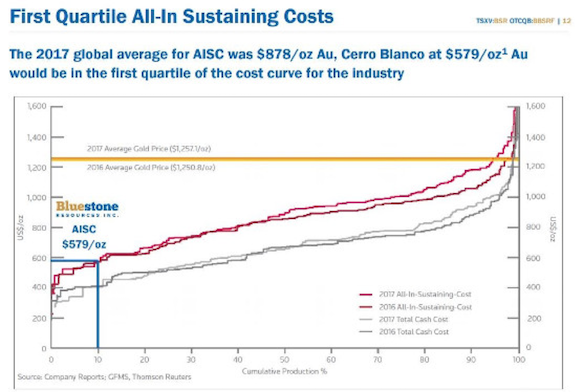

All-in sustaining costs of $579/ounce put the mine at the bottom of the lowest quartile of the global cost curve for gold projects.

Simply put, this is a very lucrative orebody.

View Bluestone’s management presentation on the feasibility study.

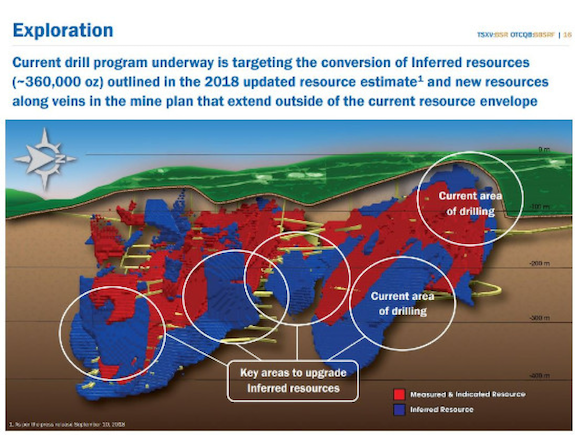

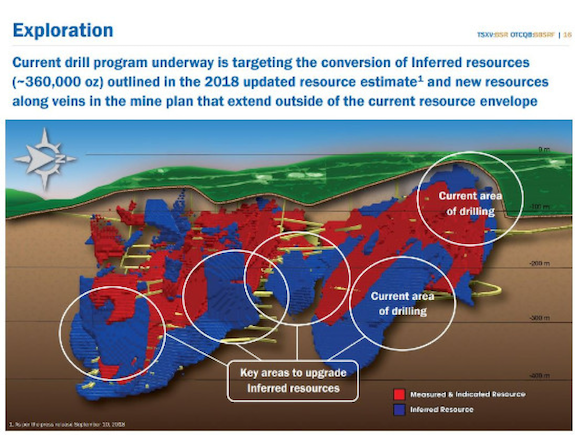

The mine’s projected eight-year life is based on producing 902,000 ounces of gold-equivalent from 940,000 ounces of reserves. Cerro Blanco has another 357,000 ounces of inferred resources that aren’t yet included in the mine plan.

Which brings up another very important point....

Substantial Room To Grow

And that’s where things get really interesting. Because not only is Cerro Blanco a compelling project using current reserves, it has the potential to grow significantly larger.

One reason is because inferred resources can’t be included in the mine plan unless they’re upgraded to measured or indicated resources.

The good news: Drills are currently turning on the project to convert as much of those inferred resources as possible. And they’re meeting with tremendous success.

For example, recently reported Hole 409 cut 3.0 meters of 16.3 g/t gold, which was great. But it also revealed a 52-meter down-dip extension of an existing vein that wasn’t known of before!

In other words, Bluestone isn’t just upgrading resources with this program. It’s growing them as well.

Plus, as the drills push more of those inferred resources into the indicated category, they will allow for inclusion of surrounding measured and indicated resources that the company couldn’t include in the feasibility study’s mine plan.

It ends up being a lot of gold that can be quickly brought into play.

Consider that Cerro Blanco currently has 940,000 ounces of high-grade gold in reserves. If just the 360,000 ounces of currently identified inferred gold resources are upgraded, we’re looking at a 38% boost in the project’s gold reserves.

And that doesn’t include any new gold resources that may be identified along the way!

It seems very likely that the current drill program has the potential to boost the company’s value significantly when it generates an updated resource estimate for the project later in 2019.

Time Is Short...

Remarkably for a company on the fast track to richly profitable production, Bluestone’s current market cap is still hovering under C$100 million.

That stands in stark contrast to the C$309 million NPV forecast in the feasibility study...which itself doesn’t include any gold resources that will be added to the mine plan over the weeks ahead.

And make no mistake: This company’s management team is laser-focused on turning Cerro Blanco into an extremely profitable gold-silver mine.

But time is short.

The release of the feasibility study is like a starting gun for Bluestone to begin negotiating financing, or for other major companies to take a hard look at this junior developer.

Market-moving news could come at any time.

Plus, with gold primed to build on its current, you’ll want to build your position in Bluestone before all those generalist investors come stampeding back into the sector.

Given the leverage potential on a rise in gold that Bluestone represents, those who buy the company at or near current levels are likely to be very glad they did.

CLICK HERE

To Learn More about Bluestone Resources