| Right time, right place for this lithium explorer

| | | Please find below a special message from our advertising sponsor, Argentina Lithium & Energy. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| |

| Right Time, Right Place For Lithium Discovery

| |

Argentina Lithium & Energy (PNXLF.OTCQB; LIT.V) has confirmed lithium-in-brine on property adjoining Rio Tinto’s at the Rincon Salar in Argentina.

More drill results are on the way soon.

| | | |

The Rincon Salar is buzzing with activity.

|

It is the site of one of the very few near-term lithium mines globally, with one mine ramping up this year.

Plus: Mining giant Rio Tinto acquired most of the salar last March for $825 million.

|

The kicker: Key concessions to the southwest and northwest of Rio Tinto’s big acquisition are held by Argentina Lithium & Energy (PNXLF.OTCQB; LIT.V)...

...And that far-smaller company has just confirmed lithium in brines of its own.

|

The Right Location

For A Lithium Discovery

|

As noted, the Rincon Salar is a hubbub of activity, with Argosy Minerals and Rio Tinto busily developing new lithium projects for a world demanding new supplies.

The companies are planning to use different processes to get the same results, with Argosy using evaporation ponds to concentrate the lithium, and Rio Tinto likely using direct lithium extraction (DLE).

| | | | Note Argentina Lithium’s concessions, in green, adjoining Rio Tinto’s big property position and Argosy Minerals’ developing mine. Argentina Lithium has confirmed its own lithium in brines.

|

Rio has constructed and is operating a pilot plant on-site, is aggressively drilling to expand the resource and has started construction of a 3,000-tonne/year starter plant to produce lithium carbonate commencing in 2024, according to miningweekly.com in their article dated July 27, 2022.

RIO’s plan is to have the starter plant serve as a pilot for a massive, 50,000-tonne/year plant there.

The company has also signed a Memorandum of Understanding with Ford Motor Company for delivery of lithium carbonate from the Rincon Salar.

|

Argentina Lithium’s Discovery

|

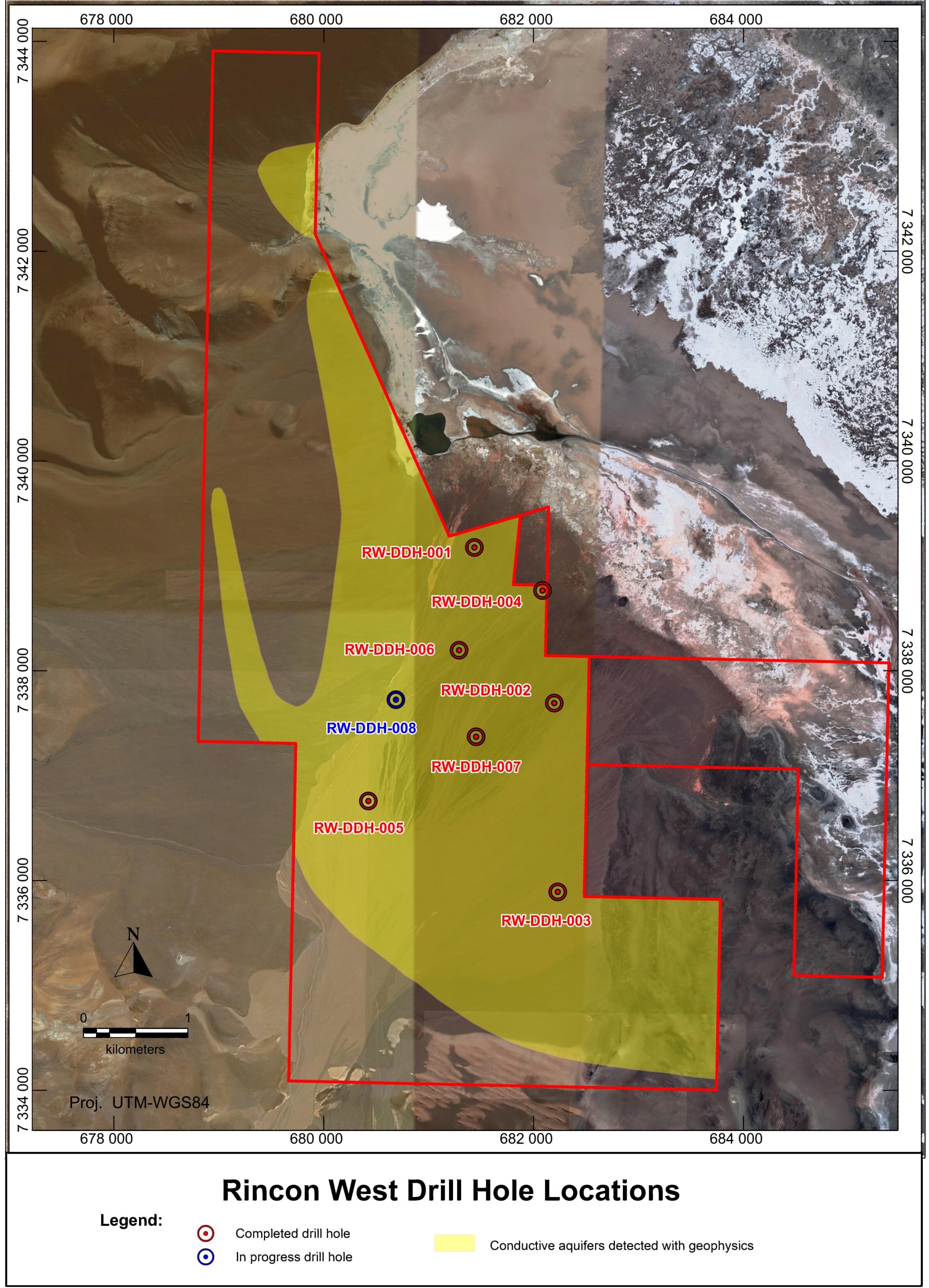

Now, proximity to other mining projects does not provide any assurances with respect to making similar discoveries, but the third company at Rincon, Argentina Lithium, announced its first discovery of lithium in brines in July, and has since reported results from six holes. Hole #7 is in for assay. Hole #8 is being drilled now, with #9 next up.

|  | | Argentina Lithium announced its first lithium in brine discovery in July, and has reported results for Holes 1-6, as noted above.

|

Consider the assays highlighted below in the context of the location of each hole in the drill plan map above, and the distance between holes. (For additional information, read Argentina Lithium’s news releases dated July 13, 2022, October 3, 2022, October 25, 2022 and January 26, 2023.)

| | |

Note that the results for holes 1, 2, 4 and 6 — the main zone — are simliar, in terms of grade, with the resources reported by Argosy and Rio, Argosy at 325 mg/L (www.argosyminerals.com.au), RIO at 367 mg/L (Montgomery & Associates, July 26, 2021, the last resource estimate before RIO’s acquisition).

LIT’s upcoming assays for Holes #7-9, each 500 to 1,000-meter step-outs, could significantly expand the area over which lithium-bearing brines occur.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| |

Argentina Lithium has a distinct advantage over other explorers in Argentina. LIT is a member of the Grosso Group, which has been actively exploring in Argentina for 30 years, since mineral exploration started there in 1993.

|

Companies managed by the Grosso Group share operational resources, providing outsized ability to acquire and manage projects by deploying an expert team.

|

Niko Cacos, President and CEO of Argentina Lithium, has worked with the Grosso Group for +30 years, from inception, and serves as a senior level executive for all the member companies.

The Grosso Group has been involved in no fewer than four major mineral discoveries in Argentina so far.

|

Argentina Lithium’s Antofalla North Project

Adjoining Albemarle’s Big Project

|

LIT’s discovery at Rincon West is exciting, and the strategy of drilling out prospects adjacent to major resources appears to be paying off.

|

Now LIT intends to apply the same strategy at its much larger Antofalla North project, located adjacent to Albemarle’s project in the Antofalla Salar.

|

The Antofalla project is controlled by Albemarle Corp., the world’s second-largest lithium producer. Albemarle stated publicly that the company controls one of the largest lithium resources in Argentina at Antofalla, albeit with no further information published. This is from Albemarle’s news release dated September 12, 2016. The company continues to drill the project area with several rigs.

Here, Argentina Lithium controls Antofalla North, covering the basin adjoining Albemarle on the north side. It measures fully 10,050 hectares, equivalent to 10 kilometers by 10 kilometers, a very substantial area indeed.

Antofalla North is anticipated to be permitted for exploration programs in the second quarter this year, and LIT is targeting first drilling for late in the second quarter — as the company simultaneously works toward a maiden resource at Rincon West.

| |

With a discovery now under its belt in a key lithium exploration region, Argentina Lithium’s team is busy working down its next steps...including some important catalysts:

|

1. Complete assays and report results from Hole #7 at Rincon West.

2. Complete drill holes #8 and 9 at Rincon West and report results.

3. Commence initial resource modelling on Rincon West.

4. Complete geophysics and drill Antofalla North neighboring Albemarle. First drilling anticipated in June-July.

5. Complete geophysics and initial drilling Rinconcita II and Paso de Sico at Rincon West and North — two additional concessions controlled by LIT at the Rincon Salar.

6. Reassess Rincon West and North, complete additional drilling as required to support resource modelling and classification.

7. If merited, have independent consultants prepare initial resource estimate for Rincon West.

8. Reassess Antofalla North, complete more drilling as required.

| |

The company is well funded to perform all of this work, with approximately US$9 million in the treasury.

| |

Argentina Lithium is off to a strong start in the prolific Lithium Triangle.

|

Over the coming months the company is pursuing new resources adjoining the best of neighbors.

|

A very low-market-cap opportunity in the heart of one of the world’s truly giant lithium-producing areas, guided by a team that lives and breathes discovery, Argentina Lithium is a company that investors will want to look into now.

|

CLICK HERE

To Learn More about Argentina Lithium & Energy Corp.

| | | |

© Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |