| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

Gold renews its rally, gaining ground above the key $1,900 level.

| | | |

I’ve been disappointed in gold over the last few days.

|

Despite the fact that Russian strongman Vladimir Putin had escalated tensions by effectively annexing two break-away sections of Ukraine and seemed on the verge of invading...

...The gold price fell.

|

Safe to say that’s not the kind of response that I, or anyone else, had expected. That’s why MarketWatch reached out to me for an explanation.

I commented that “On the one hand, it’s a fact that the gold price is easily pushed around by futures traders who can create as much ‘paper gold’ as needed to achieve their goals, without any restraint from the physical markets. So there may not be much to interpret from gold’s lack of response other than traders taking advantage of events.

“On the other hand, it is possible that the gold market had already recognized Putin’s move as a fait accompli with the latest price rally, and any further gains would be contingent on an escalation that is perceived as unlikely.”

I could have added that the approaching settlement date for the February options, with an over-weighting of $1,900 calls, was another big factor — which of course was related to my point that the price can be pushed around by traders in paper gold.

Regardless, I closed my comments to MarketWatch optimistically, noting that “Fortunately for gold bulls, with the Fed about to begin a rate-hike cycle of the kind that has been historically bullish for gold, the underlying fundamentals should buoy the price even if things calm down in Ukraine.”

No one saw that prediction, though, because MarketWatch chose to edit out these gold-bullish comments!

| | Golden Opportunities continues below...

| | | SPONSOR:

Golden Shield Resources

| | | ADVANCING HIGH-GRADE ASSETS IN GUYANA,

SOUTH AMERICA'S MOST PROMISING GOLD DISTRICT

Golden Shield Provides Update on Exploration Activities

at Marudi Project – Feb 23, 2022

READ OUR NEWS RELEASE

| |

About Golden Shield Resources:

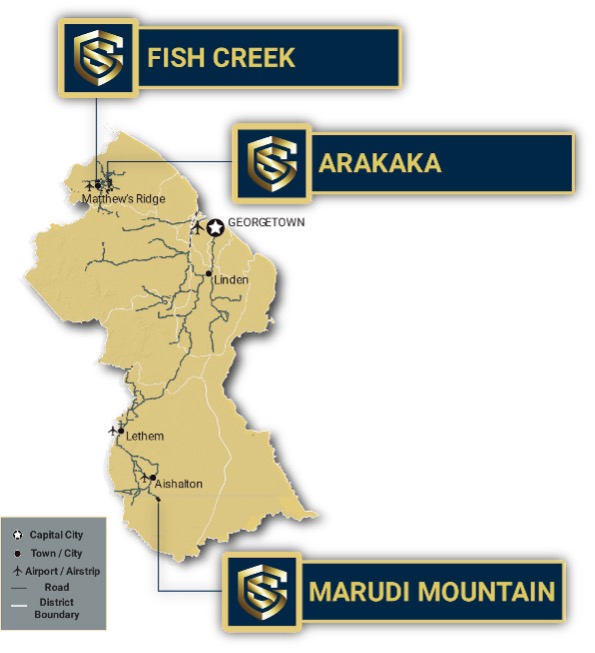

- Three 100%-owned exploration projects in Guyana: Marudi Mountain, Arakaka & Fish Creek

- Flagship Project: Marudi Mountain hosts a 350,000-ounce historical gold resource, and is currently undergoing resource expansion and exploration drilling

- Initial 13-hole, 2,346-meter drill program completed at Marudi Mountain – results imminent

- Follow-up drilling and resource expansion planned for 2022

- Experienced team of technical professionals, operators and financiers led by Chairperson Leo Hathaway and CEO Hilbert Shields

- Tight share structure with only about 27 million shares outstanding

- Newest member of Inventa Capital

|  | | VISIT GOLDENSHIELD.CA

| | |

In retrospect, from the lofty vantage of an entire day’s passing, it seems game-playing in the options market was largely the reason why gold was being held back. Because, as Putin rolls tanks into Donetsk, gold has renewed its rally.

As I write, spot gold is up about $10, or 0.50%, while silver is tripling gold’s gain on a percentage basis.

Yes, you can probably chalk up a lot of today’s gains to the Russia-Ukraine tensions. But I was encouraged that gold managed to hold its ground fairly well last week when those worries temporarily abated.

|

As I’ve noted before, geopolitical issues are no reason to buy gold, and rallies spawned by such events almost always end up fizzling out.

|

But in the current situation, gold had already established a significant uptrend before the Ukraine crisis erupted, as big money had begun to buy the metals in anticipation of the Fed’s first rate hike.

Combined with the fact that these geopolitical worries might take gold to new price plateaus and wipe away the shorts in the process, and it could end up having a net beneficial effect.

|

Add it all together and I believe the gold price will correct when/if Putin decides to let things calm down, but it will end up at a higher level than before the crisis began.

|

And then, as the Fed attempts to normalize monetary policy and fight inflation, gold’s new bull market will begin.

So hang on. The ride doesn’t appear likely to get any smoother...but it looks like we’re headed upward.

| |

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |