| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

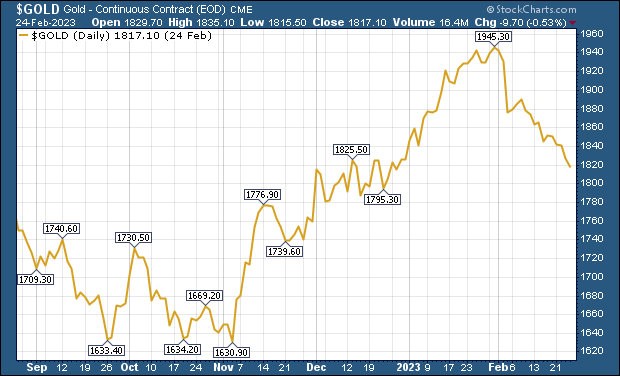

While gold is up a few dollars today, the correction from recent highs continues.

But Fed rhetoric on continued rate hikes should only briefly delay the upward trend.

| | | |

Hawkish Fed commentaries, hotter-than-expected inflation numbers and persistently strong economic data have combined to shape a view of rate hikes lasting well into summertime.

|

While that’s continued today, with January core durable goods orders coming in at 0.8% month-over-month, well above the consensus expectation of no gain at all, gold is actually (and thankfully) up a few dollars.

|

As I told you last week, I think we’re still in for a bit more of a correction, with gold trading sideways to flat going into the Fed’s next meeting, which concludes on March 22nd.

|

That view has come a long way from how bullish I was a little more than a month ago. Back then, I was speaking at a couple of mining conferences in Vancouver and noting how gold had risen more than $300.

While I noted it was extremely overbought and due for a correction, I frankly didn’t expect as much of a correction as we’ve gotten.

|  |

It’s been a fairly precipitous drop since the peak in late January...which begs the question, “How low will we go?”

As you may be able to see from the chart above, we’re down about 38% from the peak, which could mark a nice line of support.

I’ve also maintained that the $1,800 level should act like a magnet for the price, so I wouldn’t be surprised to see us breach that level and trade around it. A 50% retracement would put the price, basis continuous contract, at around $1,787.

So, from a technical standpoint, those are some key numbers to watch. From a fundamental view, it’s important to remember that the macro picture remains extremely bullish.

Although inflation has remained persistently high and data continues to show a resilient economy...with all that contributing to continued hawkish commentary from the Fed...we know that Powell & Co. are nearing the end of their rate hikes.

|

The timing for a pause may have been pushed back a month or two, but it’s coming — and probably much sooner than the current consensus view of the summer.

And just a pause in the hiking cycle will be enough to light a fire under the metals.

| |

So watch those technical support lines, but also know that the longer-term picture argues that current levels are already a bargain.

| |  |

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |