| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

Managing your emotions is the hardest part of being a gold investor.

| |

First off, credit where credit is due: I got that headline from a great financial commentator, Kevin Muir, who publishes the Macro Tourist letter.

|

I can’t believe I haven’t seen it before in all the years I’ve been involved in watching the yellow metal on a daily basis.

|

And as Kevin went on to say, “I can attest to its truth, as over the past few months, I feel as old as Yoda.”

|

The issue with gold is that it’s an emotional investment for so many of us. As I’ve remarked on a number of “Gold vs Bitcoin” panels over the past year, gold bugs are similar to crypto investors in that adherents approach both sectors with something more akin to religious fervor than objective analysis.

It’s the difference between being a “gold bug” as opposed to a “gold bull.”

And as a gold bug, I plead guilty. Jim Blanchard taught me long ago that gold is much more than an investment — it’s freedom. And as such, it’s hard not to ride an emotional roller-coaster when it gets pushed around like it has been in recent days.

| |

Gold was taken to the woodshed again last Thursday and Friday. And Friday’s beating was so vicious that I stopped watching when it was down over $50. It ended up “only” down about $35, about as minor a victory as you could imagine.

There was some hope in overnight trading, as gold was up about $25 last night from Friday’s close. Such hopes are always tempered these days, however, as the metal has been habitually trashed at the New York opening.

And so it was again today — being driven down to the point where, as I write, it’s down about $9.00.

This relentless patter of early-trading, not-for-profit gold dumps fuel the gold-manipulation theories, and I have to confess that I agree with them to some extent.

But there are also some fundamental factors at work (soaring yields, rising real rates, dollar strength, sell-stops) along with technical rationales (support failures, negative momentum indicators).

Thinking about it more broadly, it seems to me that gold’s “problem” might not be that it’s too insensitive to the other, bullish factors (unprecedented debt and currency creation globally and the attendant necessity for zeroed interest rates)…

|

…But that it’s too sensitive to what’s driving the paper gold markets.

|

First, we need to recognize that gold’s price is set via Comex trading. While the on-the-ground prices of physical gold and silver are considerably higher than the futures prices, the sheer dollar-volume of these fictitious gold and silver trades dwarf the physical market.

Of course, that could change as the so-called silver squeeze puts pressure on the fractional-reserve paper silver and gold markets.

In the meantime, however, the speculator-driven futures markets are setting the stage for gold trading around the world. And these traders don’t care about fundamentals; they only care about the next headlines.

That’s why gold peaked in the summer of 2011, just as the Fed announced “QE-Infinity.” The speculators looked ahead and didn’t see another big Fed announcement, other than an end to QE.

So they exited the trade.

Today, with the latest, $1.9 trillion stimulus package now a stale headline, the fast money crowd is exiting gold until they see another big catalyst coming down the pike.

| | |

The good news is that there’s a multi-trillion-dollar infrastructure package coming at some point, and the specs are going to start placing bets on that once it begins to loom on the horizon.

More fundamentally, gold has been suffering as the hyper-sensitive bond market has reacted to nascent inflation signals more quickly than actual inflation expectations as expressed, for example, in TIPS yields.

|

|

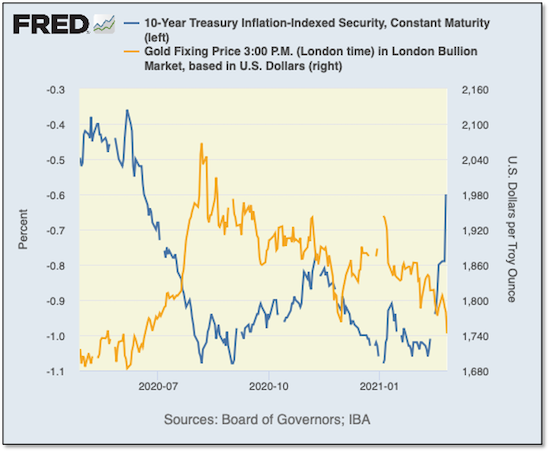

Thus, as you can see above, real rates have soared along with Treasury yields in recent days. And after a few weeks where the gold-real rates correlation broke down (and gold fell as real rates also fell), the surge higher in real rates helped send gold crashing over the last couple of sessions.

Inflation expectations will catch up, however, especially as copper and other commodities continue to soar. Combined with the fundamentals of the Biden administration’s soon-to-be-announced infrastructure plans, this should shift sentiment for gold.

|

In that regard, the other piece of good news is that sentiment for gold has been absolutely trashed, and thus the bottom is likely near.

|

So take heart, and don’t let the last few days of gold trading age you. This too will end, and I remain confident that the long-term future for gold and silver remains very bright indeed.

| All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

P.S. I strongly recommend that you click on the link above and sample some of Kevin Muir’s commentaries. He’s one of the best in the business!

| | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |