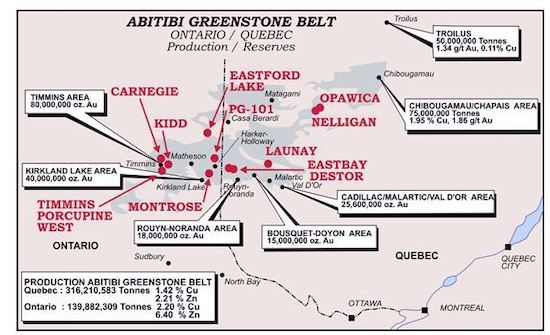

The Abitibi Greenstone Belt that runs west from Quebec into Ontario is one of the world’s most productive gold districts.

|

With past production of more than 170 million ounces in the past century-plus, the Abitibi is the very definition of a “target-rich environment.”

|

|

| The Abitibi Greenstone Belt that transects Ontario and Quebec has produced more than 170 million ounces of gold in its storied history. |

Recent mining history is replete with gold companies that have taken over historically productive mines and used modern exploration techniques to outline large resources.

|

It’s a pattern that ArcPacific Resources (ACP.V) hopes to repeat with its Rickard project, a small-scale producer from the turn of the 20th century that sits along a splay of one of the Abitibi’s most productive structures.

|

As you’re about to see, Rickard has all the markings of a project that modern exploration can transform into a significant resource, and ArcPacific will be launching a drilling program soon to put the theory to the test.

|

Just 70 Kilometers From Timmins

|

If the Abitibi is a world-class gold district, then the Timmins gold camp in northeastern Ontario is its crown jewel.

The Timmins camp alone has produced more than 80 million ounces of gold.

And, as the following map shows, it is home to a mind-boggling number of past- and currently-producing mines.

|

|

|

| ArcPacific’s Rickard gold project lies just 70 kilometers from Ontario’s uber-prolific Timmins gold camp. |

Rickard lies about 70 kilometers northeast of the Timmins camp, along an offshoot of a fault structure that hosts several gold mines — including Newmont’s Dome mine, which produced 14.5 million ounces of gold before it ceased production in 2017.

|

Past Work Will Guide Upcoming Drilling

|

Gold was discovered at Rickard over a century ago in 1917, with production beginning the following year.

The original owners didn’t bother to drill off a resource, they just sunk a 100-foot shaft into the vein system and followed the veins.

The original Rickard was mined periodically until the 1930s and even saw the mine shaft extended to 200 feet in 1934. Underground development totaled 600 meters.

|

|

|

| The headframe of the old mine shaft at Rickard. |

Sustained low gold prices would eventually stop production at Rickard. In the intervening years, a couple of operators have identified multiple zones of elevated gold values.

These zones all need follow up work, which ArcPacific is currently conducting in preparation for an initial drill program that will begin sometime in Q2 2021.

The company sees an opportunity at Rickard to both extend its previously mined high-grade shoots at depth and to find repeats of those shoots elsewhere on the property.

Once ArcPacific gets its geological bearings on the project, it will select drill targets guided by its analysis of this historic data.

The opportunity here is straightforward: Use the drill bit to identify extensions of past workings and to outline new, resource-hosting areas.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

A Silver-Rich Backstop In British Columbia

|

Of course, there are no guarantees with exploration — which is why it’s important to note that ArcPacific also has the highly prospective Lucky Mike Silver Lode (LMSL) project in its portfolio.

|

At LMSL, the company has more than 70 years of past assessments to work with and fully five past-producing mines to assess, all of which appear related to one central system.

|

The project lies in south-central British Columbia near several key projects, including Teck’s Highland Valley, Canada’s largest copper mine.

|

|

|

| ArcPacific’s LMSL project is located in central British Columbia within the Nicola Mining Division and has produced past silver samples exceeding 2 kg/t. |

That means, like Rickard, LMSL’s surrounding infrastructure is very much in place to support mine construction, assuming further exploration bears fruit.

The project’s history is one of high-grade silver production mined from silver-lead-zinc mineralized veins. The area has produced multiple samples in excess of two kilograms per tonne of silver.

Moreover, LMSL’s skarn and manto-type high-grade polymetallic mineralization forms a greater-than-7-kilometer halo that could be related to a large copper-gold porphyry at depth.

ArcPacific is currently building a new digital database of the historic work that has been done on the project.

It plans to use that database to guide its drill targeting for a program that could begin later this year.

|

|

But it is the potential for ArcPacific’s upcoming drilling at Rickard that deserves your immediate attention.

What’s the upside here?

Well, consider the case of Great Bear Resources.

Its Dixie project is located in northwest Ontario’s Red Lake district, on the same type of Archean host rocks as those that host Red Lake’s Canadian Shield counterpart the Abitibi.

Starting with historic indications that Dixie hosted Red Lake style gold, Great Bear started to drill in 2017…and made this cycle’s most impressive gold discovery.

And not only did it hit long intervals of high-grade gold at depth, it also followed a parallel structure on the property called the LP Fault that’s both high-grade and vast.

The result?

After trading around C$0.50 a share in early 2018, Great Bear’s initial discovery and subsequent finds at Dixie sent its share price parabolic.

Last June, it hit a peak of more than C$19 — a phenomenal 38-fold gain!

|

|

Of course, we’re still at a very early stage with ArcPacific and Rickard, but the project is in the same type of rocks as Dixie and in an area famous for its high-grade gold.

If you’re looking for a drill-hole bet that could pay off big, consider buying ArcPacific Resources before the drills start turning at Rickard.

|