| Here’s the time-tested way to multiply gold’s returns... |

|

| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. |

|

The Silver Bullet Strategy

|

|

Everybody knows that silver outperforms gold during a bull market. Now you can discover why that happens — and precisely what you can do about it.

|

|

It was fully 16 years ago that we first published our Silver Bullet Strategy special report.

|

|

Silver was trading below $7.00/ounce back then. It subsequently rose to nearly $50/ounce — multiplying more than seven-fold in price — and those who used the specific strategies we outlined in that report reaped much larger gains than that.

|

Silver is trading much higher than $7 these days...but I think the opportunity facing us now is just as great.

|

|

First off, consider that gold has begun a major new bull market. I won’t detail all the reasons (you should know them by heart at this point), but this era of “ever easier money” all but guarantees that gold will break its previous record highs.

Consider what that means for a gold investor.

|

|

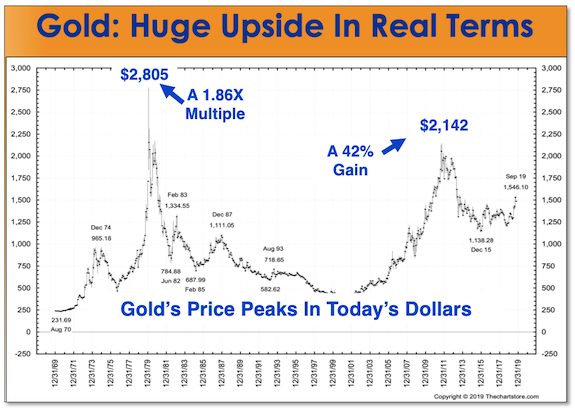

| As you can see from the chart above, gold’s high of $850 in January of 1980 is equivalent to $2,805 in today’s dollars. So to truly beat that record in real terms, gold will have to reach nearly $3,000.

Frankly, I think we could easily see those prices over the next few years. If so, gold will nearly double in price.

But now let’s look at the kind of potential silver offers....

|

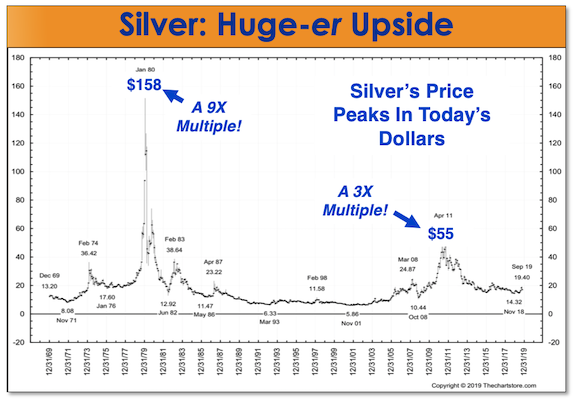

| As you can see, if silver reaches the same level it hit in 1980, it would equate to $158 in today’s dollars. That means it would multiply about nine times in price.

That’s obviously much greater upside potential than gold presents.

Of course, gold is driving the bus here. Thanks to the massive amounts of easy money that have been and will be created, the gold price will soar from today’s levels. And every serious investor needs to own gold.

But the record clearly shows that silver has multiplied the performance of gold in bull markets, and I fully expect it to do so once again.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

|

Simply put, you need to own physical gold and silver as insurance against the inevitable, unstoppable depreciation of the dollar and other fiat currencies.

But if you want to try for truly outsized gains, you need to explore the potential of mining stocks to leverage the performance of the metals themselves.

Let me put it this way: To get leverage on gold, you can buy silver. To in turn get leverage on silver, you can buy silver miners. To get leverage on silver miners, you can buy silver developers/explorers.

Of course, nothing’s guaranteed and you also increase your risk as you go down the food chain to the junior mining companies. But for a portion of a diversified portfolio, and for investors who can accept the risks, there’s no doubt that there’s the potential for truly explosive gains.

The record shows it clearly. Some of our junior silver stock recommendations in that first version of our Silver Bullet Strategy report went on to multiply 20, even 30 and more times in value. And one of our more recent silver recommendations has already tripled in price.

In short, the game is on. And if you’re looking for leverage in the metals, you need to seriously consider junior silver stocks.

|

|

Get The Latest Edition Of

The Silver Bullet

Special Report

|

|

OK, here’s the good news: We’ve just updated and republished our Silver Bullet Special Report.

|

It details the remarkable supply/demand dynamic for silver right now — including a long-running supply gap — and explains why you should completely ignore silver’s industrial demand.

Rather, you need to focus on the powerful monetary demand factors we detail...the factors that virtually demand much higher silver prices.

And here’s the best part: The Silver Bullet Special Report details a powerful, three-part strategy combining...

|

• Silver Bullion —

including the single best (and cheapest) way to own physical silver

• Options — yes, they’re risky...but here’s a way to reduce those risks in a prudent manner

• Silver Stocks — specifically, my top seven silver stock picks!

|

|

This three-part strategy yielded extraordinary gains that last time that silver took off on a multi-year bull run, in the early 2000s.

Now you can put it to work for you.

To get a copy of our latest, greatest edition of The Silver Bullet Strategy for just $39.95, simply CLICK HERE.

|

|

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |