| This valuation mismatch could pay off big | | | Please find below a special message from our advertising sponsor, Medgold Resources. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. | |

Medgold Resources (MED.V; MGLDF.OTC) saw its market cap crater last year when a JV partner essentially orphaned Tlamino, its flagship project in Serbia.

Fast forward to 2021 and Medgold has put out a PEA on Tlamino that pegs its value at many multiples of its current trading levels.

It’s a valuation mismatch that could offer significant leverage on gold when it returns to bull market form.

| | |

A company is trading at roughly 10% of its implied value.

|

That, in a nutshell, is the investment case for Medgold Resources (MED.V; MGLDF.OTC).

How did this opportunity come about?

It’s a case of shifting corporate priorities. You see, up until last year, Medgold had a JV agreement in place with Fortuna Silver Mines where Fortuna could earn up to a 70% interest in Medgold’s flagship Tlamino project in Serbia.

The companies spent 2018 and 2019 punching 55 holes (~9,000 meters) into Tlamino, an effort which allowed Fortuna to earn its initial 50% interest in the project.

That effort resulted in the release, last year, of a significant, 680,000-ounce gold-equivalent resource on Tlamino’s Barje target.

At that point, Fortuna was in the midst of shifting its corporate priorities and elected to pursue other projects, leaving Medgold and Tlamino more or less orphaned.

|

But here’s the thing: The team at Medgold knew the Barje resource could become an attractive takeout target on its own, with or without Fortuna’s assistance

|

With that thought in mind, it raised some more money in the back half of 2020, negotiated an option with Fortuna to buy back its interest and re-take full ownership in Tlamino…

…And worked on generating a preliminary economic assessment (PEA) for Barje — a report that would clearly show the market what the deposit, and Medgold, was worth.

That report hit the market in January, and it made one thing readily apparent....

|

Barje:

A Gem Of A Project

|

At first glance, Barje’s 670,000 ounces of gold equivalent might seem on the smallish side, but as the recent PEA makes clear, this gold-silver deposit has a lot going for it.

For starters, it is nicely profitable, with an after-tax NPV, discounted at 5%, of $86 million and a post-tax IRR of 46% (and this is based on just a $1,500/ounce gold price).

|

At an $1,800/ounce gold price, the post-tax NPV jumps to $139 million and the post-tax IRR to 69%.

|

An open-pit mine at Barje could be built for $74 million initial capex and would produce 50,000 ounces of gold-equivalent per year over an eight-year mine life.

| |

|

The 2.6 g/t average grade of that open-pit operation would be well more than double the average grade of the planet’s active open-pit gold mines.

Capex payback could be achieved in just two years and all-in sustaining costs would average only $522/ounce over the life of a mine.

Simply put, Barje is a gem of a project that could easily attract takeout interest at any point in time.

|

Infrastructure, Infrastructure, Infrastructure

|

Tlamino’s sparkling economics are enhanced by exceptional infrastructure advantages, thanks to its location on Serbia’s southern border.

The resource is near-surface and relatively flat-lying, allowing for easy access with what should be a reasonable strip ratio.

It lies about eight kilometers east of Mineco’s Podvirovi mine and there’s a power line in the adjacent valley. Road access is more than adequate with trail access from the main road.

| |

|

The project lies in simple, open terrain and its location in Serbia gives it access to a mining-friendly government where major and junior miners are already active.

Indeed, China’s Zijin Mining and global major Rio Tinto both have large projects under development in Serbia, where the permitting process is notably short.

All these advantages give Barje and Medgold a clear path to development and a compelling story to tell would-be buyers.

| |

Importantly, though, Medgold could grow by simply duplicating its Barje project. And in fact, it could do much more than duplicate it.

|

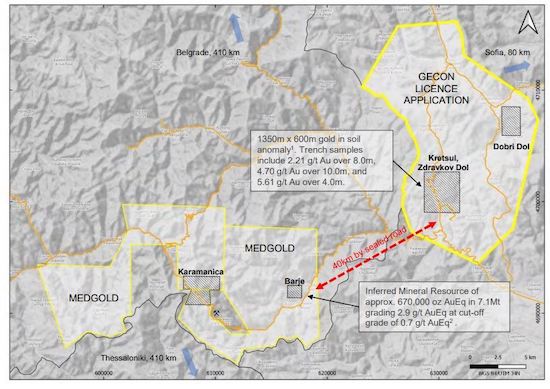

You see, management is high on its nearby Zlogosh property in Bulgaria, where past work has defined a very large gold-in-soil anomaly spanning 1,350 meters by 600 meters.

|

Better still, historic trench samples include 8.0 meters of 2.2 g/t, 10.0 meters of 4.7 g/t and 4.0 meters of 5.6 g/t. The map below shows, outlined in bold yellow, the License Application that makes up the Zlogosh property.

|

|

Here’s the important part: Medgold notes that the geology at Zlogosh seems identical to that at Barje, located only 40 kilometers away.

With the early signs pointing toward similar gold grades and geology, and with a much larger potential size, there’s no wonder why Medgold is looking at this property as the easiest and quickest path to growing its gold resources.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

A “Cheapie With A Chance”

|

With a market cap that currently hovers below C$10 million — and a PEA that shows its primary project is worth many times that level — Medgold’s investment case is pretty clear.

|

On this basis alone, Medgold has plenty of opportunity to see a very significant re-rating as the gold market recovers and as the company advances its Barje and Zlogosh properties

|

But there’s another clear path toward a much higher valuation: Mid-tier and major producers are always on the hunt for open-pittable deposits that can be developed quickly, inexpensively and very profitably.

Medgold and its Barje project fit that bill perfectly.

With exploration on Zlogosh providing some blue-sky upside, the gap between Medgold’s current market cap and even the most conservative NPV projection for Barje makes the company a compelling opportunity at current levels.

| | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |