| A sea change in the markets… | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

The best annual report on gold just released its chartbook preview, and it clearly shows that the greatest move in gold since the 1970s is at hand.

| |

For die-hard gold bugs like me, the release of Incrementum AG’s annual In Gold We Trust report is like Christmas morning for a child.

|

But in advance of that big day, their release of the charts for that massive annual report, their Preview Chartbook, is like Christmas Eve.

|

They just released that chartbook, and as usual it doesn’t disappoint. In fact, it presents clear and compelling evidence that one of the greatest runs we’ve ever seen in gold — perhaps exceeding that of the 1970s — is at hand.

|

I’m happy to say that their Preview Chartbook is available to you at no charge, and you’ll find the link to it at the end of this letter.

But first, I’d like to show you a few of their compelling charts….

|

|

If you’ve followed my commentaries for some time, you know that I believe gold and the stock market can both continue to rise over the coming months and years, because the ongoing tidal wave of central bank liquidity is propelling all asset classes higher.

In other words, gold bulls shouldn’t necessarily hope for a stock market crash or significant correction to launch gold. The yellow metal simply doesn’t need this as a driver.

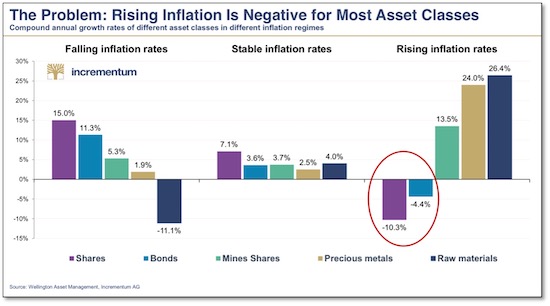

That said, Incrementum’s Preview Chartbook presents compelling evidence that higher inflation leads to gold outperforming stocks. The chart above shows the compound annual growth rates for major asset classes in various inflationary environments.

And as you can see, precious metals have not only historically outperformed equities, but stocks have usually fallen rapidly during times of high inflation.

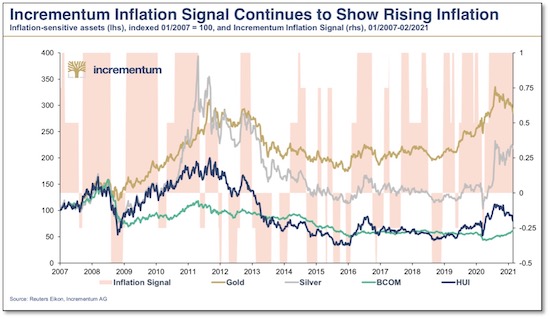

The bad news for equity investors, and the good news for gold bulls, is that Incrementum’s proprietary inflation signal shows that significantly higher inflation rates are coming.

|

|

Of course, this isn’t news to anyone who’s been following the mainstream inflation indicators lately. The reopening of economies around the globe as the pandemic fades away is a well-known theme.

Combined with supply-chain disruptions and year-over-year comparisons coming next month, and we’re about to see some shocking inflation numbers.

So how do you take advantage of this?

Obviously, as the first chart shows, precious metals is one way. But, as we’ve shown over five decades in Gold Newsletter, carefully selected mining shares can multiply the gains in gold and silver.

And in that regard, the final chart I’m featuring shows that we’re just in the early stages of a major mining stock bull market.

|

|

This chart from Incrementum compares the current bull market in mining stocks to previous runs. As you can see, while this bull market is a bit extended in terms of time, it’s reached only a third or less of the degree of previous major moves.

And that’s the perfect recipe. We want a gold-stock uptrend to last many years to give us more time to maximize our gains.

Another consideration: This chart compiles all the major gold producers, and you could dramatically improve your performance by focusing on the better companies.

Moreover, the junior gold stocks like those we focus on in Gold Newsletter can multiply the performance of the major companies. And if you’re a subscriber, you’ve been reaping the benefits of that advantage over the past few years of this bull market.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| |

I’ve only presented a small taste of what Incrementum’s Preview Chartbook presents in their 80+ pages of fascinating charts.

Their table of contents gives you an idea of the main topics they’re covering this year:

|

• Historic Monetary and Fiscal Stimulus

• The Status Quo of Gold

• Inflation and the Boy Who Cried Wolf

• Silver's Silver Lining

• Mining Stocks - The Party Has (Just) Begun

• Why Gold is still largely under-owned

• Quo vadis, aurum?

|

I can tell you that every page of this chartbook presents a fascinating new angle on what’s going on in this historic period for economies, the markets…and the precious metals.

It’s absolutely invaluable, and I urge you to click on the link below to view it at no charge.

In addition, I urge you to CLICK HERE to subscribe to Gold Newsletter at a special half-price rate.

| |

Gold and silver seem to have bottomed over the last few days, and to have begun new rallies. The gold stocks, from the majors down to the juniors we focus on, are starting to leap higher, and we cover dozens of the top opportunities.

|

The timing is perfect, and I strongly recommend that you choose this opportunity to get positioned by subscribing now.

| All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |