| A crown of gold atop the ring of fire… |

|

| Please find below a special message from our advertising sponsor, Redstar Gold Corp. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

A Crown Of Gold

Atop The Ring Of Fire

|

|

Nothing excites investors like a gold discovery story.

But when you add in world-class gold grades...plus a growing deposit atop the fabled Pacific ring of fire...you can see why Redstar Gold’s (RGC.V; RGCTF.OTC) project in Alaska’s Aleutian Islands is about to...well...catch fire.

|

|

In gold exploration, resource growth and rising gold prices are a great recipe for an investment that can multiply in value.

|

|

That’s a great base case for investment. But add in the thrill of exploration — and exploration that’s stepping out from proven high-grade gold resources — and you get a recipe that could be deemed fool-proof.

Consider the facts....

In today’s world of diminishing reserves after years of under-funded exploration, gold miners are scouring the planet for deposits that can help shore up their reserves.

|

|

So juniors that can prove up mineable, high-grade resources at scale have an excellent shot of making money for their shareholders through M&A activity.

|

|

The key is to have a project big enough, and with enough potential targets, that resource growth is almost baked into the cake.

And that’s exactly the kind of project that tiny Redstar Gold (RGC.V; RGCTF.OTC) has assembled in southwest Alaska on two adjacent islands within the state’s Aleutian Arc.

|

|

A Golden Crown Atop The “Ring of Fire”

|

|

The Aleutian Islands might seem like a far-flung destination to find big deposits of gold and other metals, but geologically, they are ideally situated atop the “Ring of Fire” that circumscribes the Pacific Rim.

The name refers to the ring of volcanism that encircles the Pacific Ocean. This geological setting is prime territory for large metals deposits. The map below testifies to this fact.

|

|

Some of the world’s largest and richest mines are located along the “Ring of Fire.” And for an investor in Redstar, an intriguing fact about those mines is that some of the most profitable are low-sulfidation vein systems — exactly like the one that hosts Unga’s main deposit.

To give you a sense of how much major miners prize these types of deposits, consider what they were willing to pay for deposits of similar grade along the “Ring of Fire.”

|

|

•

Cerro Negro: Goldcorp paid $3.4 billion for this Argentine project, which has proven and probable reserves of 16.87 million tonnes @ 9.7 g/t gold and 80.43 g/t silver.

• El Penon: Yamana Gold bought this gold-silver project in Chile when it acquired Meridian Gold for $3.5 billion. It has 10.84 million tonnes of reserves grading 5.03 g/t gold and 173.7 g/t silver.

• Kupol: Kinross bought this project in Russia (7.4 million tonnes of reserves grading 8.8 g/t gold and 111.0 g/t silver) for $3.1 billion when it acquired Bema Gold and is now one of Kinross’s most profitable mines.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

|

A High-Grade Resource Already Outlined

|

|

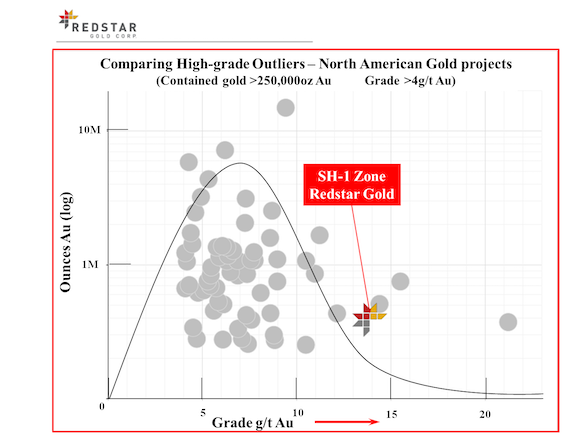

Now granted, the initial resource Redstar has outlined on Unga does not match the scale of these three deposits. But as the chart below demonstrates, in terms of grade, Unga’s SH-1 deposit is definitely in the discussion.

|

|

|

At 13.8 g/t gold and 14.2 g/t gold-equivalent, SH-1 is one of the highest-grade gold projects in North America.

That’s according to a recently released NI 43-101 compliant estimate that Redstar generated for the target. Using a 3.5 g/t gold cut-off and a $1,475 gold price, that estimate pegs SH-1’s inferred gold resource at 384,318 ounces and its inferred gold-equivalent resources at 395,825 ounces.

|

|

The Opportunity To Quickly Grow That Resource

|

|

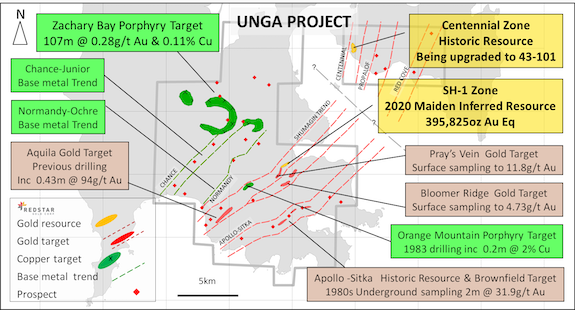

Between Redstar’s holdings on Unga Island and its corresponding holdings on the adjacent Popof lsland, the company boasts no less than three zones with historical resources that have been identified to date.

That includes the past-producing Apollo and Sitka mines on Unga. The Apollo mine was the first gold mine operated in Alaska and produced 150,000 ounces of gold at grades between 3.4-10.3 g/t from 1886 to 1922 according to historic records.

Sitka’s resource is undefined, but a 1982 underground sample from the area returned grades of 31.9 g/t gold and 161 g/t silver over 2 meters.

|

|

More importantly: The sulfide mining blocks at both the Apollo and Sitka mines remain unmined.

|

|

The overall mine area remains open down-dip into primary, sulfide mineralization that contains gold and silver, as well as lead, zinc and copper. This is one of Redstar’s exploration priorities for 2020.

|

|

|

On Popof Island, the Centennial target has an historical resource outlined by Battle Mountain Gold in the early 1980s. The resource is a heap-leachable development target that follow-on drilling could quickly prove up to NI 43-101 compliance.

What’s more, the district scale of the Unga project — which spans both the Unga and Popof Islands — means that it contains no less than 38 gold and silver prospects, including four high-grade epithermal targets and four porphyry copper gold targets.

|

|

A Great Time To Build A Position

|

|

As you can see, just by proving up the existing resources at Apollo-Sitka and Centennial, Redstar can quickly add to the resources it has established at SH-1.

Better still, Centennial lies just four kilometers from the year-round tidewater port of Sand Point that services the area and just two kilometers from the airport. The airport sees daily flights from Anchorage and the port receives weekly shipping from Anchorage and Seattle.

In short, the infrastructure is there to tempt a major to build a mine…once Redstar proves up enough resources to make it a takeout target.

|

|

In the near term, drilling is on the way. The 2020 program gives Redstar a source of news flow that could soon begin to move the company’s share price.

|

|

Thus, Redstar Gold is a great drill-hole speculation for the first half of 2020. And if those drills find more high-grade gold, Redstar will also make for a great medium- and long-term lever on rising gold prices.

For investors looking to speculate on these possibilities, now is the time to do so.

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |