| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

Gold recovers as the winds of sentiment begin to shift once again.

| | | |

I’ve been talking a lot lately about how the change in the investor consensus — from a looming end to rate hikes to higher for (much) longer — had sent gold and silver reeling.

|

The recent economic data have been just a bit less buoyant. For example, today’s ISM manufacturing index for February came in at 47.7, against expectations of 48.0, indicating the kind of economic slowdown that the Fed wants to see.

While this hasn’t helped the stock or bond markets much, it has seemed to help gold somewhat. Combined with the simple turning of the calendar from February and closing of short positions, the yellow metal has actually posted two decent days of gains.

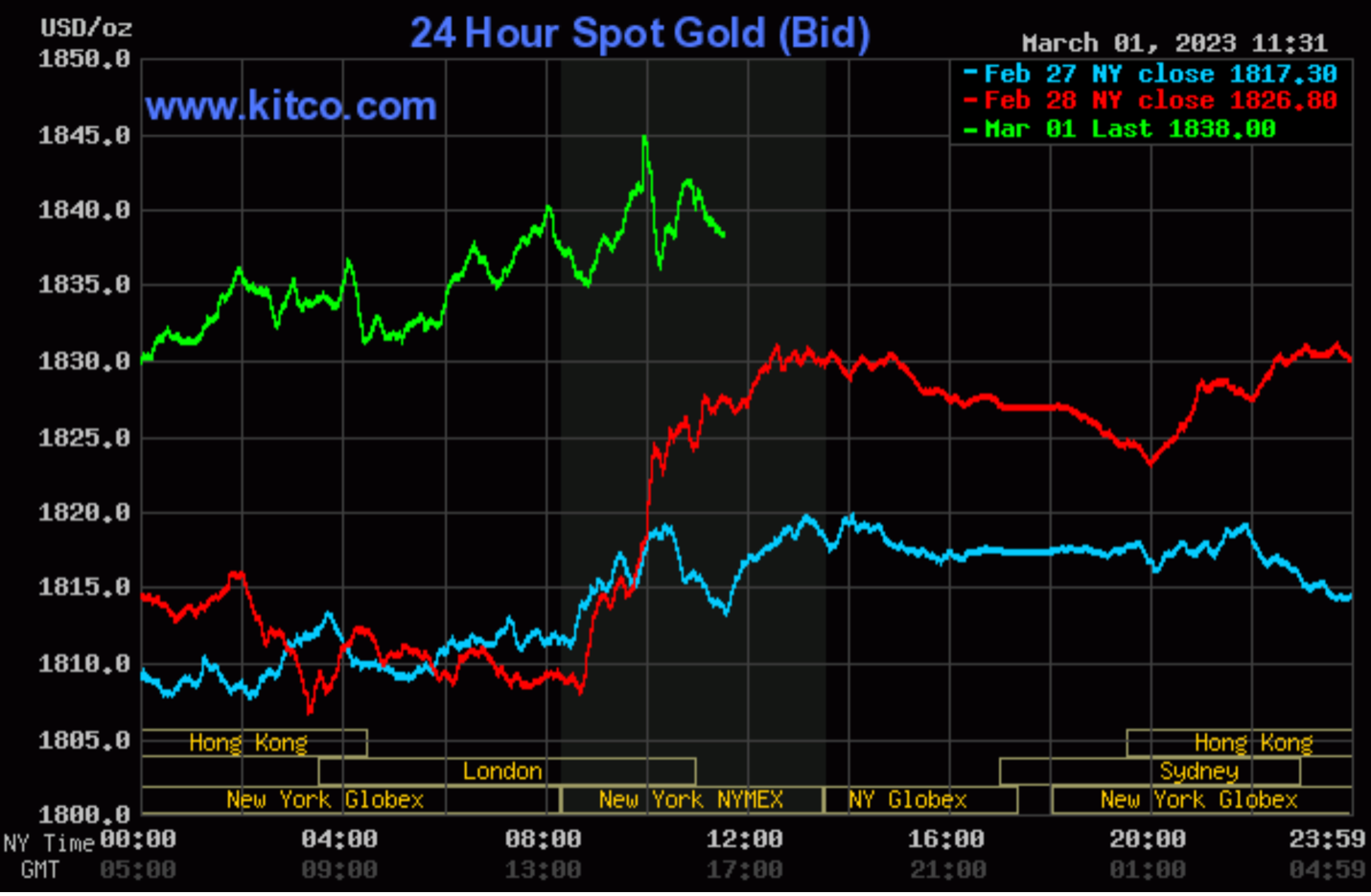

As you can see from this chart, spot gold is up about $21 from Monday’s close as I write:

|  |

This is encouraging, and a sign that the very bearish sentiment of February may be abating, at least for gold.

As you know, I believe the pendulum had swung far too far toward the belief that the Fed would be hiking rates well into the summer. Some analysts have even predicted a fed funds rate of 6% or more.

I’m far from that camp. For one thing, there are still the three factors that I believe will, either individually or in combination, force the Fed to bring its rate-hike crusade to a screeching halt in the weeks ahead:

|

1) Something breaking in the stock or bond markets (likely bonds)...

2) The upcoming recession (although this is likely to hit in the back half of the year)...

3) The soaring costs of servicing the federal debt at higher interest rates.

|

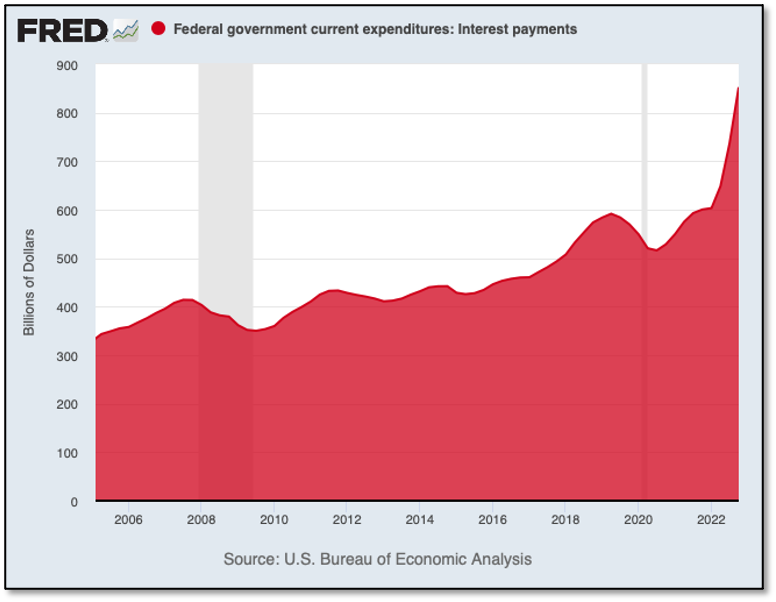

To refresh you on the last point, remember that the latest official estimates of the federal debt-service costs came in at an eye-popping $852.6 billion.

|  |

This is the Q4 estimate, and not only doesn’t factor in all the Fed’s rate hikes, but also the amount of debt that is rolling over at these higher rates.

You’re well aware of my prediction that federal interest expense will reach $1 trillion a year, and that I believe this “big number” will prompt some of the crazies in Congress to start grumbling about defaulting on the federal debt.

|

But consider that if rates get to the 6% level that some are predicting by this summer, the interest expense would soar to nearly $2 trillion.

|

If the new federal deficit baseline is $1 trillion annually, the interest costs alone would be between $1 trillion and $2 trillion, dwarfing all other expenditures and exponentially accelerating the build-up of debt.

In other words, we’ll have to borrow more to pay just the interest costs on the debt we already have — a classic debt spiral that would quickly destroy even the world’s reserve currency.

It can’t, and won’t, be allowed to happen.

So there’s an impenetrable wall directly ahead of the Fed, and few are seeing it.

Unfortunately, the markets have been ignoring these issues, instead focusing on the day-to-day flow of economic data. This presents a very real opportunity for those of us who can look ahead toward the eventual end of this tightening cycle...and who can take advantage of the bargains in today’s mining share market.

Toward that end, I’m unveiling no less than four new junior mining stock picks in our March issue of Gold Newsletter, set to be delivered tomorrow morning.

|

This includes one still-tiny company that is not only the best play, but perhaps the only play on a critical yet overlooked element crucial to the solar panel industry.

| |

You can find out all the details in our March issue of Gold Newsletter. If you’re not already a subscriber, you can rectify that unfortunate situation by CLICKING HERE.

| |  |

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |