|

Dear Fellow Investor,

Probably the metal most associated with the electric vehicle boom is lithium.

That makes sense, as batteries based on lithium ion technologies power these vehicles.

And as the EV market makes a shift from the hybrid vehicles to the Battery Electric Vehicles (“BEVs”) made popular by Tesla, a dramatic increase in demand for lithium as a key component of those batteries has ensued.

With waiting lists for Tesla’s mid-range Model 3, the market is already gearing up for a big switch-over from the internal combustion engine to electric vehicles. The question is no longer “if,” but “when.” And when is likely sooner than you imagine.

So how big is the market?

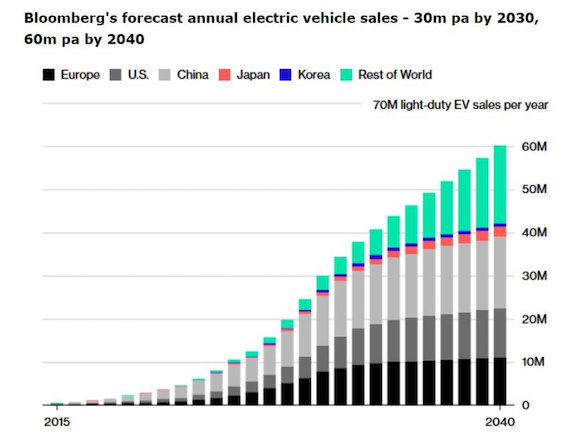

Well, Bloomberg estimates that EVs will own a 55% market share of all new car sales by 2040, with a fast-moving upward trend in the next decade as automakers across the globe ramp up EV production.

(Source: Bloomberg research)

The EV Future Is Now For Automakers

From BMW to Toyota. From General Motors to Volkswagen. Car makers are adding hybrid, plug-in hybrid and BEVs to their offerings at a rapid rate.

In 2018 alone, we saw commitments to major investments in EVs from Volkswagen, the world’s biggest car maker.

Toyota also stepped up its EV game, committing to producing 10 EV models by the early 2020s. Plus Toyota Tsusho, Toyota’s trading arm, is making upstream supply chain investments in lithium production.

Tesla Model 3 (Source: Tesla)

And then, of course, there’s Tesla. The company has been sporting a market cap on par with GM thanks to the wild popularity of its Model S and Model 3 EVs. Tesla is ramping up production fast and, in 2018, reportedly sold 139,782 Model 3s.

Gigafactories Are Popping Up Like Mushrooms

More importantly for those interested in leveraging the increased demand for lithium spurred by the EV boom, battery gigafactories (again led by Tesla) are sprouting up all over the globe.

Tesla’s main factory in Nevada will soon have capacity to produce 35 GWh worth of batteries, enough to take up 60,000 to 85,000 tonnes of lithium carbonate equivalent (“LCE”) all by itself.

Tesla is by no means the only player in this market. Indeed, in terms of EV growth, China is the engine that will drive the industry.

The Chinese government is determined to get more EVs on the road to help alleviate the country’s severe air pollution problems. That has translated into a goal of having EVs make up 20% of sales (7 million cars) by 2025.

China is also building gigafactories to get there. Indeed, according to Benchmark Mineral Intelligence’s Simon Moores, China accounts for almost 60 percent of the 40 lithium-ion battery metals megafactories his firm is currently tracking.

Moreover, China is a key player, along with Korea and Japan, in the production of lithium-ion batteries.

Tianqi and Gangfeng Lithium, its two biggest players in the space, have been busy creating vertically integrated lithium operations that include interests in lithium operations, chemical processing of that lithium and battery manufacture.

Brines Versus Hard Rock: Two Key Sources Of Supply

South America, Australia and China dominate the world’s lithium production, with Chile, Argentina, Australia and China accounting for 85% of the world’s lithium production, or 216,000 tonnes of LCE in 2017.

The “Lithium Triangle,” formed where the borders of Chile, Argentina and Bolivia meet, provides the largest proportion of that production.

Lithium there is produced by evaporating the salty brines (“salars”) that populate this high-desert part of the Andes.

Lithium carbonate is generated by pumping the briny water in these areas to surface and then moving it through evaporation ponds to bring the LCE to a salable concentration level. This process takes about 12-18 months.

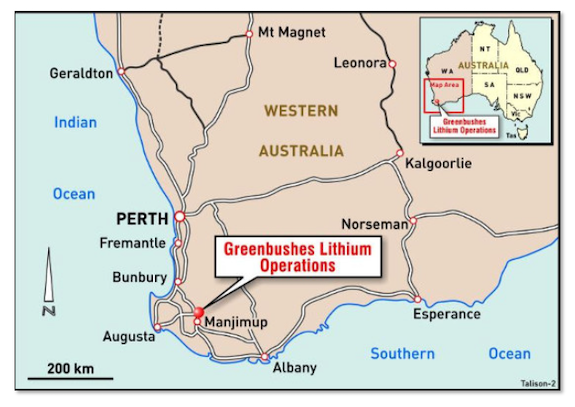

The other primary source of lithium is from hard rock mining, primarily in Western Australia. The Greenbushes mine south of Perth contains the world’s largest spodumene deposit, which is the primary lithium-containing hard rock mineral.

There are two primary intermediate products from lithium mining, lithium carbonate and lithium hydroxide. As mentioned, lithium prices are usually quoted in terms of lithium carbonate equivalent (“LCE”).

Lithium hydroxide is gaining greater prominence in the industry, however, as EV OEMs like Tesla have developed a preference for batteries that use the lithium derived from lithium hydroxide.

A desire to reduce the expensive cobalt content and increase the more power-dense nickel content of the batteries has led to this preference.

And while the lithium carbonate produced by lithium brines can be converted into lithium hydroxide with an extra step, it is generally less expensive to generate lithium hydroxide directly from spodumene.

Lithium Market Dominated By Handful Of Players

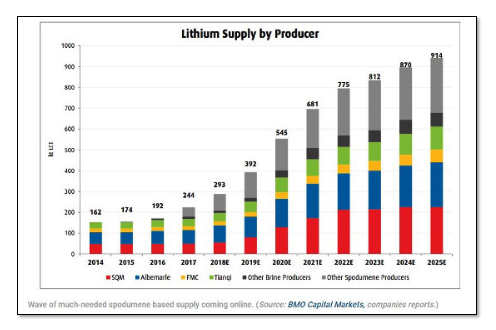

Just as a few regions account for a vast amount of the world’s lithium production, a few companies generate the vast majority of this global supply.

The key players are:

• Albemarle — North Carolina-based Albemarle is a specialty chemical company that derives roughly a third of its revenues from lithium production.

• SQM — Short for Socieded Quimica y Minera de Chile, SQM is a state-run, diversified chemical company that controls key lithium production facilities in Chile’s Atacama Desert.

• Livent — Spun off from specialty chemical producer FMC in 2018, Livent is another key player in the lithium space. The company’s October IPO raised $390 million in a turbulent market for global stocks.

• Tianqi Lithium — The Chinese company added to its 51% ownership stake in the Greenbushes Mine in Australia recently by taking a 24% stake in SQM. The controlling stake in Greenbushes is through its control of Talison Mining, a joint venture with Albemarle. It has filed for a Hong Kong listing.

• Gangfeng Lithium — Gangfeng is China’s largest lithium compounds producer and the second largest overall. It is one of the most vertically integrated of the major lithium companies. Like Livent, the company recently listed (on the Hong Kong exchange) and had a rocky debut due to global market volatility.

Source: BMO Markets, Mining.com

Report: Hamstrung Lithium Market In 2018

As the volatility experienced by Ganfeng’s Hong Kong offering and Livent’s IPO indicates, 2018 was a difficult year for lithium companies.

Much of that had to do with broader market volatility related to trade war worries and the potential of a slowing economy in China.

However, it also had causes specific to the lithium market. In particular, a bearish report on the industry in February 2018 severely hamstrung valuations of lithium companies after its release.

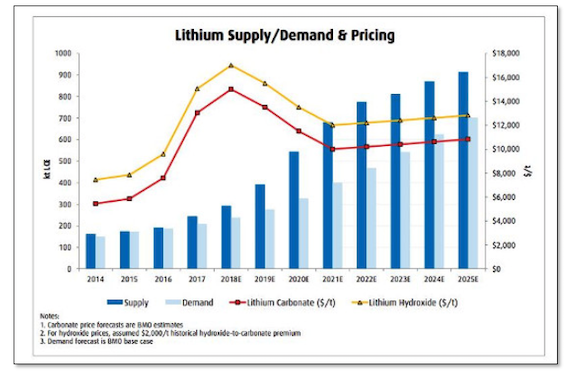

According to the Financial Times, Morgan Stanley’s analysts predicted over-supply in the lithium market would cause lithium prices to drop by 45 percent by 2021.

The Wall Street firm’s thesis was based on its prediction that expansions in lithium supplies, particularly from Chile, could add more than 500,000 tonnes per year to global lithium supplies by 2025.

After a two-year period in which lithium prices had more than doubled, lithium prices fell over the balance of 2018, even though the firm predicted 2018 would be another year of supply deficits, before oversupply kicked in this year.

The Case For Constrained Lithium Supplies

But not everyone agrees with Morgan Stanley’s bearish outlook for the battery metal.

The main issue is that the lithium market has a long history of bottlenecks and ramp-up issues. New projects in the Lithium Triangle must compete with other stakeholders for water, which is scarce in the arid region.

Underscoring this notion is the fact that there was a 20-year gap in the opening of new mines in the area before Orocobre’s Salar de Olaroz brine operation entered production in 2014.

Andrew Miller, senior analyst for Benchmark Mineral Intelligence, told Investing News Network that “what’s actually played out in terms of supply [in 2018] has been incremental new volumes reaching the market and not a ‘tsunami of supply’ like some had predicted.”

On the demand side, Benchmark’s Simon Moores says that “lithium remains extremely strong and is getting stronger in the medium term.” He points not only to the EV market, but to the market for energy storage.

Source: BMO Markets, Mining.com

With intermittent power sources like wind and solar driving the green energy revolution, battery-driven storage solutions will be essential to electric grid stability. He concluded by telling INN: “We think prices are high, they’re sustained and they’re backed by a real demand story.”

Recent Weakness Weeds Out “Promotes”

For those interested in investing in the lithium sector, a useful side effect of the 2018 down market for lithium stocks is that it has weeded out many of the highly-promoted junior plays that had proliferated in the space over the past few years.

It’s good that many of these plays have been weeded out, because success in the lithium space is an uphill climb — even if a company’s management team is dedicated to growing its long-term value as opposed to just its short-term share price.

First, as you can see from the structure of the industry, the vast majority of lithium production is controlled by a handful of players.

Moreover, while some announced production hikes by the majors have yet to materialize, these core players have nameplate capacity that should allow them to cover most of the near-term supply increases needed to meet demand from the ballooning EV market.

Second, and this is a related point, the market power held by the majors makes the smaller projects held by most junior companies difficult to finance.

That said, there are a few names out there with compelling stories and the potential to find either financing or JV partnerships to move their projects forward.

A Couple Of Ways To Play The Trend

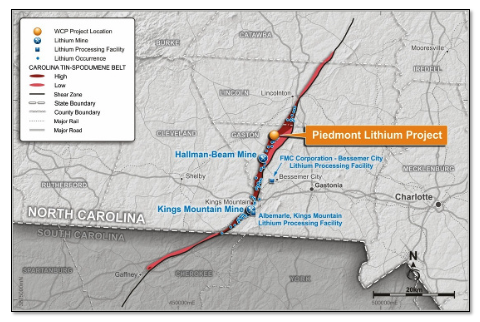

One that’s a recent addition to Gold Newsletter’s portfolio is Piedmont Lithium (PLL.AX; PLL.Nasdaq), a company focused on hard rock lithium production in Albemarle’s home state of North Carolina.

Piedmont’s eponymously named lithium project is located relatively near EV auto factories, including BMW’s operations in South Carolina. That gives the company a ready-made market of potential buyers for its lithium resource. Drilling is underway to expand that resource at this very moment.

The lithium hydroxide product from this hard-rock resource should be of interest to auto companies, who are increasingly showing a preference for the nickel-intensive batteries that use lithium extracted from lithium hydroxide.

The project’s location in a safe jurisdiction near significant infrastructure makes it stand out among its junior brethren.

Add in the possibility that Albemarle might eventually take an interest, and you have a story with the ability to deliver substantial leverage on rising lithium prices.

The other lithium pick in the Gold Newsletter portfolio is Bearing Lithium (BRZ.V; BLILF.OB).

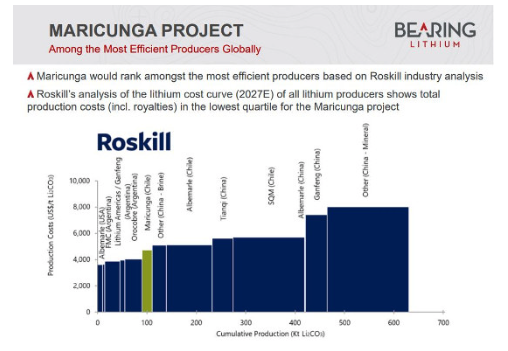

Bearing owns an 18% interest in the Maricunga lithium project in Chile. Maricunga is one of two lithium brine projects in Chile at the feasibility stage.

The recent feasibility study that Bearing and its JV partners put out on the project showed compelling economics. Maricunga has a post-tax NPV, discounted at 8%, of $908 million and a post-tax IRR of 21.0%.

The study projects 20,000 tonnes per year of LCE production at a cash cost of $3,772/tonne LCE over a 23-year mine life. The project has a 4.2-year payback that includes a two-year ramp up.

The partners submitted an environmental impact statement to the Chilean Environmental Review agency in September 2018. Project infrastructure, including access to power and water, has been secured through long-term contracts.

Bearing’s share in Maricunga puts it way ahead of its peers in the lithium space. A recent analysis of lithium projects by Roskill puts Maricunga’s estimated total production costs in 2027 in the lowest quartile of potential lithium producers.

With a market cap around C$15 million, Bearing is trading at a fraction of the value implied by its interest in Maricunga. Its share of one of the rare lithium projects (not held by a major) with a clear path to production make the company a “must-own” for those looking to play the lithium trend.

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|