| Where will yield shock push gold? | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

| Gold Newsletter Preview: | | Yield Shock | |

Last week’s stunning move in yields derailed gold. Where does the metal go now?

| |

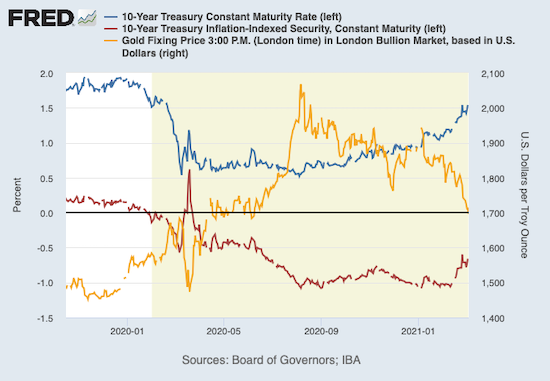

Over the last couple of months, I’ve been discussing the rise in Treasury yields, including real, inflation-adjusted yields, and their effect on gold.

Last week we saw those deleterious effects spread to the U.S. stock market, particularly the tech-heavy Nasdaq, sending investor worries to near-panic levels.

Fear was in the air. And it is there to some extent again today, as the Nasdaq is dropping (even while the Dow is rallying), the 10-year Treasury yield has surpassed 1.6%...and gold is down another $20 at the time of writing.

As you can see from the chart below, both nominal and real yields remain elevated.

|

|

While we haven’t seen a very close, day-to-day correlation, it’s hard to escape the fact that gold has been driven down by the surge in yields.

And most of that increase in yields is due to the bond market’s recognition of the rising inflationary pressures that we’ve been talking about.

Our friend Peter Boockvar recently published a great commentary on this in his daily service:

“In looking at the rise in the 10-year yield from the closing low of 0.51% on August 4th, 2020 we can break down how much of the rise since is due to an increase in inflation expectations and how much is the estimate for growth. So, we’ve seen a rise of 95 bps in the nominal 10-year yield to this morning’s 1.46% level since that low. Since August 4th, the 10-year inflation breakeven in the TIPS market is higher by 65 bps to 2.22% today. Thus, about 2/3 of this move higher in nominal rates is on higher expectations for inflation relative to growth.”

Considering the growing signs of inflation just ahead, it’s not surprising that the markets are reacting.

And boy are they, with the rise in rates creating cracks in the foundation of the equity markets. Whenever the 10-year Treasury yield has touched 1.5%, for example, we’ve seen tremors spread through the U.S. stock market.

Again, the selling has been particularly heavy in the high-flying, tech-heavy Nasdaq.

While the talking heads on CNBC are earnestly assuring viewers that the sell-off so far is “mostly sector rotation,” they haven’t been able to resist the temptation to trot out the old “Tech Wreck” headlines.

Frankly, I think the recent turmoil has represented a pre-fight face-off between the stock market and the Fed…with a battle royale about to begin.

When that battle happens, whether it’s days or weeks ahead, we will find out to what extent the stock market is dependent not upon low interest rates, but ever-lower rates.

The Fed, of course, will “yield” and do whatever is necessary to keep its financial-asset house of cards erect. A key question will be how soon they act. Will they wait until a market crash, or will they move more quickly, to forestall a potential crisis.

You can bet that the markets will progressively test the Fed’s resolve, searching for the level that triggers the central bank to act.

And there’s another scenario that, while we have talked about it before, we haven’t spent enough time discussing in these pages: The Fed losing control.

|

This is what Wall Street genuinely fears most. As long as the Fed is there to catch the stock and bond markets when they fall, speculators can put up with the occasional sell-off and just plow back in.

|

But what if investors begin to sniff weakness from the Fed? What if the “bond vigilantes” return and demand significantly higher yields?

The Fed would have to respond with ever-greater purchases of Treasurys, to levels that would make the Bank of Japan blush.

The question is whether it would be enough. And if it isn’t, if the Fed genuinely does lose control and Treasury yields rise, even to just 2%-3%, the implications for debt-service costs would send the federal budget into a deficit-ballooning spiral. And this would force a greater, and much quicker, depreciation of the dollar.

Gold, in this scenario, would likely perform as we have been expecting it would over the next five years or so…but those years would compress into months or even weeks. Everything’s happening much more quickly these days, so this would simply reinforce that pattern.

As Mencken said, “be careful what you wish for.” I’d much rather have a longer, steadier gold bull market, like that of the 2000s, wherein we can reap tremendous profits from our junior mining plays.

But in either scenario, you’ll want to be positioned in gold.

| | Golden Opportunities continues below... | | | SPONSOR: | Gold Investors,

It's Time To Double Down | | Companies in Canada’s Gold-Rich Abitibi Greenstone Belt Have Seen Shares Skyrocket By Up to 1,400% in the Past Year. | If you're interested in long-term growth, look no further than the junior already standing among the giants of the industry: Clarity Gold Corp (CSE: CLAR, OTC: CLGCF).

From its stellar management team, to its projects in one of the most highly-sought mining districts in the world, Clarity Gold is aligned for success.

The Canadian company set its sights on the Abitibi greenstone belt of Quebec, an area that is becoming one of the hottest targets for major producers looking to replenish their rapidly-declining reserves.

It's not impossible that a junior resource company could score one of the world's last remaining underdeveloped gold properties. But it's rare, and even more so when those properties sit amongst high-value operations owned by some of the world's biggest gold producers and explorers, like Amex Exploration.

Which sets them on a course to potentially become one of the brightest stars in the gold mining universe. It's the kind of dream setup that can mean real wealth for investors who recognize the potential early. | | Click here to learn more... | | |

In our March issue of Gold Newsletter, released late last week, I devoted much of the issue to discussing these developments and potential future scenarios.

If you’re looking for someone to tell you precisely when and where the bottom will be in this gold correction, you won’t find it in this issue. As I’ve stated before, no one can tell you where the absolute bottom will be, and you shouldn’t trust anyone who tells you they can.

But I will tell you this: When the rebound does begin, it will come so quickly that you’ll risk getting whiplash.

With that in mind, you need to begin accumulating the best mining stocks at these major lows. And our March issue of Gold Newsletter — with coverage on 39 top junior mining stocks — is packed with specific ideas, including:

|

• A company that just signed a deal on a massive, 15,000-hectare silver exploration property. And it comes with more than promise…it also comes with profits.

That’s because the property is already in production, selling 1.7 million ounces of silver a year!

• A junior gold company with 645,000 ounces of indicated resources at 3.67 g/t gold-equivalent…plus 217,000 ounces of inferred resources at 2.68 g/t gold- equivalent…

…Plus recent drill holes including 21 meters of 9.82 g/t gold-equivalent and 52 meters of 3.17 g/t gold-equivalent…and a market cap still under C$15 million!

• A gold mine developer that — by merely changing its mine plan on paper — was able to double its mineable ounces and multiply its projected value to $1.3 billion.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| |

You can get all the details on these new red-hot stock picks by subscribing to Gold Newsletter now.

To get a full year of Gold Newsletter…and get immediate access to our exciting March issue packed with valuable investment intelligence and details on dozens of exciting junior mining plays…simply click on the link below.

| | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |