|

|

It sounds like a contradiction in terms, especially in days when gold trades above $1,835 an ounce.

But ultra-cheap gold…based on a 3.71-million-ounce gold-equivalent resource and an extraordinary portfolio of other exploration projects…is exactly what Element79 Gold (ELEM.CN; ELMGF.OTC) offers investors.

|

Thanks to its recent acquisition of the Maverick Springs project, located along Nevada’s prolific Carlin Trend, Element79 Gold has taken possession of a tremendous gold and silver resource.

|

Better still, the company also has a promising gold project called Snowbird in British Columbia and a 15-property portfolio of additional Nevada projects (plus an Ontario gold project).

In addition to the cheap valuation of Element79’s large gold-equivalent resource at Maverick Springs, the company’s current market cap means you’re getting all the other projects in its portfolio essentially for free.

Simply put, few juniors offer the leverage to higher gold prices that Element79 Gold offers today’s investor.

|

|

That leverage starts with the large gold-equivalent resource Element79 was able to parlay with the acquisition of Maverick Springs.

The project was originally staked in 1986 and was plied with 47,000 meters of drilling in 195 holes between 1987 and 2004.

Then it went dormant, thanks to a high net smelter royalty on the property that has kept the project from moving forward.

|

|

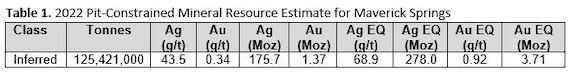

| According to a recently updated estimate, Maverick Springs contains a gold-equivalent inferred resource of 3.71 million ounces.

|

With gold trending upward, the management team at Element79 is confident they can work out an agreement that works for all parties to the transaction.

|

Success with this effort would be huge, as it would unlock the potential of a multi-million-ounce gold-equivalent resource…in Nevada no less.

|

An updated resource estimate has just pegged that resource at an inferred 3.71 million gold equivalent ounces, using a gold price of $1,650 and a silver price of $22.

|

|

All by itself, the value of Maverick Springs makes Element79 a bargain of the first order.

And that’s before you consider the high-grade gold potential of Snowbird, the British Columbia project on which the company has signed a letter of intent.

There’s no doubt that gold is there at Snowbird — historical trenching and underground exploration have resulted in the following:

|

• Historical sampling along 66 meters of the Peg-leg vein yielded gold assay values of 13.03 g/t across an average width of 0.8 meters

• Nugget-style areas up to 8,508 g/t gold and 2,900 g/t silver over 0.15 meters in historic drilling

|

Using today’s prices for gold, that high grade drill intercept, all by itself, represents more than $500,000 per tonne worth of the yellow metal!

Element79 is confident more gold remains to be found at Snowbird. It’s just that its current owners ran out of financial resources to test it properly.

Assuming the deal for Snowbird closes, it will make a very valuable backstop to Maverick Springs in terms of Element79’s market cap.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Get A 15-Property Nevada Portfolio

…Essentially For Free

|

On top of Maverick Springs and Snowbird, Element79 controls a portfolio of 15 properties located along Nevada’s prolific Battle Mountain trend (and its Getchell trend).

These properties are at varying stages of exploration, but there appear to be several projects of merit among them.

|

|

| In addition to its flagship Maverick Springs project, Element79 Gold controls a 15-property portfolio along the Battle Mountain and Getchell trends.

|

Element79 has the option of either exploring them on its own, vending some projects to other buyers to raise funds for work at Maverick Springs, or even spinning a group of them out into a separate company.

Thus, those who invest in Element79 Gold now will get exposure to potential value-creating events from this property package.

|

|

Considering all that Element79 has going for it, its market cap (just north of C$50 million) looks like a bargain.

Consider that the company already has a 3.71-million-ounce gold-equivalent resource to its credit.

|

At current trading levels and with the current US-CAD dollar exchange rate, that’s equivalent to buying gold for less than $12 an ounce.

|

Throw in the high-grade upside at Snowbird and the value-creation possibilities of its Nevada portfolio, and you have a company that looks like one of the steals of the current market.

If you like gold’s future in these times of rising inflation, you’ll want to take a close look at Element79 Gold for leverage on the yellow metal.

|