| Nickel stock poised to profit from the EV Revolution | | | Please find below a special message from our advertising sponsor, Silver Elephant Mining. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. | |

| The Nickel Stock Poised To Profit From The EV Revolution | |

Nickel-heavy cathodes are the standard for lithium batteries that offer longer range and faster recharge for electric vehicles (EVs).

More than lithium, cobalt or copper — nickel is the best way to profit from the EV revolution.

And now Silver Elephant Mining (ELEF.TO; SILEF.OTC) is making a play in the space, having just acquired a project hosting hundreds of millions of pounds of nickel…and the potential for much more.

| | |

|

“Well, I’d just like to re-emphasize, any mining companies out there, please mine more nickel. Okay. Wherever you are in the world, please mine more nickel.”

|

It was a recognition that the era of electric vehicles (EVs) is here…and there isn’t nearly enough nickel available to meet the resulting demand.

|

Consider that more than 20 countries have announced plans to ban internal combustion engines from 2020 to 2040 and replace with them EVs.

The list of countries is growing and already includes some with the world’s largest economies, including China, India, UK, Germany, California (USA) and France.

| |

|

EV penetration is expected to reach 22%-30% of global vehicle production by 2030, according to a recent research report by Mckinsey’s Ken Hoffman.

This means 25 to 35 million new EVs on the road each year, requiring one million tonnes (2.2 billion pounds) of Class 1 nickel for the lithium batteries to go inside of those EVs.

| |

|

That’s up to 40% of today’s total nickel production of 2.5 million tonnes in a roughly balanced market.

Current nickel usage in batteries of all kinds accounts for 10% of total nickel demand; by 2030 that will increase to 40% of total nickel demand.

And this new demand is coming at a time when the global nickel supply is actually set to shrink, creating a structural deficit starting in 2021.

| |

|

Why can’t the market churn out more nickel?

Class 1 high-purity nickel (which batteries require) comes from nickel sulphide deposits where mine reserves have been significantly depleted. Nickel sulphides are just hard to find.

Class 2 nickel (roughly 50% of the total nickel supply) is extracted from laterite deposits by mixing ores with acids in a pressure cooker that emits a toxic discharge.

There have been several documented cases of laterite environmental accidents. One involved Vale’s giant Onca Puma ferro nickel mine in Brazil. In 2017 it was forced to shut down for three years.

|

What About Nickel Substitutes In Batteries?

|

Consumers want longer range, greater acceleration and faster recharge in their EVs. That means more nickel for the cathodes of the lithium car batteries.

The cathode standards have recently evolved to NMC 811 (80% nickel, 10% manganese and 10% cobalt) from NMC 622 (60% nickel), increasing nickel content while phasing out cobalt (mined mostly from the Congo).

| |

|

Analysts and technology evangelists see NMC811 as the de-facto standard for at least the next 10 years, as echoed by Elon Musk’s plead for nickel.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

How To Profit From This EV Nickel Revolution?

|

Silver Elephant Mining (ELEF.TO; SILEF.OTC), with the support of a bought-deal financing backed by Canaccord, Mackie Research and Sprott Capital, has acquired a major-league Class 1 nickel deposit in Canada called Minago.

Minago is part of Canada’s Thompson Nickel Belt (TNB), the fifth largest nickel-bearing belt in the world, with over five billion pounds of Class 1 nickel production since 1958. Current annual production by Vale S.A. in the TNB is 33 million pounds.

| |

|

Minago is big, spanning 197 square kilometers, and features high-voltage (230 kV) transmission line running beside a highway that transects the property. This means a relatively low incremental infrastructure cost.

The project contains a sulphide nickel deposit known as the Nose, which was advanced to the permit stage as an open pit mine in the last nickel bull cycle 10 years ago.

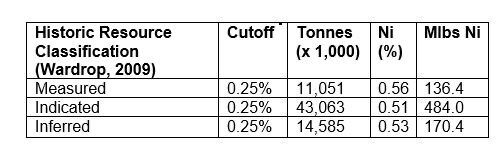

The deposit went through 68,092 meters of drilling and, in 2009, received an NI 43-101 compliant resource calculation from Wardrop Engineering, as tabulated below:

|

|

That’s right. With measured, indicated and inferred resource totals, the Nose resource encompasses 790 million pounds of nickel across all these resource categories. That’s an in situ value of $6.5 billion dollars at a recent nickel price of $8.22/lb.

| |

|

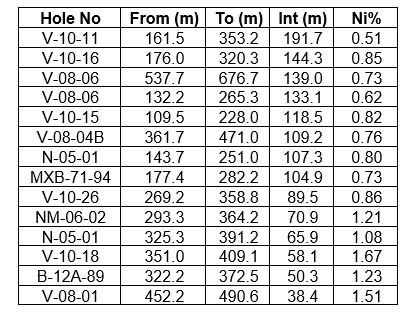

Drill highlights at Minago include:

|

|

If Grade Is King,

Recovery Is The Ace Of Spades

|

Elon Musk is urging that nickel be mined efficiently and in an environmentally sensitive way.

Given that stance, Musk will likely rule out purchasing Class 2 nickel produced from laterite deposits (due to pollution) and Class 1 nickel produced from low-grade sulphide deposits with low metallurgical recovery (due to inefficiency).

Metallurgical test work conducted in 2008 on Minago rocks achieved a nickel concentrate that contains 22.27% nickel with a nickel recovery rate of 77.2%.

A high concentration of nickel in sulphides explains the high metallurgical recovery and high concentrate grade at Minago.

Typically in mining (and especially in nickel sulphide mining), higher grade ore tends to achieve higher nickel recovery rates. High grades and recoveries have a compounding effect in reducing mine operating and energy costs.

|

Minago’s Considerable Upside

|

How big could Minago get?

Well, consider that, in addition to the Nose deposit, the project also boasts the South Target, the O Limb and the Nose West Extension targets, all of which have reported significant nickel drill intercepts.

If you start with the hundreds of millions of pounds of nickel in the measured, indicated and inferred categories for the Nose deposit, you can see that the billion-pound benchmark is within reach if these additional targets reach their potential.

| |

|

In a recent news release, Silver Elephant chairman John Lee praised its VP Canadian Operations Dan Oosterman as “ideally suited to unveil Minago to the market and explore the project to its full potential.”

Oosterman started his career at Falconbridge and INCO, and helped drill the T3 deposit in Thompson, not far from Minago.

Lee further stated in an interview that Elephant’s value proposition is to “fill the insatiable and eruptive Class 1 nickel demand from EVs by expanding the nickel sulphide resource at Minago to district scale and eventually bringing the Minago project to production with industry partners.”

The industry partners could be any of several emerging lithium battery and EV manufacturers, including Tesla, Ford, Panasonic, Porsche, Volkswagen or others.

| |

Technically, the nickel price has a confirmed multi-year breakout at $8/lb ($17,000/t).

| |

|

How high could nickel go?

Considering current stagnant nickel-mine production and lack of nickel substitutes in batteries until at least 2030, your guess is as good as anyone’s.

But before you dismiss nickel going back to the prior all-time high of $20/lb ($50,000/t) set in 2007, recall that hedge fund speculators hoarded cobalt in 2017.

That resulted in cobalt’s four-fold price increase from $10 to over $45 in 18 months.

| |

|

With 790 million pounds of nickel in the ground marching towards the 1-billion-pound benchmark, how much would Minago be worth if nickel goes to $40?

Perhaps it is time to own a piece of Silver Elephant Mining (ELEF.TO; SILEF.OTC) before it’s too late.

| |

CLICK HERE

To Learn More about Silver Elephant Mining

| | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |